Trade-barrier analytics and their impact on Nigeria’s supply chain ecosystem

Feature Highlight

Nigeria’s consumer economy is structurally exposed to global supply chain shocks due to deep import dependence on the major sparring economies.

Background

2018 ended on tentative promises of truce talks and negotiations, after the United States and China mutually imposed tariffs on over $200.0 billion worth of two-way goods earlier in the year. The rift, which effectively began in March 2018 with the US’s broad tariff on solar panels and China’s retaliation of a 25.0% tax on 128 US products, has heightened the risks to globalisation and trade. Despite a 90-day tariff-halt agreement reached in December 2018, the conflict escalated to a new phase. The breakdown in negotiations by May 2019 resulted in more tariffs and the US blacklisting of Chinese telecoms giant Huawei Technologies Co Ltd. Subsequent peace attempts have since been futile. Now, this escalating feud is turning uninvolved players into winners and losers.

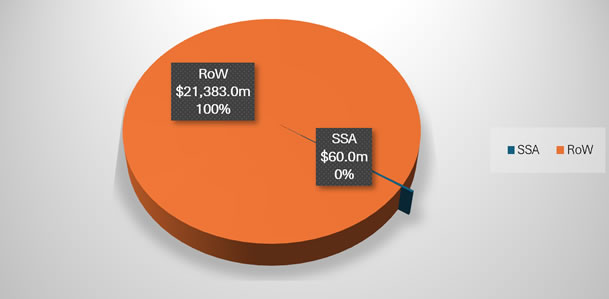

Clear evidence of the emerging dichotomous outcomes for third parties can be gleaned from analysis of global trade flows. A November report by the United Nations Conference on Trade and Development (UNCTAD) documents a $21.4 billion US trade diversion from China in the first half of 2019 which benefitted exporting countries and regions such as Taiwan ($4.2 billion), Mexico ($3.5 billion), and the European Union ($2.7 billion), including others like Vietnam, the Republic of Korea, Canada and India. However, Sub-Saharan Africa (SSA), which is a region highly integrated into the global supply chains (intra-regional trade at 15.0% of total trade is the lowest in the world), is facing increasing risks not offset by significant export opportunities from the trade diversion ($60.0 million).

This limited export opportunity for SSA is especially consequential for Nigeria, the region's largest consumer market, which faces significant sensitivities to exogenous shocks. The country's heavy reliance on crude oil exports, accounting for 86.0% of its export earnings in the second quarter of 2019, risks being undercut by the global demand slowdown and supply chain recalibration induced by the tariffs. The subsequent sections will explore the full spectrum of implications for the Nigerian market via price and trade channels. Furthermore, the sections will offer strategic recommendations to reposition the economy within this fracturing international trade landscape.

Chart 1: Sub Saharan Africa’s share of trade diversion benefits

Source: UNCTAD, Author’s compilation

Mapping the transmission channels to Nigeria

Nigeria’s consumer economy is structurally exposed to global supply chain shocks due to deep import dependence on the major sparring economies. The US and China are central trade partners, accounting for roughly 16.0% of Nigeria’s total trade in 2018, and a disproportionately high 27.0% of total imports.

This concentration embeds fragile transmission pathways through which external frictions translate into domestic instability. Nigeria relies heavily on China for machinery, electrical equipment, plastics, footwear, and vehicles, while key imports from the US include refined fuels, cereals, and medical devices. When operating costs, tariffs, or policy disruptions emerge in these economies, the effects flow directly into Nigeria’s import channels, raising prices for critical inputs and essential intermediate goods. These pressures are amplified by non-tariff barriers, which elongate delivery times, complicate logistics, and increase the administrative cost of trade.

To understand how these global tensions convert into real-economy stress for Nigerian households and firms, the following section examines two primary transmission mechanisms, which are the Supply Chain Substitution Channel and the Price and Inflation Channel.

Supply chain substitution channel

The most immediate way global trade conflicts disrupt Nigeria’s consumer economy is through trade dumping. When tariffs shut producers out of a major market, they often redirect trade to other economies with fewer barriers.

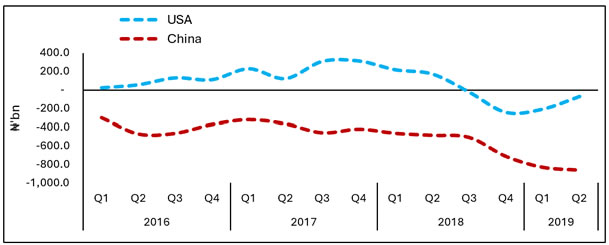

Following the escalation of US-China trade tensions, Nigeria experienced a surge in redirected imports. Between Q2:2018 and Q2:2019, imports from the United States rose 136.7% y/y to ₦422.1 billion, while imports from China increased 91.7% y/y to ₦1.02 trillion. These growth rates are the highest for any quarter since Q1:2017 for the US and the second highest for China. By contrast, exports to the US barely moved (+0.8%), and although exports to China increased 242.1% (low-base effect), the absolute volumes were too small to offset the import shock (trade deficit widened 1.8x to ₦863.4 billion). In Q2:2019, China accounted for 26.0% of Nigeria’s imports but less than 6.0% of its exports.

This data about worsening imbalance may be pointing to the influx of foreign products seeking absorption in alternative markets, as the tariff war limits opportunities for US and Chinese goods in either country. On the face of it the increased inflow may seem beneficial for consumers who will, other things equal, experience an increase in goods supply and lower prices. Over the long term, the effect will be negative and manifest in the form of job loss and income decline. Should local manufacturers fail to outcompete cheap imports, some would inevitably become unprofitable and would eventually scale down or cease operation. Furthermore, dumping can reinforce the cycle of import dependence when the incentives to deepen the local supply chain are watered down by the unit economics of cheap imports. These points are not to argue for autarky but to highlight the growing risks to the Nigerian consumer market stemming from the trade war.

Chart 2: Nigeria’s goods trade balance with the US and China

Source: NBS, Author’s compilation

Price and inflation channel

On paper, given the heavy reliance of the Nigerian economy on global input markets, the US-China trade war should transmit an external shock to the Nigerian consumers through the Consumer Price Index (CPI).

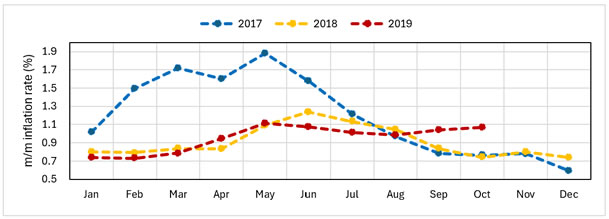

An analysis of National Bureau of Statistics (NBS) data reveals that, throughout the escalation of global trade tensions in the first half of 2019, it had barely any effect on headline inflation. For instance, annual headline inflation trended lower from 11.37% in January to a year-low of 11.02% by August. In contrast, monthly (m/m) pressures rose steadily till a H1:2019 peak of 1.1 in May – the same period US and China reignited the trade feud. A further analysis of the monthly inflation trend over H1 with previous years suggests that the inflation pattern is not unusual. In fact, it is not until September that there is a noticeable breakoff with the historical pattern so far this year. Unlike in 2017 and 2018, when monthly inflation was decelerating, September’s rate printed at 1.04%, up from 0.99% in August. This inflection point points to the land border closure policy rather than the US and China.

The available data appears to contradict expectations of a price shock transmitting from global supply chains to the domestic market. Despite the escalation of trade tensions, the immediate pass-through to Nigerian headline inflation has been muted. However, dismissing the risk entirely may be premature because economic shocks often behave like a storm; the lightning is seen before thunder is heard. The exact impact of the US and China rift may be hard to measure going forward, considering that the recent land border closure is expected to cause shock to domestic prices, unless the policy is reconsidered.

Chart 3: Monthly Inflation Trend for Nigeria

Source: NBS, Author’s compilation

The Nigerian consumer market and macroeconomic ripples

Nigeria’s consumer market is the largest in Africa. A recent report by the United Nations Population Fund (UNFPA) puts the population at 201 million, growing at 2.6 percent annually. By headcount alone, the population trajectory implies an expanding consumer market with scalable opportunities for output absorption and corresponding value creation for firms that can meet that demand.

While the market's scale is undeniable, finer details on demographics and economic quality highlight challenges. For one, the demographic profile highlights a heavy economic burden, with only 54.0 percent of the population falling within the economically productive working age of 15 to 64 years. Compounding this pressure is the erosion of consumer purchasing power as per capita income has drifted downward toward the $2,400 mark, from its 2015 peak of roughly $2,600. Currently, countries like Angola (c.$2,780) and South Africa (c.$6,120) have stronger economic demand power. The negative trend for Nigeria is not surprising considering the impact of sticky inflation and currency depreciation.

This context is relevant considering the worsening trade relations of US and China, which is potentially increasing “dumping”. In an economy with fragile demand power and price sensitivity, these products can undercut locally manufactured products and, where they are input goods, displace local supply and efforts at strengthening backward integration. The result is a market where the numbers look promising but fail to translate to corporate earnings. The structural pressures may be playing out in the performance of consumer goods companies. Nestle Nigeria’s Q2:2019 published in July shows tepid revenue expansion of 4.6% y/y to ₦70.94 billion, a growth rate that is negative when adjusted for inflation. Similarly, Unilever’s revenue contracted 1.7% y/y to ₦23.42 billion while PZ Cussons’ full-year report, in August, showed revenue declining by 7.7% percent to ₦74.33 billion.

Conversely, it can be argued that the underwhelming corporate performances of these publicly traded companies do not directly confirm the transmission of the tariff rift into earnings. Nonetheless, they still underscore the fundamental challenge of operating in a broader market with declining consumer purchasing power. The implications, therefore, of the rerouting of cheap international supply into that domestic space significantly complicate economic and business issues.

Policy implications and recommendations

The trade conflict between the US and China may be influencing an autarky-leaning, or mildly put, protectionist mindset that is slowly surfacing around the world. In Nigeria, President Muhammadu Buhari in August closed all land borders, including Seme and Idiroko. The lockdown was to curb the smuggling of goods, especially outflows of subsidised petrol and influx of protected commodities like rice. The policy, while well-intentioned, mirrored knee-jerk protectionism similar to the US and China feud, which, instead of strengthening competitiveness and domestic capacity, focused blame on external forces. The point being made is not for uncontrolled borders, rather it is for economically sound policies that do not cause negative effects like rising price level and fractured cross-border trade relations.

For policymakers

• Reconsider the blanket protectionist measures and implement performance-based incentives like tax holidays and priority foreign exchange allocation for companies that have visible backward integration investments and commit to achieving set targets.

• Introduce modern border management technology such as drones, scanners, and digital trackers. Establish joint security patrols with neighbouring countries to tackle illegal goods flow.

• Endeavour to sustain an equally unbiased relationship with the US and China to avoid negative consequences of diplomatic fallout.

• Deepen export channels and economic value chain to capture opportunities that emerge as trade patterns realign due to the trade war and reduce overdependence on crude oil as the main export.

• Explore opportunities to shift from a fixed exchange regime to more flexible systems that build economic resilience to global volatilities.

• Ensure the full implementation of the new minimum wage Act passed earlier in the year.

For businesses

• Increase participation in backward integration to immunize own supply chain from global supply channel risks. The investment also opens opportunities to create additional value stream and even secure strategic positionings within own industry.

• Expand supply partnerships in new geographies to manage risks from geopolitical shocks and take advantage of cost variations that may result from an increasingly politicized international supply chain.

• Adjust business model to accommodate the reality of large low-income mass market and limited premium segment. The disappearing middle class should form part of business strategy going forward.

• Streamline operating cost to create legroom for price shocks that may lag due to trade protectionism disruption of supply chains.

• Adopt scenario-based business planning to ensure flexibility to dynamic economic events and uncertainty in the fiscal and monetary policy space.

Conclusion

The trade conflict between US and China has worsened since it commenced over a year ago. The costs have not inspired caution and return to common sense economics. UNCTAD's analysis shows a $35.0 billion reduction in Chinese exports to the US market in the first half of 2019, with about two-thirds of the trade rerouted to alternative markets. Still, $14.0 billion of trade has been either lost or captured by US producers, according to UNCTAD. The former might be more probable given that US consumers are paying the cost of higher prices. Beyond these two feuding juggernauts, the trade rift is weighing on the global economy. The International Monetary Fund (IMF) recently downgraded global growth for 2019 by 0.3% to 3.0%, the slowest pace since the 2009 global recession.

For sub-Saharan Africa, particularly Nigeria, the immediate threat is not inflation from import scarcity, but rather the perverse consequence of dumping. A worsened net trade balance, specifically with China, the world’s factory, risks flooding the local consumer market with cheaply diverted goods, which may offer short-term price relief but pose long-term structural risks. This could stall the nascent backward integration efforts by local manufacturers, leading to job losses and a cycle of dependency. As a result, policymakers and businesses must work to build resilience for the consumer markets by taking well-thought-out and proven economic and commercial pathways rather than short-term options that will worsen susceptibility to the worsening global trade and related risks.

Samuel Taiwo is a recognised leader in Financial Planning and Analytics whose work sits at the crossroads of corporate finance, supply-chain intelligence, and consumer-market resilience. With a decade of experience supporting multinational CPG and commercial organisations, he has established a reputation for transforming complex financial and operational data into clear, predictive, and actionable insights. His expertise spans advanced analytics, elasticity modelling, cost-to-serve intelligence, and risk-sensitive forecasting capabilities he has used to guide strategic decisions, strengthen market transparency, and inform policy-oriented dialogue in emerging and advanced markets alike. He has remained committed to evidence-based financial planning and data-driven economic resilience. His growing portfolio of publications, advisory engagements, and thought-leadership efforts continues to reinforce the analytical foundations needed for capital-market development, sustainable consumer markets, and long-term financial stability.

Other Features

-

Analysis of CBN’s new regulations on cash management and dual ...

By revising cash policies and mandating dual connectivity for payment terminals, the Central Bank of Nigeria seeks to ...

-

Africa’s crypto investment market: where growth may emerge next

Africa’s crypto investment market: where the next growth coould explode.

-

Lessons from the 2025 Goalkeepers Report: What kind of innovation ...

The 2025 report issues a clear call to action for policymakers and engaged citizens.

-

Profit: The most powerful engine for scaling impact, dignity, and ...

The most prosperous countries in the world are not those with the most aid programmes. They are those with the most ...

-

Expect turbulent asset markets in 2026

The negative impact of Trump’s tariff and immigration policies will be felt more acutely in 2026.

-

The scars of partition

Contrary to his rosy assurances, partitions often result in tragedy, as borders drawn by cartographers rarely align ...

-

Best site to sell Bitcoin in Nigeria (Fast BTC to Naira in 2026)

Apexpay stands out because it focuses on what Nigerian users actually want: speed, good rates, and simplicity.

-

The quiet influence of securitisation in financing Africa's energy ...

The scale of Africa’s energy transition demands financial solutions that are modern, secure, and scalable.

-

Lean carbon, just power

Why a small, temporary rise in African carbon emissions is justified to reach the continent’s urgent ...

Most Popular News

- NDIC pledges support towards financial system stability

- Artificial intelligence can help to reduce youth unemployment in Africa – ...

- FRC Chairman commends NDIC for prompt remittance of operating surplus

- Pan-African nonprofit appoints Newman as Advisory and Executive Boards Chair

- UN adopts new consumer product safety principles

- Dollar slumps as Fed independence comes under fire