Highlights of the Bank Neutral Cash Hubs guidelines

Feature Highlight

Cash management activities produce risks and significant operational costs to banks. To reduce the risks and costs borne by banks, the Central Bank of Nigeria has introduced Bank Neutral Cash Hubs and issued guidelines to regulate the activities.

Introduction

Several consumers and communities in Nigeria trade in cash for their commercial day-to-day activities. Although banks are simultaneously offering cash services and taking action to comply with the cashless policy of the Central Bank of Nigeria (CBN), cash management activities produce risks and significant operational costs to banks. In view of this, the CBN, in collaboration with the Banker’s Committee, established the Nigerian Cash Management System which seeks to reduce cost and improve operational efficiency in the country’s cash management value chain. Against this background, the CBN, on June 2, 2022, issued guidelines for the registration and operation of bank neutral cash hubs (BNCH) in Nigeria (the Guidelines).

BNCHs are neutral cash collection centres which will provide a platform (connected to the Nigerian Interbank Settlement System (NIBSS)) that enables customers to make cash deposits and receive value irrespective of the bank with which their account is domiciled. According to the Guidelines, the objectives of introducing BNCHs are to reduce the risks and costs borne by banks, merchants and huge cash handlers in the course of cash management activities; deepen financial inclusion; and leverage on shared services to enhance cash management efficiency.

This article seeks to highlight the key provisions of the Guidelines.

Permissible and Non-Permissible Activities

The Guidelines define the scope of operations of BNCHs by setting out the permissible and non-permissible activities of BNCHs. The permissible activities that BNCHs may carry out include:

a. receipt of Naira denominated deposits on behalf of financial institutions from individuals and businesses with high volumes of cash;

b. disbursement of Naira denominated withdrawals on behalf of financial institutions to individuals and businesses with high volumes of cash; and

c. any other activities that may be permitted by the CBN.

BNCHs are prohibited from:

a. carrying out investing or lending activities;

b. receiving, disbursing, or engaging in any transaction involving foreign currency;

c. subcontracting another entity to carry out its operations; and

d. performing any activities not expressly permitted by the CBN.

Eligible Promoters and Registration Requirements

According to the Guidelines, Deposit Money Banks (DMBs) and Cash Processing Companies (CPCs) are the only eligible promoters who may apply for the registration of a BNCH.

The CBN grants approval to register a BNCH in two stages namely: (i) Approval-in-Principle (AIP); and (ii) Final Approval and a formal application is required for each BNCH site to be set up by a promoter.

The registration requirements for an eligible promoter seeking to register a BNCH include the following:

a. To obtain an AIP, the promoter must make formal application addressed to the Director, Currency Operations Department (COD) which must clearly state a request to be granted approval to operate a BNCH and be accompanied with the required documents provided in Paragraph 5.1 of the Guidelines; and

b. Following the receipt of an application with complete and satisfactory documentation, the CBN shall issue an AIP to the promoter.

c. After receiving an AIP, the promoter of the BNCH is required to comply with and satisfy the documentation requirements, financial requirements, pre-approval inspection requirements, post-commencement requirements, technology requirements, and data and network security requirements provided in the Guidelines before the CBN will issue a Final Approval to the promoter of the BNCH.

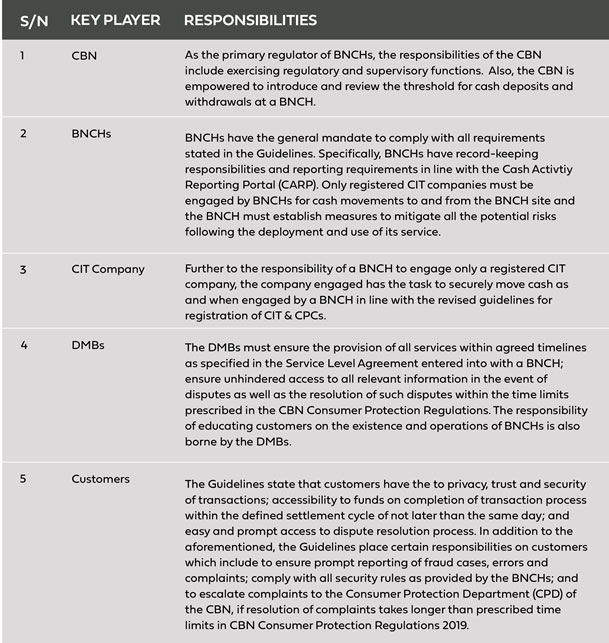

Responsibilities of Key Players

The efficient operations of a BNCH will be dependent on the collaborative effort among certain key players being the CBN, BNCH, Cash-in-Transit (CIT) company, DMBs and customers. In order to promote effective cooperation and to support efficiency in operations, the Guidelines define the roles and responsibilities of these key players.

Consumer Protection

In order to ensure the protection of consumers, the CBN placed obligations on BNCHs to adhere to certain consumer protection measures. The Guidelines mandate that BNCH shall do the following:

a. ensure 24/7 open communication to receive complaints and enquiries from customers;

b. clearly inform customers of all charges for services;

c. ensure the arrangement of consumer protection mechanisms against loss of service, fraud and privacy of customer information to enhance confidence in the services provided by the BNCH;

d. provide the leading role in dispute resolution and collaboration with relevant agencies for resolving disputes; and

e. resolve customer complaints within a reasonable time not exceeding 48 hours from the date the complaint is lodged with the BNCH.

Remarks

On a global scale, we note that access to cash for communities is a growing concern. In the United Kingdom, the closure of several bank branches within communities have led to private and governmental efforts to maintain access to cash for people and businesses, Grace Witherden wrote in which.co.uk in December 2021. According to his article in Financial Times the same month, Siddharth Venkataramakrishnan said major UK banks have supported an initiative for the establishment of shared banking hubs where the banks work jointly to offer cash services. Banks which have agreed to collaborate under the initiative to open bank hubs in four locations in England include Barclays, HSBC, Lloyds, NatWest, Santander, TSB and Danske Banke. While the shared banking hubs in the UK differ from BNCHs in that the hubs in the UK are not neutral because transactions are available to only customers of collaborating banks and not all banks, a common aim of BNCHs and the UK banking hubs is to ensure access to cash and ultimately, financial inclusion for all communities.

The neutrality of the BNCHs will benefit traders and purchasers in market clusters, as well as other consumers who transact daily with large volumes of cash by improving the ease and efficiency of cash transactions. A single trip to a BNCH would save time and money which would have been spent on multiple trips to the branches of different banks. Furthermore, evidence of insurance to cover hub vault cash and total deposits are prerequisites to the grant of final approval and this will ensure that the hub vault cash and deposit by customers are adequately protected.

Unlike the previously circulated draft guidelines, the Guidelines is silent on the minimum threshold for deposit and withdrawal limit for BNCHs. However, the Guidelines state that the CBN is empowered to introduce and review the threshold for cash deposit and withdrawal. This is a welcomed approach as it enables the CBN to adapt the transaction amount threshold limit to meet the demands of customers as well as prevent abuse of BNCHs.

In conclusion, the introduction of BNCHs is a laudable initiative and its effective implementation will greatly benefit the Nigerian populace.

Detail Commercial Solicitors is distinct as Nigeria’s first commercial solicitor firm to specialize exclusively in non-courtroom practice. Based in Lagos, Nigeria’s business capital, DETAIL is totally committed to its clients’ business objectives and reputed for dealing with the minutiae. Email: info@detailsolicitors.com.

Other Features

-

The quiet influence of securitisation in financing Africa's energy ...

The scale of Africa’s energy transition demands financial solutions that are modern, secure, and scalable.

-

Lean carbon, just power

Why a small, temporary rise in African carbon emissions is justified to reach the continent’s urgent ...

-

Utilising the FTSA to unlock value in Nigeria’s gas production

Given the FG’s recent investment drive to fully monetise the country’s gas reserves, now is an opportune ...

-

Islamic finance posts double-digit growth in 2025

Forward-looking projections suggest that total assets are on track to cross USD 6 trillion by the end of 2026.

-

Can you earn consistently on Pocket Option? Myths vs. Facts breakdown

We decided to dispel some myths, and look squarely at the facts, based on trading principles and realistic ...

-

How much is a $100 Steam Gift Card in naira today?

2026 Complete Guide to Steam Card Rates, Best Platforms, and How to Sell Safely in Nigeria.

-

Trade-barrier analytics and their impact on Nigeria’s supply ...

Nigeria’s consumer economy is structurally exposed to global supply chain shocks due to deep import dependence ...

-

A short note on assessing market-creating opportunities

We have researched and determined a practical set of factors that funders can analyse when assessing market-creating ...

-

Rethinking inequality: What if it’s a feature, not a bug?

When the higher levels of a hierarchy enable the flourishing of the lower levels, prosperity expands from the roots ...

Most Popular News

- NDIC pledges support towards financial system stability

- Artificial intelligence can help to reduce youth unemployment in Africa – ...

- Nigeria’s December PMI hits 57.6 points as economic activities strengthen

- Afreximbank backs Elumelu’s Heirs Energies with $750-million facility

- Lagride secures $100 million facility from UBA

- GlobalData identifies major market trends for 2026