Latest News

Data-driven resilience and the Russia-Ukraine conflict’s effects on Nigeria’s consumer goods supply chain

News Highlight

The Russia-Ukraine conflict is also negatively impacting packaging supply chains.

Background

The first half of the year may have birthed another major shock that could redefine the expectations for the global economy in 2022 and the years ahead. The recent invasion of Ukraine by Russia could potentially throw a spanner in the wheels of the expected recovery in the global GDP and supply chain network post-COVID-19 disruption. This conflict could materially impact global inflation and supply chain dynamics negatively.

First, Russia is the World's second-largest producer of crude oil (c.10.5mbpd behind the US with c.11.6mbpd as of 2021) and is responsible for c.23.0% of global ammonia exports and about 15.0% of global fertiliser exports. Ukraine accounts for more than 10.0% of global wheat exports and roughly 16.0% of global corn (maize) exports as well as a significant share of global sorghum trade (about 4.0–5.0%). Third, Russia accounts for about 40.0% of Europe’s natural gas supply before the invasion (via pipelines such as Nord Stream 1, Yamal–Europe, and Ukraine transit routes). Lastly, the hostility from the war has started to affect trade flow through the black sea - a channel that accounted for roughly 3.0% (c.$99.0bn) of global maritime trade in 2019.

The cumulative effect of these negative passthrough from the war could have far-reaching effects globally, including on Nigeria, which is heavily reliant on importation for its domestic consumption and manufacturing activities. In the following sub-sections, I assess the impact of the ongoing Russia-Ukraine war on Nigeria’s Consumer Goods Supply Chain and Consumer Market Stability.

Commodity shocks and the supply chain crunch

Before the war in Ukraine began, Nigeria was importing roughly 4.0 to 5.0 million metric tonnes (MMT) of wheat annually, according to the U.S. Department of Agriculture (USDA, 2021). About 30.0% of this wheat came from Russia and Ukraine combined. With ports in the Black Sea under blockade and global traders scrambling for alternatives amidst the conflict, wheat prices spiked over 60.0% between February and April 2022. For Nigerian millers, this translates into immediate shortages, upward price reviews, and rationing.

Companies like Flour Mills of Nigeria (FMN) and BUA Foods face difficult case scenarios between absorbing rising input costs and passing them on to consumers whose purchasing power is already weakened by double-digit inflation. Energy and transportation costs rise sharply as diesel prices climb beyond ₦800 per litre, driven by global oil price volatility and domestic supply bottlenecks.

The Russia-Ukraine conflict is also negatively impacting packaging supply chains. Both countries are major producers of aluminium, glass, and chemical intermediates used in food and beverage packaging. Importers struggle to secure materials, thereby forcing Nigerian manufacturers to scale back production or seek costly substitutes. This is further buttressed by the Manufacturers Association of Nigeria (MAN) report indicating a 25.0-30.0% increase in average production costs across member firms as of mid-year.

Inflation and the squeeze on consumers

The negative pass-through from global supply shocks has fuelled an accelerated increase in the headline inflation rate in H1:2022, climbing to 17.7% in May from 15.6% in December 2021, according to data from the National Bureau of Statistics (NBS). The upward pressure is broad-based, reflecting higher import bills, elevated energy prices, and sustained disruptions in global supply chains triggered by the Russia–Ukraine conflict.

Food inflation continues to intensify as surging global grain prices, higher freight costs, and rising logistics expenses filter into domestic markets. With Nigeria importing more than 95.0% of its wheat, the global spike of over 40.0% in wheat prices in Q1:2022 is feeding directly into the cost of everyday staples. In many urban markets, a family-size loaf of bread is now c.55.0% more expensive than at the start of the year, while other household groceries are recording similar double-digit price increases. For urban consumers, wages lag far behind the pace of price increases, forcing individuals to pivot towards cheaper or unbranded locally sourced products, which is arguably seeing premium brands compete aggressively in market share with economy brands in noodles, detergents, and dairy products.

In Lagos, a city that shapes national consumer trends, even middle-income households are adjusting their budget expenses to match current realities. Retailers confirm that smaller pack sizes and sachet-based products, which were previously seen as low-income strategies, are now mainstream across middle-income tiers. This “sachetization” offers immediate affordability but also drives up packaging waste and complicates manufacturers’ cost management.

Case Study 1: Nestlé Nigeria and the battle for margin

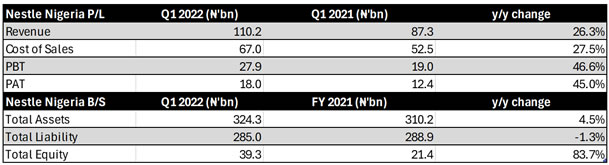

Nestlé Nigeria, one of the largest players in the FMCG space, enters 2022 with strong brand equity in food and beverages but also high exposure to imported raw materials, particularly milk derivatives and grains. The company reports 26.3% revenue growth in Q1 2022, yet the cost of sales rose by a higher margin (up 27.5%). The company faces a difficult equation: keep retail prices stable to preserve market share or raise them and risk volume decline.

In its management’s statement regarding its Q1 earnings, Nestlé emphasises operational agility with a focus on local sourcing initiatives, efficiency programs, and product portfolio adjustment. But even with these measures, profit margins remain under strain. The firm increases its use of local maize and sorghum as partial substitutes for imported wheat, a move mirrored by smaller competitors. The shift marks a modest step toward supply-chain localisation, though infrastructure and quality constraints persist.

Nestlé’s example underscores the delicate balance FMCG firms must envisage in adapting quickly enough to survive without undermining brand perception or consumer trust.

Chart 1: Snapshot of Nestle Nigeria’s financial statement

Source: NSE, Author’s compilation

Currency pressure and fx scarcity

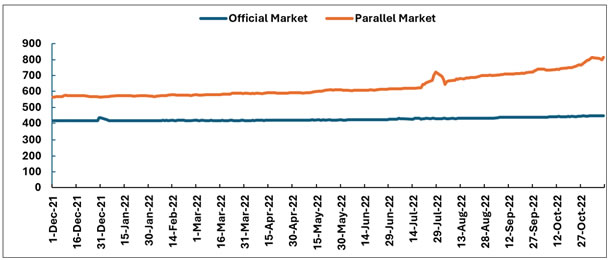

Even before the conflict in Eastern Europe, Nigeria’s foreign-exchange market was under pressure. The CBN maintains multiple exchange windows, with the official rate diverging sharply from the parallel market. As oil price fluctuates and portfolio inflows dry up, the naira depreciates further, pushing import costs higher across the board.

By mid-2022, the parallel market rate hovered near ₦600/$1, while official rates remained around ₦415.00/$1.00. For import-dependent FMCG firms, this multiple exchange rate window creates persistent uncertainty. Sourcing forex to facilitate payment for raw material inputs like wheat, milk powder, or machinery parts becomes a near-daily battle.

Unilever Nigeria, which manufactures personal care and home products, in its recent corporate disclosures, indicated that currency pressure adds “structural cost layers” beyond commodity inflation. Despite efforts by Unilever to localise raw materials via backward integration, such as palm oil and cassava starch, the FMCG giant acknowledges that full substitution will take years. For now, pricing adjustments and cost optimisation remain the main levers.

Chart 2: Exchange Rate One-Year Trajectory

Source: Rate captain, CBN, Author’s compilation

Energy costs and operational strain

The energy intensity of Nigeria’s manufacturing sector amplifies the shock. With unreliable grid supply, most FMCG factories depend on diesel generators. As global energy markets react to the Russia-Ukraine conflict, diesel prices double within months. Companies divert capital from innovation and expansion toward maintaining basic operations.

Dangote Sugar Refinery (DSR) provides a telling example. The sugar giant reports that fuel costs account for an expanding share of its cost base, even as sugar prices rise in international markets. The government’s backward integration policy provides some buffer, but imported raw sugar still forms most inputs. Transporting finished products to markets across Nigeria becomes significantly more expensive due to diesel price spikes and insecurity along key routes.

This operational squeeze forces FMCG companies to rethink logistics networks by consolidating distribution hubs, adopting night shifts to avoid fuel waste in traffic, and renegotiating third-party transport contracts. Yet these are short-term fixes in a structurally fragile system.

Shifts in consumer behaviour

As costs rise, Nigerian consumers recalibrate priorities. Essential goods such as food, soap, and beverages retain demand; however, discretionary categories weaken. Consumers buy smaller units more frequently, favour open-market stalls over supermarkets, and increasingly rely on informal credit networks.

According to a recent KPMG Nigeria survey (April 2022), 68.0% of respondents report changing brands in at least one major FMCG category since February, citing price as the primary factor. Price elasticity is highest among middle-income earners, who traditionally sustain demand for mid-range brands. The shift has ripple effects on marketing, distribution, and retail partnerships.

FMCG firms respond with tactical innovations: bundle promotions, flexible payment schemes for distributors, and intensified presence in neighbourhood kiosks. Digital ordering platforms, once peripheral, begin to gain traction as companies seek to reduce logistics friction and reach fragmented retail channels.

Case study 2: Flour Mills of Nigeria’s resilience under pressure

Flour Mills of Nigeria (FMN), one of the oldest indigenous consumer goods groups, began 2022 with diversified operations in food, agro-allied, and sugar. The company’s reliance on imported wheat exposes it to direct negative impact from the Russia-Ukraine crisis. By May 2022, FMN’s wheat procurement costs had risen 64.1% y/y (as of the March 2022 financial year). Yet, FMN continues to operate at scale, leveraging forward contracts and domestic blending to keep bakeries supplied.

The company’s Chairman, John Coumantaros, notes in an April 2022 press briefing that FMN is “committed to sustaining supply even in difficult times.” This determination, however, comes with thinning margins. The company raises product prices incrementally but also invests in local grain development through partnerships with the CBN’s Anchor Borrowers Programme. The initiative aims to reduce dependence on imports in the medium term.

FMN’s case highlights a wider truth: resilience is increasingly tied to vertical integration and local value chains. FMCG companies that invest early in backward integration stand a better position to weather shocks of importation risks.

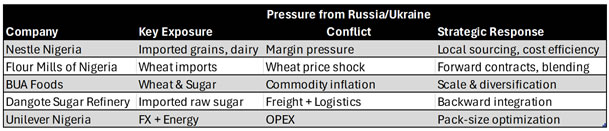

Chart 3: Snapshot of How Nigerian FMCGs are Coping with the Pass-through Effect of the Russia-Ukraine War

Source: Author’s compilation

The policy tightrope

The FG faces a policy conundrum in 2022. On one hand, high oil prices are set to boost export revenues; on the other, petrol subsidies (estimated at ₦4.0 trillion annually) erode fiscal gains. This leaves limited room for direct consumer relief or manufacturing incentives. Monetary policy offers little comfort with the CBN maintaining tight controls on foreign exchange, while inflation limits its ability to lower interest rates.

Trade policy also remains reactive. Import bans and tariffs on select goods aim to promote local production but often create unintended distortions. For example, temporary import restrictions on edible oils and cereals, which were intended to boost self-sufficiency, are likely to compound supply shortages during the Russia-Ukraine disruption. The result is an uneven playing field where compliant FMCG companies bear higher costs while smuggling and informal imports thrive.

Consumer protection agencies attempt to monitor price gouging and counterfeit products, but enforcement capacity is stretched thin. The Federal Competition and Consumer Protection Commission (FCCPC) issues statements urging manufacturers to maintain “ethical pricing behaviour,” yet acknowledges that cost pressures are real and systemic.

The informal market’s expanding role

The turbulence being experienced over the year magnifies the informal sector’s dominance in Nigeria’s consumer landscape. Informal traders absorb shocks faster, adjust prices more fluidly, and serve as critical distribution nodes when formal supply chains falter. However, informality also limits regulatory oversight and quality assurance.

For multinational FMCG companies, this creates a paradox: informal markets sustain volume but dilute pricing discipline and brand integrity. Companies increasingly deploy field agents to monitor product flow, while experimenting with digital inventory tracking to minimise arbitrage.

Corporate response and strategic adaptation

Across the sector, three broad strategic responses define the impact of the crisis on FMCG supply chain dynamics:

1. Localisation and Sourcing Innovation: Companies accelerate efforts to localise inputs via developing backward integration projects from cassava starch to palm oil and maize derivatives. Although progress is uneven, the urgency gives new momentum to long-stalled localisation programs.

2. Portfolio Realignment: Companies streamline SKUs, focusing on high-turnover essentials. Premium extensions are paused, while mid-tier brands receive renewed marketing support. Smaller pack sizes and refill models proliferate to sustain accessibility.

3. Operational Efficiency and Digital Integration: Manufacturers invest in data analytics, route optimisation, and warehouse automation to offset energy and logistics costs. Digital ordering platforms like TradeDepot and Omnibiz gain traction as FMCG partners seek transparency in fragmented retail networks.

Investor sentiment and market confidence

The Nigerian Stock Exchange (NSE) reflects mixed sentiment in the first half of the year. While FMCG stocks initially benefit from defensive investor positioning, earnings headwinds soon temper optimism. Nestlé Nigeria’s share price declined -10.1% as of H1:2022, while Unilever Nigeria (+2.1%), Cadbury (+96.0%), and BUA Foods (+13.6%) had performed positively within the period.

Foreign investors remain cautious, citing currency risk and policy uncertainty. Domestic institutional investors continue to view FMCG as a long-term play on demographics rather than short-term performance.

The long view taking shape

As the year continues to unfold, Nigeria’s FMCG sector stands at a crossroads. The Russia-Ukraine conflict has revealed structural weaknesses long masked by market growth, such as over-reliance on imports, fragile logistics, energy inefficiency, and shallow local value chains. Yet, it also sparks a new wave of strategic introspection.

The companies that emerge stronger from 2022 are those that view disruption dynamics as a catalyst for localisation (via backward integration), improved efficiency, and closer consumer engagement. Consumers would still be faced with adjustment hurdles such as tightening budgets, shifting loyalties, and rediscovering value.

Samuel Taiwo is a distinguished Financial Planning and Analytics expert whose work has had a substantial and measurable impact on the fields of corporate finance, supply-chain intelligence, and consumer-market stability. He is recognised in the industry for developing analytical frameworks and predictive models that materially influence executive decision-making, strengthen financial integrity, and enhance the resilience of complex consumer markets. His contributions extend across pricing intelligence, elasticity modelling, cost-to-serve optimisation, and risk-sensitive forecasting areas in which his methodologies have been adopted by multinational CPG and commercial organisations to improve operational performance and long-term strategic planning. His analyses have informed policy-oriented discussions, supported market-regulatory insight, and provided data-driven guidance during periods of significant macroeconomic volatility. As an author of influential industry publications and contributor to high-level advisory engagements, his recognised expertise in financial analytics, and his continuing contributions to the advancement of the field establish him as a subject-matter authority whose work delivers lasting value to industry, policy, and the broader financial-analysis community.

Related News

Latest Blogs

- The Museum of West African Art saga

- The complexity and complication of Nigeria’s insecurity

- Between bold is wise and wise is bold

- Prospects of port community system in Nigeria’s maritime sector

- Constitutionalism must anchor discipline in Nigerian Armed Forces

Most Popular News

- NDIC pledges support towards financial system stability

- Artificial intelligence can help to reduce youth unemployment in Africa – ...

- Africa needs €240 billion in factoring volumes for SME-led transformation

- ChatGPT is now the most-downloaded app – report

- CBN licences 82 bureaux de change under revised guidelines

- Green economy to surpass $7 trillion in annual value by 2030 – WEF