Latest News

Goldman Sachs leads league table of top global M&A financial advisers

News Highlight

The American bank advised on deals worth $1.098 trillion in 2018.

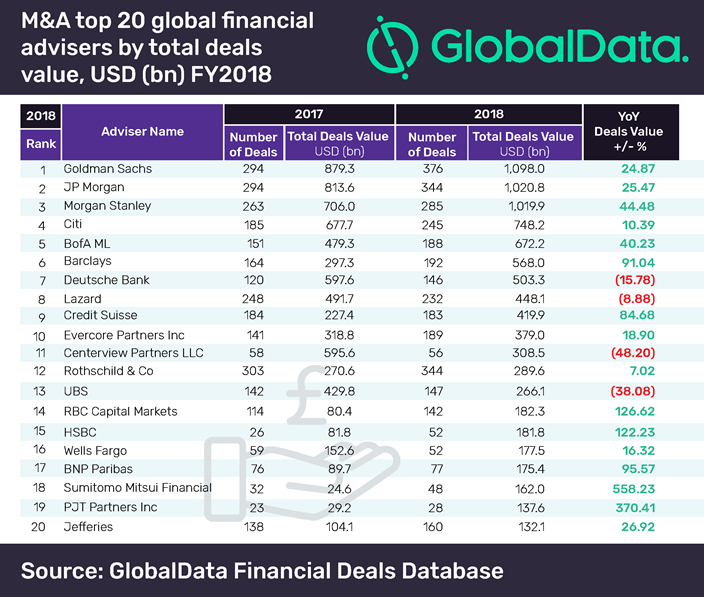

Goldman Sachs has emerged as the top-ranked mergers and acquisition (M&A) financial adviser for 2018, leading the league table for the global top 20 financial advisers for FY2018. The table, which is compiled annually by GlobalData – a leading data analytics company – shows the American bank advised on deals worth $1.098 trillion last year, and also maintained its number one position on the ranking from the previous year.

According to a statement released on Friday by GlobalData, Goldman Sachs achieved a 24.87 per cent increase in deal value and a 27.89 per cent growth in deal volume for FY2018. The bank closed 376 deals compared with 294 deals in 2017. Its biggest deal last year was the $80.4 billion acquisition of Shire, an Irish drugmaker, by Takeda, Japan’s largest pharmaceutical firm in December.

The data analytics company also confirmed that JP Morgan achieved second place with a total deals value of $1.020.8 trillion, while in third position was Morgan Stanley with $1.019.9 trillion worth of deals. Citi and Bank of America Merrill Lynch secured fourth and fifth positions, with deals valued at $748.2 billion, and $672.2 billion, respectively.

“The top three financial advisers, Goldman Sachs, JP Morgan and Morgan Stanley, each advised on more than $1tn worth of deals maintaining a significant lead over the rest of the Top 20 during the year,” said Prakhar Baghmar, Financial Deals Analyst at GlobalData.

18th-ranked Sumitomo Mitsui Financial, a Japanese financial services company, saw a massive 558.23 per cent growth in deals value from $24.6 billion in FY2017 to $162 billion last year.

GlobalData said it compiles the league table of the top global M&A financial advisers using real-time data tracked from all merger and acquisition, private equity/venture capital and asset transaction activity globally.

Related News

Latest Blogs

- Redefining wealth beyond numbers

- Nigeria’s WCO chairmanship as opportunity for trade facilitation

- Lessons of Lekki massacre for Nigerian business leaders

- AI solutions for improved poultry and fish production

- Between strong labour union and weak industry

Most Popular News

- NDIC pledges support towards financial system stability

- Artificial intelligence can help to reduce youth unemployment in Africa – ...

- Africa-focused Madica expands portfolio with two new AI startups

- West African Development Bank raises EUR 1 billion

- Swedfund invests $10 million in Moniepoint to boost MSME growth

- UNCTAD16 opens in Geneva to chart way for resilient supply chains, others