What do caring for babies and market creation have in common? A lot

Feature Highlight

Just as infants rely on their parents or caregivers for every aspect of their care and development in infancy, markets depend on entrepreneurs and investors to undertake every essential task in their creation.

In the world of entrepreneurship, the journey of creating and scaling new markets shares striking similarities with the process of caring for infants in their earliest stages of development. Fresh off paternity leave, I have been reflecting a lot on these similarities and how an innovation theory called interdependence and modularity helps connect the dots.

Babies, with their adorable innocence and vulnerability, rely entirely on their caregivers for every aspect of their well-being. From feeding and dressing to bathing and soothing, parents or caregivers shoulder the responsibility of meeting their every need. This nurturing also extends beyond basic care to encompass the critical task of introducing them to the world, teaching them language, behaviour, and safety. Essentially, parents must attend to virtually every aspect of a baby’s early development to ensure their healthy growth.

As children grow, parents gradually delegate various tasks to them. Sometimes children, often before they are ready, demand to take on certain tasks. For instance, as youngsters mature, they begin to feed themselves, master potty training, read, and develop awareness of basic hazards in their environment. None of this is new information when thinking about a child’s development.

Now, let’s draw parallels with the process of market creation. As a new market emerges, the entrepreneur must take on a multitude of responsibilities – from crafting the new product and educating the customer on its benefits to building out distribution and often establishing the entire value network. This is sometimes referred to as vertical integration.

For example, when Ford Motor Company was creating a new automobile market for hundreds of millions of people who couldn’t afford cars, the company “ran coal and iron ore mines, timberlands, rubber plantations, a railroad, freighters, sawmills, blast furnaces, a glassworks, and more. Capping it all was a giant factory at River Rouge, Michigan, which built the parts and assembled the cars.” Similarly, when Tolaram, makers of Indomie noodles in Nigeria, began the process of creating the market for noodles in the country, the company built manufacturing plants, distribution networks, retail shops, and invested heavily in customer education. The same process happened for the telecommunications sector across Africa. Early companies and entrepreneurs needed to invest in building out the entire cellular infrastructure if they were going to successfully create the market.

Just as infants rely on their parents or caregivers for every aspect of their care and development in infancy, markets depend on entrepreneurs and investors to undertake every essential task in their creation. Over time however, as markets (like infants) mature, specific tasks and activities can be reliably outsourced to suppliers and partners.

The interdependence and modularity theory provides insight and guidance as companies consider what activities to manage in-house or outsource. Modularity theory is a framework for explaining how different parts of a product’s architecture relate to one another and consequently affect metrics of production and adoption.

A product is modular when there are no unpredictable elements in the design of its parts. Modularity standardizes the way by which components fit together – physically, mechanically, chemically and so on. The parts fit and work together in well-understood, crisply codified ways.

A product is interdependent when the way one part is made and delivered depends on the way other parts are made and delivered. Interdependency between parts requires the same organisation to develop both components if it hopes to develop either component.

Organisations perform a myriad of connected activities such as design, sourcing of raw materials, manufacturing, testing, distribution, marketing, sales, after-sales service and support, and so on. Each step adds some value to the finished product.

Before an organisation chooses to outsource any of these activities to outside suppliers, it should start by asking itself whether the activity meets the following standards:

Specifiability: The standards must specify all the critical design elements for producing desired outcomes.

Verifiability: There must be a way to verify that the standards are met.

Predictability: A system that is verified to meet the standards must produce the desired outcomes with a high degree of predictable success.

If the interface isn’t specifiable, verifiable, or predictable, then the organisation must integrate that particular operation by handling it in-house. For example, if the organisation cannot rely on distribution companies to get its product to retail stores for sales in a specifiable, verifiable, and predictable manner, then the organisation is better off developing its own distribution channel. Alternately, if the organisation cannot depend on external retail outlets to sell its products in a specifiable, verifiable, and predictable manner, then the organisation is best served by developing its sales channel.

As babies progress through infancy and into childhood, they gradually assume greater responsibility for their own needs and development. Caregivers progressively entrust them with tasks, allowing them to become more self-reliant over time. This evolution continues until they reach adulthood, where they become fully accountable for their own growth and well-being. Similarly, in the early stages of market creation, entrepreneurs, investors, and policymakers bear the burden of nurturing and shaping the market. As the market matures, various responsibilities can be outsourced to suppliers, partners, and other stakeholders within the ecosystem.

Efosa Ojomo is a senior research fellow at the Clayton Christensen Institute for Disruptive Innovation, and co-author of The Prosperity Paradox: How Innovation Can Lift Nations Out of Poverty. Efosa researches, writes, and speaks about ways in which innovation can transform organisations and create inclusive prosperity for many in emerging markets.

Other Features

-

Sustainability linked loans and the prospects for Nigerian businesses

There have been globally accepted principles promulgated over the years by collaborative efforts for sustainable ...

-

Why AI’s business models will determine its potential to ignite ...

Most technologies are primarily available to people in high-income countries. If AI follows the same path, it will ...

-

Can AI technology really create global prosperity? (part 1)

The flood of capital and interest in developing AI-focused products and services has been met with both excitement ...

-

Africa PPP 2024 to focus on energy, water, transport, tech and ...

Africa’s foremost infrastructure, development, investment, and partnership summit, Africa PPP returns to ...

-

Driving Nigeria's economic growth through mobile technology

Despite the mobile sector's significant contributions to Nigeria's economy, its resilience is being challenged ...

-

OPEC’s pride in its African roots

Looking throughout our 63-year history, many significant meetings took place in African cities.

-

How to use Netflix Gift Card to pay for your Netflix subscription

Learn how to easily use Netflix gift cards to pay for your subscription. Get step-by-step instructions on buying ...

-

The best sites to buy and sell Bitcoin in Nigeria: A comprehensive ...

Buying and selling BTC doesn’t have to be a hassle. Check out to best sites to buy and sell Bitcoin in Nigeria ...

-

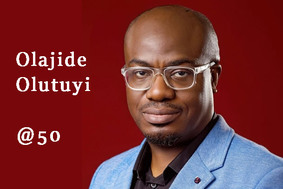

At 50, Olajide Olutuyi vows to intensify focus on social impact

Like Canadian Frank Stronach utilised his Canadian nationality to leverage opportunities in his home country of ...

Most Popular News

- AfDB has invested $1.44bn to support infrastructure development in Nigeria

- CBN raises interest rate by 50bps to extend hiking cycle

- IMF Deputy Managing Director Antoinette Sayeh to retire from the Fund

- Swedfund invests $30mn in Access Bank for MSMEs financing in Nigeria

- Nigerian inflation rate climbs to 34.19 percent

- ADIPEC Technical Conference receives record-breaking submissions