Latest News

AMCON plans ‘quick’ divestment from Polaris Bank

News Highlight

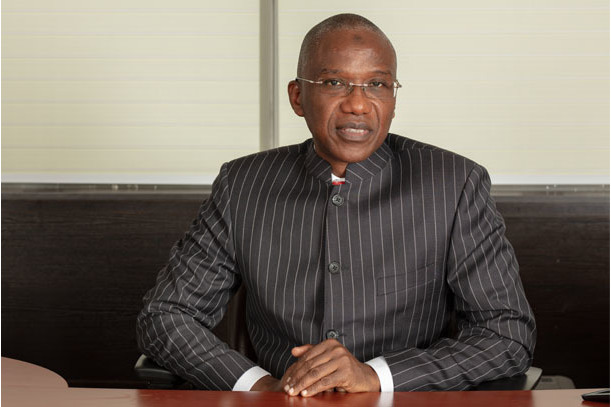

Ahmed Kuru said AMCON has met with the management of Polaris Bank and will sell the business in less than two years.

The Asset Management Corporation of Nigeria (AMCON) has said it plans a quick sale of Polaris Bank, the bridge bank that was set up by the Central Bank of Nigeria (CBN) to take over the assets and liabilities of the defunct Skye Bank Plc.

“The divestment must be quick,” said Ahmed Kuru, Chief Executive Officer of AMCON, in an interview with Bloomberg. Kuru added that the agency has met with the management of Polaris Bank and will sell the business in less than two years.

Last month, the CBN had revoked the license of Skye Bank and set up Polaris Bank as a bridge bank, which was capitalised with N786 billion, or equivalent of $2.2 billion.

According to Kuru, the CBN intervened in Skye Bank because of a lot of systemic issues. The move helped to save more than 5,000 jobs and almost N1 trillion deposits. He said, “It is a very big bank and if you allow anything to happen to it, it will affect some other financial institutions.”

The AMCON boss said the agency has no plans to offer another rescue package to any bank in the country as a 2023 deadline has been set for it to dissolve its operation.

Following a banking crisis in 2009, AMCON was established in 2010 as a tool for reviving the financial system by efficiently resolving the non-performing loan assets of Nigerian banks. As at the end of last year, it had recovered N740 billion debts.

Kuru stated that the agency will advertise for financial advisers for the sale of Polaris Bank after an investigation into the cause of its capital and liquidity challenges. “We plan to prosecute individuals suspected to have contributed to the bank’s (Skye Bank) collapse with a view of recovering any bad loans linked to them,” the AMCON CEO said.

Similarly, last month, the CBN had issued a notice of revocation of the operating licence of 182 financial institutions in the country, including 154 microfinance banks, six primary mortgage banks and 22 finance companies. According to the CBN, these financial institutions became insolvent, failed to recapitalise or voluntarily liquidated.

Related News

Latest Blogs

- What is most important for Nigeria in 2026

- Restoring asset declaration as a tool of public accountability

- Tackling antibiotic resistance through safer food systems

- Big government, little governance

- What will matter in Nigeria in 2026

Most Popular News

- NDIC pledges support towards financial system stability

- Artificial intelligence can help to reduce youth unemployment in Africa – ...

- Pan-African nonprofit appoints Newman as Advisory and Executive Boards Chair

- Abebe Aemro Selassie to retire as Director of African Department at IMF

- Dollar slumps as Fed independence comes under fire

- UN adopts new consumer product safety principles