Nigeria's recession: Can private wealth change the tide?

Feature Highlight

In 2013, there were 15,700 High Net Worth Individuals in Nigeria, with a combined wealth of $82 billion.

Introduction

The Nigerian economy fell into a recession in the second quarter (Q2) of 2016, as it recorded a GDP growth rate of -2.06% (www.nigerianstat.gov.ng/report/434) owing, amongst other variables, to the fall in the price of oil. In a bid to resolve the current economic crisis, there have been propositions on mechanisms to be adopted by the Nigerian government in reviving the economy which include: assets sale; advance payment of licence renewals; infrastructure concessions; economic diversification; widening the tax net, etc.

This article posits that government should, in addition to the options stated above, pay attention to mobilizing the private wealth of Nigerian citizens as a low hanging fruit for reviving the Nigerian economy.

To drive this thesis that private wealth should be harnessed urgently, we would analyze some empirical statistics to compute the private wealth of Nigerian citizens; and proffer possible ways of utilizing private wealth to engender growth and productivity, and to invest in critical infrastructure.

Private Wealth Drives GDP

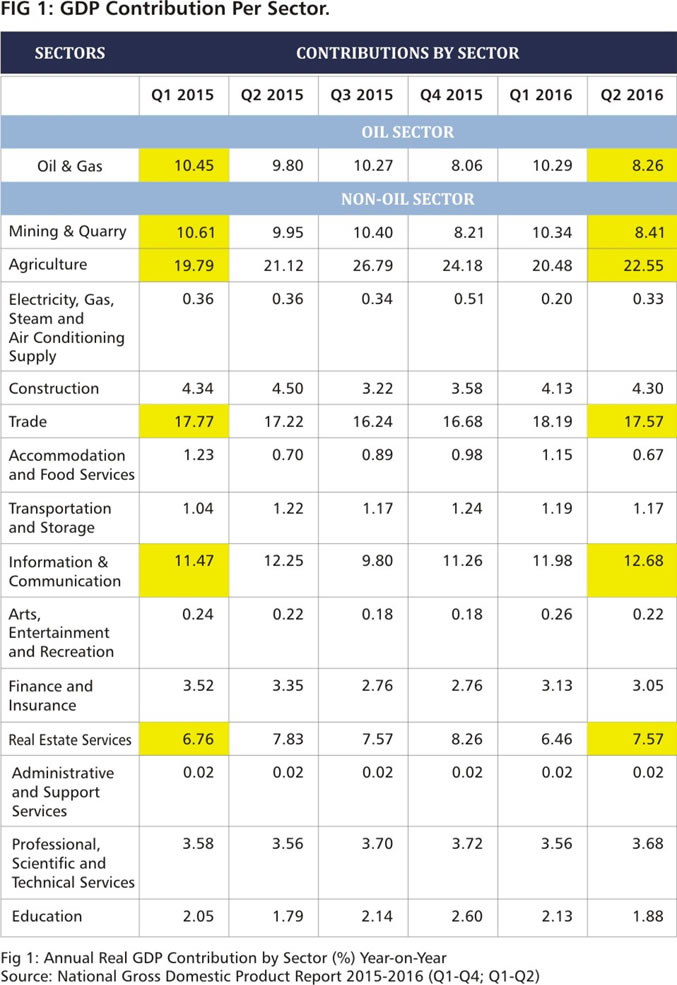

The correlation between the Nigerian Oil Sector (Government's cash cow) and Gross Domestic Product (GDP) tells a profound story. Figure 1 (particularly the figures highlighted in yellow) leads to several conclusions highlighted below:

a) The straight facts from the National Bureau of Statistics show that the Oil Sector accounted for 10.45% and 8.26% of real GDP in Q1 2015 and Q2 2016, respectively. Non-Oil sectors on the other hand, contributed about 89.55% and 91.74% to the nation's GDP in Q1 2015 and Q2 2016, respectively.

b) The Oil Sector accounts for 85% of Federal Government's income but is not the key driver for Nigeria's GDP since it last accounted for less than 10% of GDP. Over 90% of Nigeria's GDP was activated by the private activities in the non-oil sectors in Q2 2016.

c) Activities such as: Agriculture (22.55%), Trade (17.57%), Information and Communication (12.68%), Mining (8.41%) and Real Estate (7.75%) led the pack in their contributions to Nigeria's GDP in the last quarter.

d) The trend is that these top five GDP contributors (Agriculture, Trade, Information & Communication, Mining and Real Estate) have not shown a significant decline from Q1 2015 to Q2 2016. Conversely, some of these sectors like Real Estate have shown growth.

e) Given the above, it is clear that the fact that the oil prices have dropped does not necessarily mean a decline in activities in the non-oil sectors.

It would seem intuitive that if government focuses on policies that incentivize increased private sector expenditure in these five top sectors that are highest GDP contributors, Nigeria should improve by several economic indices despite the drop in oil prices. A boost in Agriculture for example, would reduce food import bill, decrease foreign exchange demand, increase employment and generally reduce food prices.

Redirecting Nigeria's Private Wealth

Nigeria is one country where its citizens have private wealth which, if redirected into the economy with the right incentives and specific government policies, may reflate the country's economy within a few years.

Here are some simple statistics that depict how much the private wealth of Nigerians may actually be worth:

I. Overseas Education Spending:

Nigerians spend over $2 billion annually on education abroad. (Vanguard, February 10, 2016). To put this in perspective, if $2 billion is converted at N400/$1, it would amount to N800 billion. To drive this home, kindly note that N800 billion is over double the N369 billion budgeted for Education in Nigeria's 2016 Budget. Should Nigeria not privatize some of the public universities (some of them who have very decent infrastructure) and incentivize the private sector to own and manage these citadels in order to replicate what they go abroad to seek?

It should be noted that many universities in the United States are funded by private endowments.

II. Private Wealth in Domiciliary Accounts:

The Central Bank of Nigeria (CBN) noted some months ago (Punch, March 4, 2016) that about $20 billion (N 8 trillion if converted at N400/$1) is lying idle in different domiciliary accounts of Nigerian citizens.

III. Nigerians in the Diaspora:

Nigerians in the diaspora have remitted about $104.57 billion into the country between the year 2010 and 2015. Analysis from remittances reveal that about $10 billion was remitted in 2010; $11 billion in 2011; $21 billion in 2012; $20.77 billion in 2013; $21 billion in 2014 (World Bank Migration and Development Brief 2015) and $20.8 billion in 2015. (Migration and Remittances Fact Book 2011 & 2016; Cp-africa.com)

IV. Statistics on High Net Worth Individuals (HNWIs):

Nigeria has the 3rd highest number of HNWIs in Africa. In 2013, there were 15,700 HNWIs in Nigeria, with a combined wealth of $82 billion, (Business Wire, February 14, 2014) which is about N32.8 trillion at N400/$1.

Conclusions

These statistics are very symptomatic and a few clear messages come through:

a) Whilst government's foreign exchange income has dwindled on the back of falling oil prices and reduced oil production, the GDP of Nigeria is privately led and held – and many of the sectors still sustain growth.

b) A combination of monies spent by Nigerians for overseas education, inward remittances by Nigerians in the diaspora and monies in Nigerian USD dorm accounts show a sizable wallet owned by Nigerians in USD.

c) An indeterminate number of Nigerian citizens (circa less than 10%) put together control more USD wealth (in net-worth) than the federal budgetary allocations over the next few years.

d) Many HNWI Nigerians who had healthy USD wealth are enriched today by the devaluation in the Naira and may have an incentive (given the right climate) to invest the windfall in Nigeria.

A few random questions may be thrown out there on possible ways to unlock some of the private wealth:

a) Can Nigeria attract more diaspora USD by simply having interest earning domiciliary accounts, at an interest rate of a few basis points above what can be earned in the typical destinations like the UK or the US?

b) Can government attract immediate income by a policy that allows companies make advance or forward payments on their taxes becoming due (based on a projected income with mechanism for netting off when the year-end audit has been prepared)? The companies would in exchange receive a healthy tax rebate that should in any case be cheaper than 16% at which government currently borrows.

c) Can government ask some companies to bid as consortiums to adopt some Nigerian universities (just the way Kellogg adopted Northwestern University, for example) and to take over the financing of these universities in exchange for zero education tax (currently 2% of income) for a set number of years?

It is important to note that whilst citizens have an inalienable right to wealth preservation, it stands to reason that given clear investment value propositions and the right incentives that are compelling; discerning investors (and Nigerians are indeed such) would redirect some of these monies to laudable projects in Nigeria.

Detail Commercial Solicitors is distinct as Nigeria's first commercial solicitor firm to specialize exclusively in non-courtroom practice. Based in Lagos, Nigeria's business capital, DETAIL is totally committed to its clients' business objectives and reputed for dealing with the minutiae. Email: info@detailsolicitors.com

Other Features

-

Africa needs AfDB President that is ready to deliver

As the AfDB elects its next president, the real question isn’t who inspires – but who has the experience ...

-

Governments are not startups

If public policymakers start mimicking business founders, they will undermine their own ability to address complex ...

-

How unrealistic budgeting fuels corruption and abuse of office

“The budget is the skeleton of the state stripped of all misleading ideologies.” – Rudolf ...

-

Highlights of the Investment and Securities Act 2024

A key objective of the Act is to bolster investor confidence through the implementation of stricter regulations ...

-

The rise of contemporary African art in a global market

It is real-time online auctions that we believe will most successfully expand the reach of African contemporary art ...

-

How to subscribe to Twitter Blue in Nigeria (2025 Guide)

Learn how to subscribe to Twitter Blue (X Premium) in Nigeria using reliable payment methods like a virtual dollar ...

-

New report offers insights for successful private equity exits in ...

The increasing prevalence of secondary deals (PE to PE transactions) have steadily risen over the last decade from ...

-

Africa must stop buying what it already has

The future is still ours to claim. But it will not be given. It must be built – by Africans, for Africans, with ...

-

Most Popular News

- Artificial intelligence can help to reduce youth unemployment in Africa – ...

- African Development Bank elects Sidi Ould Tah ninth president

- Nigerian digital lender pioneering new model attracts $4.2m seed investment

- Uganda Secures $800 million from IsDB to fund development through 2027

- GenAI to mostly transform and not replace 25% of exposed jobs

- Global space economy market to surpass $511 billion in 2029