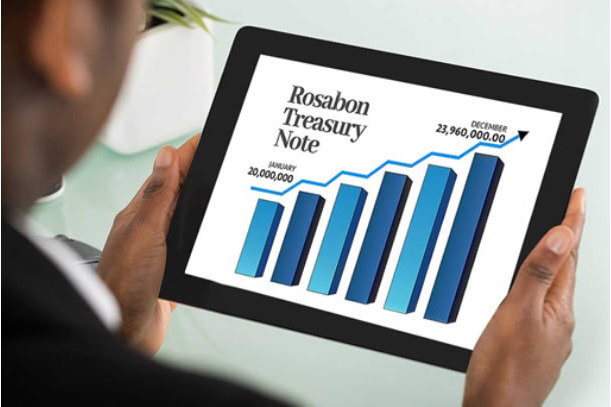

Financial Planning: How you can earn 16.5 per cent interest through Rosabon Treasury Note

Feature Highlight

Rosabon Treasury Note offers Nigerians the opportunity to build their passive earning capacity and improve their economic wellbeing.

In light of the ongoing global pandemic, Rosabon Financial Services, Nigeria’s leading Non-Bank Financial Services provider, Services has offered for subscription, its second quarter Treasury Note at 16.5 per cent to better help customers save during this period.

Rosabon Treasury Note is the ultimate earning package with exciting interest rates for individuals and organizations. Individuals can earn a high-yield interest rate of up to 16.5% per annum on placed funds. It is available to new and existing customers to enjoy secure, convenient and rewarding returns.

Due to the rising global challenges brought on COVID-19, the negative impact on economic growth has increased significantly as the active and future earning capacity of many Nigerians have taken a huge hit. To mitigate this reality, Rosabon Treasury Note offers Nigerians the opportunity to build their passive earning capacity and improve their economic wellbeing.

According to Chukwuma Ochonogor, Managing Director, Rosabon Financial Services: “Having a sustainable game-plan to grow your funds money is always smart and Rosabon offers a broad range of money-growth programs designed to help you meet your unique financial goals.

With Rosabon Treasury Note, you can make your money work harder for you and experience the seamless and convenient way to grow your funds. With a minimum of N50, 000, the earning package guarantees premium interest rates on your funds.

You can also borrow up to 150% of your funds, enjoy flexible investment tenors and monitor growth of your funds.”

With the ongoing fight against COVID-19, Rosabon Financial Services has unleashed various credit and treasury offerings to help many with their finances as part of its contribution to fighting COVID-19 and its economic effects in Nigeria. The institution has also reached out to its customers, urging them to use its digital and electronic investment portal platforms during this period of the pandemic to remain safe.

Ochonogor reiterates the institution’s commitment to continued service, “The health and safety of our customers is our top priority. We will continue to keep you informed. Our Business Continuity plan ensures that we are able to maintain operations even during this crisis. We are committed to providing you with unlimited access to financial services and your money.”

Click here for more information about our treasury offerings.

Contact our Financial Advisory experts today on 0815 088 0038, 0815 088 0039, 0815 084 6657 or talk to us via social media (@RosabonFinance).

Other Features

-

How much is a $100 Steam Gift Card in naira today?

2026 Complete Guide to Steam Card Rates, Best Platforms, and How to Sell Safely in Nigeria.

-

Trade-barrier analytics and their impact on Nigeria’s supply ...

Nigeria’s consumer economy is structurally exposed to global supply chain shocks due to deep import dependence ...

-

A short note on assessing market-creating opportunities

We have researched and determined a practical set of factors that funders can analyse when assessing market-creating ...

-

Rethinking inequality: What if it’s a feature, not a bug?

When the higher levels of a hierarchy enable the flourishing of the lower levels, prosperity expands from the roots ...

-

Are we in a financial bubble?

There are at least four ways to determine when a bubble is building in financial markets.

-

Powering financial inclusion across Africa with real-time digital ...

Nigeria is a leader in real-time digital payments, not only in Africa but globally also.

-

Analysis of NERC draft Net Billing Regulations 2025

The draft regulation represents a significant step towards integrating renewable energy at the distribution level of ...

-

The need for safeguards in using chatbots in education and healthcare

Without deliberate efforts the generative AI race could destabilise the very sectors it seeks to transform.

-

Foundation calls for urgent actions to tackle fake drugs and alcohol

Olajide Olutuyi, Executive Director, Samuel Olutuyi Foundation, warns: “If left unchecked, the ‘death ...

Most Popular News

- NDIC pledges support towards financial system stability

- Artificial intelligence can help to reduce youth unemployment in Africa – ...

- Africa needs €240 billion in factoring volumes for SME-led transformation

- ChatGPT is now the most-downloaded app – report

- Global trade to hit record $35 trillion despite slowing momentum

- CBN licences 82 bureaux de change under revised guidelines