Policy responses to the looming recession in Nigeria

Feature Highlight

We are not in a recession yet; but that may not be far away unless the right steps are taken without further delay.

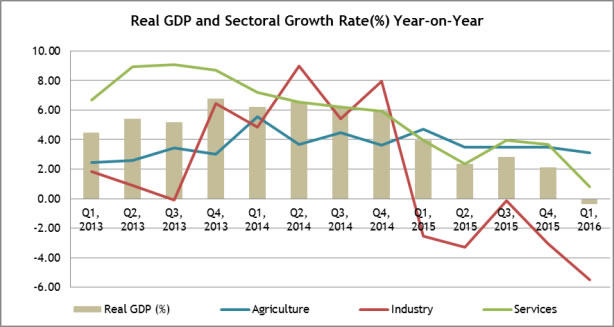

The aggregate output data recently released by the National Bureau of Statistics (NBS) for the first quarter of 2016 shows that Nigeria’s economy is at the verge of sliding into a recession. With a 0.36% contraction in GDP, many sectors of the economy have shrunk. These include manufacturing, real estate, financial services and petroleum. Oil revenues, which used to account for between 60%-70% of government revenues, are now estimated to have provided about 40% of consolidated government revenues since the decline of oil prices. This has weakened government's balance sheet and pushed current account deficit to an estimated 2.4% of GDP in 2015, according to the IMF.

The situation has been compounded by the destruction of oil installations by Niger Delta militants. Crude oil production is currently at its lowest level in 25 years (with production volume of 1.4 million barrels per day). Nigeria’s total exports have dropped by 40%.

We are not in a recession yet; but that may not be far away unless the right steps are taken without further delay. Based on the econometric definition, if a recession persists for several more quarters in a row, then a depression ultimately becomes real. From sustained high single-digit growth rate of average 6% over the last decade (till 2014), Nigeria’s GDP growth nosedived to 2.8% last year and is forecasted to fall even lower in 2016, based on IMF estimates.

Source: National Bureau of Statistics (NBS)

This, indeed, is quite disconcerting for a country that achieved the glory of becoming the largest economy on the African continent only a few years ago. The continued reliance on a single product for the better part of Nigeria’s budget revenue is what makes the economy to be fraught with serious risks.

The spiral effect of low crude oil prices is widespread and deep. For instance, with the current fiscal shock, majority of state governments are either unable to pay – or are late in paying – workers’ salaries and contractors. The removal of fuel subsidy has led to increase in transportation costs. Also, investors’ confidence is at a very low level. In short, evidence around the country attests to how tough conditions have become for the ordinary folks and businesses.

Cyclical World

The economic trend of the post-World War 2-era observed over the last 70 years is without question cyclical. The gyrations of global commodity prices and financial markets have become a common feature. This is even more pronounced in commodity-based and mono-product-dependent countries like Nigeria. So the ability to forecast, diversify or build fiscal buffers to be able to hedge against such occurrences is very fundamental to withstanding the impact of price shocks or financial crisis periods.

Whereas successive governments in Nigeria have failed in their responsibility to diversify the economy, what is even worse is the shortsightedness and lack of political will to save for this current rainy day when the economic outlook was buoyant and GDP was expanding. At its peak in early 2007, the Nigerian Excess Crude Account (ECA) was over $20 billion while foreign reserves crossed $40 billion. Thanks to this financial shock-absorber; Nigeria was able to withstand the impact of the global financial meltdown in 2008. Despite the clamour by critics who stood against the setting up of the ECA, it is fair to say that the funds served a very good purpose when it was needed most. Unfortunately, the savings were never replenished to the pre-2008 level.

That current adverse conditions will reverse with time is not in doubt. But, rather than dwell in the blame-game, how President Muhammadu Buhari and his economic team respond to the impending economic downturn will determine how quickly Nigeria can rebound.

Source: Central Bank of Nigeria, Bloomberg

The Right Response

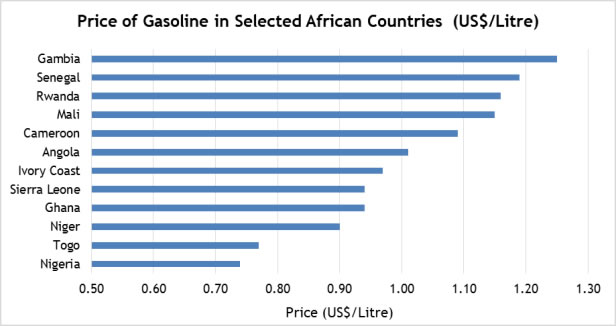

The ongoing economic crisis revolves around two main factors – namely, the subsidy debacle and Naira exchange rate. All sorts of numbers and arguments have been bandied around on the removal of the subsidy on petrol as well as the exchange rate policy. Without pandering to any sentiments, it is fair to say that the solution lies in the political will and sound economic judgment of the President.

Last year, Nigeria paid over N600 billion as backlog of fuel subsidy payments to petroleum product marketers, according to the Minister of State for Petroleum. At its peak in 2012, Nigeria spent well over N1.7 trillion paying oil subsidy. But much of the petroleum products ultimately ended up in neighbouring West African markets where prices were higher. This has been the practice, historically. Thus the argument that the ‘common man’ benefits for petrol subsidy is invalidated.

But if we must face reality, it is the market forces that best determine prices of goods and services. When prices are skewed due to a regime of overregulation, you are bound to get this sort of practice by market operators with the attendant negative impact on the economy.

Source: GlobalPetrolPrices.com

Striking a Balance

Rather than subsidize consumption, the government should aim at supporting domestic production (by artisans, manufacturers and value-adding entrepreneurs) and local refining of crude oil. Instead of dolling out frivolous handouts to the already well-off refined petroleum product importers or subsidizing the lifestyle of middle- to high-income households with multiple vehicles, the government should target the most disadvantaged and vulnerable citizens (unemployed youths, rural women and children) by providing direct conditional grants and subventions. But more importantly, government should invest heavily in infrastructure (roads, railways and housing) and social services (healthcare and education) that have the capacity for catalyzing economic productivity, creating jobs and improving the human capital available in the country.

On the naira exchange rate, most Nigerians recall with nostalgia the favourable exchange rate regime of the 1970s/1980s. Those years are gone. The inability or unwillingness to diversify the economy over the last three or more decades remains the main cause of the challenges we faced today. The attempt to manage exchange rate volatility via administrative fiat could not have been successful. It is apparent that when every conceivable consumer product (both food and manufactured goods) and refined petroleum products are imported, the outcome is what we see today. These items gulp a large portion of our forex proceeds. With further declining export earnings, the trade deficit is no longer sustainable.

The alternative is either to deplete the foreign exchange reserves for the purpose of defending the naira or curtail non-essential imports. None of these measures are salutary, especially if you consider the unintended consequences on the economy. Examples of the fallouts could be social discontent, stifling of economic activities and worsening living conditions.

In my view, the solutions – with manageable economic and social fallouts – include the easing of the pricing mechanism for petroleum products and liberalization of the ownership of local refineries. The Dangote refinery is expected to come on stream in a couple of years. Nevertheless, more private sector participation in the acquisition and construction of new refineries will eliminate the importation of refined petroleum products and reduce the pressure on our forex reserves.

The recent Central Bank of Nigeria announcement after its Monetary Policy Committee meeting on Tuesday, 24th of May, that the apex bank will create a dual forex window and lift restrictions on conversion and capital control is a welcome development, albeit it is coming a little too late when a recession is already looming. It remains to be seen what immediate impact these measures would have on the exchange rate, foreign capital inflow and investor confidence – factors that are quite crucial to stem the current economic slide. But as the saying goes, “better late than never.”

Chamberlain S. Peterside, PhD is the Executive Chairman of Lagos-based Xcellon Capital Advisors Ltd.

Other Features

-

The quiet influence of securitisation in financing Africa's energy ...

The scale of Africa’s energy transition demands financial solutions that are modern, secure, and scalable.

-

Lean carbon, just power

Why a small, temporary rise in African carbon emissions is justified to reach the continent’s urgent ...

-

Utilising the FTSA to unlock value in Nigeria’s gas production

Given the FG’s recent investment drive to fully monetise the country’s gas reserves, now is an opportune ...

-

Islamic finance posts double-digit growth in 2025

Forward-looking projections suggest that total assets are on track to cross USD 6 trillion by the end of 2026.

-

Can you earn consistently on Pocket Option? Myths vs. Facts breakdown

We decided to dispel some myths, and look squarely at the facts, based on trading principles and realistic ...

-

How much is a $100 Steam Gift Card in naira today?

2026 Complete Guide to Steam Card Rates, Best Platforms, and How to Sell Safely in Nigeria.

-

Trade-barrier analytics and their impact on Nigeria’s supply ...

Nigeria’s consumer economy is structurally exposed to global supply chain shocks due to deep import dependence ...

-

A short note on assessing market-creating opportunities

We have researched and determined a practical set of factors that funders can analyse when assessing market-creating ...

-

Rethinking inequality: What if it’s a feature, not a bug?

When the higher levels of a hierarchy enable the flourishing of the lower levels, prosperity expands from the roots ...

Most Popular News

- NDIC pledges support towards financial system stability

- Artificial intelligence can help to reduce youth unemployment in Africa – ...

- Nigeria’s December PMI hits 57.6 points as economic activities strengthen

- Afreximbank backs Elumelu’s Heirs Energies with $750-million facility

- Lagride secures $100 million facility from UBA

- GlobalData identifies major market trends for 2026