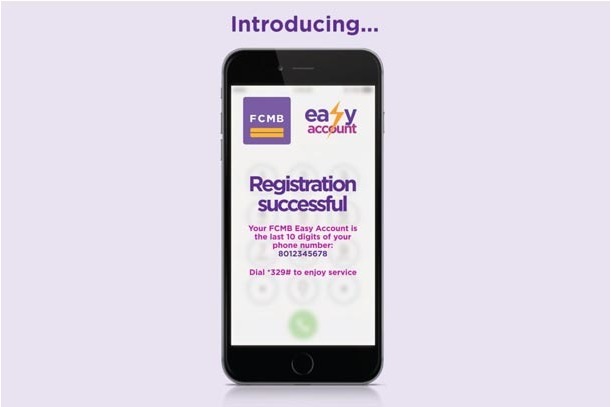

Something easy is here! Your phone number is your account number!

Feature Highlight

The Bank stated that the self-service, stress-free and secured FCMB Easy Account, is available on all GSM networks in Nigeria.

Leading Lender, First City Monument Bank (FCMB), has taken another major leap in the retail and mobile banking segments of the Nigerian financial services industry. It has launched a new product called FCMB Easy Account. Described as banking made accessible to all, a significant and value-added feature of this product is that the telephone numbers of the customers, without the first digit, serve as their respective account numbers. The Account is an enhanced version of its *329# USSD platform.

In a statement, the Bank explained that FCMB Easy Account has been designed to make banking accessible to all Nigerians and will help to achieve the laudable goal of financial inclusion for most Nigerians as set by the Central Bank of Nigeria (CBN). It is a product open to all, particularly to meet the needs of low-income earners and the unbanked segment of the society. It enables the account holders have access to convenient and secured financial services, irrespective of their locations.

The Bank stated that the self-service, stress-free and secured FCMB Easy Account, is available on all GSM networks in Nigeria. It enables everyone in any location in Nigeria (rural, urban or remote) open an FCMB Easy account and carry out banking transactions on their mobile phones, even if there are no banks physically located at the area. All they need to do is dial *329# from their mobile phones and follow the instructions. Internet service availability which has been a major constraint to mobile banking service access is not required for FCMB Easy Account, as the account operates on the USSD platform.

FCMB Easy Account customers can send and receive money to and from friends, families and business partners across all banks in Nigeria. They can also deposit funds into their accounts at over 100,000 agents and banking locations of FCMB and other banks and mobile money operators in Nigeria. FCMB Easy account customers can also use their accounts for airtime purchase, bill payments and other payments.

With a clear understanding of its market and environment, FCMB is well positioned to continue to create value by delivering exceptional services, while enhancing the growth and achievement of the personal and business aspirations of its customers.

Dial *329# to get started!

For more information about FCMB Easy Account, visit www.fcmb.com/easy-account.

Other Features

-

Can you earn consistently on Pocket Option? Myths vs. Facts breakdown

We decided to dispel some myths, and look squarely at the facts, based on trading principles and realistic ...

-

How much is a $100 Steam Gift Card in naira today?

2026 Complete Guide to Steam Card Rates, Best Platforms, and How to Sell Safely in Nigeria.

-

Trade-barrier analytics and their impact on Nigeria’s supply ...

Nigeria’s consumer economy is structurally exposed to global supply chain shocks due to deep import dependence ...

-

A short note on assessing market-creating opportunities

We have researched and determined a practical set of factors that funders can analyse when assessing market-creating ...

-

Rethinking inequality: What if it’s a feature, not a bug?

When the higher levels of a hierarchy enable the flourishing of the lower levels, prosperity expands from the roots ...

-

Are we in a financial bubble?

There are at least four ways to determine when a bubble is building in financial markets.

-

Powering financial inclusion across Africa with real-time digital ...

Nigeria is a leader in real-time digital payments, not only in Africa but globally also.

-

Analysis of NERC draft Net Billing Regulations 2025

The draft regulation represents a significant step towards integrating renewable energy at the distribution level of ...

-

The need for safeguards in using chatbots in education and healthcare

Without deliberate efforts the generative AI race could destabilise the very sectors it seeks to transform.

Most Popular News

- NDIC pledges support towards financial system stability

- Artificial intelligence can help to reduce youth unemployment in Africa – ...

- ChatGPT is now the most-downloaded app – report

- CBN licences 82 bureaux de change under revised guidelines

- Africa needs €240 billion in factoring volumes for SME-led transformation

- Green economy to surpass $7 trillion in annual value by 2030 – WEF