Brickstone set to develop industry’s knowledge for project finance

Feature Highlight

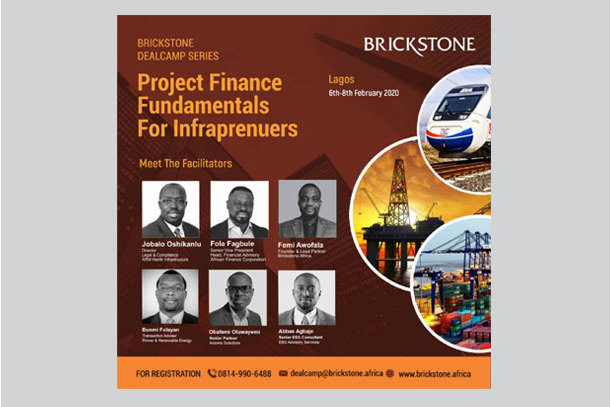

The Project Finance Fundamentals for Infrapreneurs training, one of the courses in the Brickstone Dealcamp Series, will hold in major African cities, including Abuja, Lagos, Port Harcourt and Accra.

The African Development Bank currently seeks investments from global pensions and commercial financiers to help fund the continent’s infrastructure gap, which is estimated at $170 billion. This infrastructure need presents an investment opportunity, especially for ‘infrapreneurs.’ As used in the context of this article, infrapreneurs refer to entrepreneurs or business owners who are typically in corporate businesses but are desirous of developing large-scale projects such as toll roads, power plants, renewable energy, gas plants, airports, large-scale real estate projects, and so on.

While the government should provide an enabling environment for infrastructure investment, the private sector should equally play a leading role in major infrastructural developments. For infrapreneurs to overcome the obstacles often associated with project delivery, it is necessary to develop a string of “infrastructure finance” capabilities, in order to attract capital from investors.

Our survey at Brickstone reveals that 80 per cent of entrepreneurs who show interest in the development of infrastructure do not have the knowledge and capacity to develop and execute these projects. Our research further reveals that most entrepreneurs cannot demonstrate in-depth knowledge of their large-scale projects during their pitches to institutional investors, and they often find it difficult to secure the right equity funding needed to attract additional funding required for the projects. Consequently, the African private sector has not been able to take its rightful place in infrastructure project delivery.

Understanding the need for knowledge exchange in infrastructure finance, Brickstone Africa has set up the Brickstone Dealcamp Series – a training series designed for African infrapreneurs who seek to develop projects but lack the knowledge of project and corporate finance principles. Under the training series, the Brickstone Africa team provides intensive two or three-day programmes, using best practice masterclass finance training tools designed specifically for entrepreneurs involved in large-scale projects in energy, infrastructure and real estate sectors.

The Project Finance Fundamentals for Infrapreneurs is one of the courses in the Brickstone Dealcamp Series. The trainings will hold in major African cities, including Abuja, Lagos, Port Harcourt and Accra. The three-day training focuses on the infrastructure financing process.

It is important for entrepreneurs to know that infrastructure financing is a lengthy process that could take between one to five years to achieve financing close (i.e. raising the required capital, which sometimes could be over $2 billion on a single project). Infrastructure financing is an enormous undertaking, which requires four major phases of the project development life cycle, namely a) early stage development, b) pre-financing stage, c) financing stage and d) post financing stage. These four phases are extensively covered in the Brickstone Project Finance Fundamentals for Infrapreneurs course.

During the early development stage, issues discussed would include the origination process of an infrastructure project. We define an infrastructure project as a capital-intensive facility that requires securing a conditional right from a ceding authority pursuant to a tendering process or an unsolicited proposal to build an infrastructure facility under a contracted revenue (either on price or quantity or both). Brickstone stresses that during the early development stage, infrapreneurs must develop realistic estimates of the large-scale project and ensure the revenues are sufficient to cover capital and operating expenses and repay project debt with an acceptable margin of safety.

The early development stage ends where the infrapreneurs and ceding authorities agree to proceed on developing the project. There are activities that may involve negotiating on and formalizing as the project development proceeds with an agreed implementation plan.

The pre-financing stage is the lengthiest of the stages and could occur between one to five years. This is where most African projects get stalled and are not able to move forward. This stage includes detailing transaction plans with supporting transaction documentation such as Project Agreements, Information Memorandum and a Detailed Financial Model. It is worth noting that before a lender decides to lend on a project, such a lender must ensure the concerned project is financially and technically feasible by analyzing all the associated factors, including the Financial Model and Project Agreements. The experience of the lender also comes to bear at this point, as this determines how long the infrastructure financing process would take.

For the financing stage to happen, the infrapreneur needs to acquire equity or loan from a financial services organization whose goals are aligned with the project. During this step, the borrower and lender negotiate the loan amount and come to a unanimous decision regarding the same.

As the project commences during the post-financing stage, it is imperative to keep track of the cash flow from its operations as these funds will be utilised to repay the loan taken to finance the project.

Finally, it is important for infrapreneurs to note that project development is a journey towards achieving bankability. It is usually a long and expensive expedition, which could cost as much as 5-10 per cent of the total project cost. A less knowledgeable infrapreneur would spend a lot more. The knowledge to achieve bankability is what is lacking amongst most African business executives and infrapreneurs. Brickstone Africa has set out to close this knowledge gap through the Brickstone Dealcamp Series.

More information on the Brickstone Dealcamp Series can be found at www.brickstone.africa.

Other Features

-

Lessons from Lesotho for low-income countries

For years, global development practitioners have been trapped in a false choice of aid versus trade. Lesotho tried ...

-

Unlocking opportunity: Why mobility is key to Nigeria’s prosperity

Transforming mobility in Nigeria requires a collective, system-wide approach from key stakeholders across the entire ...

-

5 best virtual cards for Apple Music subscription in Nigeria

Discover the 5 best virtual cards for Apple Music in Nigeria: Cardtonic, Tribapay, Klasha, Vesti, and SnappyPay, ...

-

Unlocking opportunity: How poultry can catalyse prosperity in Nigeria

According to a recent survey, 45% of Nigerians – equivalent to 92.7 million people – do not consume ...

-

How the ISA 2025 reshapes Nigeria’s crowdfunding regulation

The Investment and Securities Act 2025 expands the SEC’s oversight functions, mandates the registration of all ...

-

The tragedy of Emmanuel Macron

The contrast between Macron’s early promise and his current image seems almost theatrical.

-

Unlocking opportunity: A new vision for eye care in Nigeria

Pull Quote: Market-Creating Innovations Opportunities in Nigeria Series – Part 1 of 7.

-

Open banking will revolutionise financial services in Nigeria

Open banking is poised to unlock unprecedented opportunities for innovation, foster healthy competition among ...

-

Redefining global trade: Africa's strategic role in a multipolar world

BCG's report provides insights into how African business leaders can position for the future by investing in ...

Most Popular News

- NDIC pledges support towards financial system stability

- Artificial intelligence can help to reduce youth unemployment in Africa – ...

- Verod Capital exits Tangerine Pensions, sells stake to APT Securities

- Africa Finance Corporation closes record $1.5 billion syndicated loan

- New discovery offers hope against devastating groundnut disease

- Prospect of rally dampens after oil prices tumble