Structural analytics of Nigeria’s equity market performance

Summary

Amid elevated uncertainty, the domestic bourse staged a remarkable reversal, posting gains of 14.9% in Q2 and 9.6% in Q3, fully offsetting earlier losses.

Background

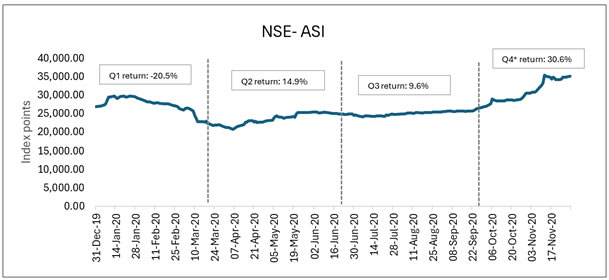

The Nigerian equities market is on course to deliver one of its strongest annual performances of the decade this year, buoyed by an extraordinary rebound that followed the unprecedented shocks of the COVID-19 pandemic. Like many countries across the globe, Nigeria entered 2020 confronted by a health and economic crisis that prompted sweeping lockdowns across Lagos, Ogun, and Abuja – the epicentres of the outbreak. The disruption plunged the economy into consecutive GDP contractions in Q2 (-6.1%) and Q3 (-3.6%), with the equities market initially mirroring this downturn as the NSE All Share Index (NSE-ASI) slumped 20.5% in Q1. Yet the market quickly emerged as a leading indicator of recovery. Amid elevated uncertainty, the domestic bourse staged a remarkable reversal, posting gains of 14.9% in Q2 and 9.6% in Q3, fully offsetting earlier losses. Momentum intensified in Q4, with October and November alone delivering a combined return of 30.6% and pushing year-to-date (YTD) performance to 30.5%. Over the last decade – indeed, since the post-global financial crisis era – this performance has been surpassed only in 2017 (41.2%) and 2012 (38.6%). In the following sub-sections, I unpack the key drivers behind this resurgence, assess sector-level performance, benchmark Nigeria’s market against selected Sub-Saharan African and global peers, and provide a forward-looking outlook for 2021.

Chart 1: One-Year Trajectory of the NSE- ASI

Source: NSE, Author’s compilation

Major Drivers of the Equity Market Rally

1. Accommodative Monetary Policy Stance: To cushion the economy from the impact of the pandemic, the Central Bank of Nigeria (CBN) pursued an aggressively accommodative stance, cutting the Monetary Policy Rate (MPR) by 200 basis points (bps) YTD to 11.5% – 100bps in May and another 100bps in September. In addition, the apex bank introduced forbearance measures in early Q2, allowing banks to restructure loan terms for distressed borrowers, which eased pressure on asset quality and improved corporate earnings outlooks. Furthermore, the lower benchmark rates simultaneously diminished the attractiveness of fixed-income instruments. For example, following the May policy rate cut, yields on 365-day Treasury bills collapsed from 4.0% to just 15 bps at the November 25, 2020, auction. This dramatic repricing catalysed a major portfolio rotation into equities as investors sought higher risk-adjusted returns.

2. Surge in Domestic Participation: Foreign portfolio investors withdrew significantly during the early months of the pandemic. According to the NSE Domestic & Foreign Participation Report (October 2020), the foreign share of market activity fell from 63.4% a year earlier to 33.4%, amplifying the drag on Q1 performance. In contrast, domestic participation surged, rising to 65.0% by November 2020 – the highest level in a decade. This influx of local investors provided a solid backbone for the market’s rally from Q2 onward. Notwithstanding, while the stronger domestic participation reduces vulnerability to external shocks, there are potential downsides – domestic capital alone is insufficient to support long-term market deepening or accelerated economic expansion. In the meantime, this has provided the necessary impetus for the market to rebound strongly.

3. Impact of New Listings: A major contributor to the market’s strong performance was the listing of BUA Cement on January 9, 2020, following the merger of CCNN and Obu Cement. At listing, the company added ₦1.39 trillion – about 10.1% to total market capitalisation and became only the fourth firm on the exchange valued above ₦1.00 trillion. Since its listing at ₦41.00 per share, BUA Cement appreciated by 34.1% to ₦55.00 by the end of November, with market capitalisation rising to ₦1.86 trillion. This single listing significantly lifted the industrial goods sector and contributed to the broader market rally.

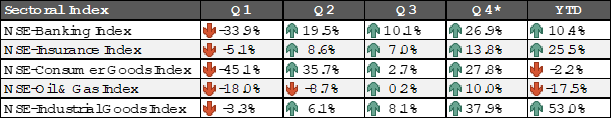

Sectoral Analysis of Market Performance

The sectoral analysis of the NSE performance year-to-date (YTD) reveals a more interesting pattern. Out of the five major sector indices captured on the NSE, three have reported bullish performance, while the other two are in the negative corridor. Leading the gainers is the industrial goods sector index with a YTD return of 53.0%. This is followed closely by the insurance sector index with gains of 25.5%, while the banking sector index has rallied 10.4% YTD.

A notable driver of the market-leadership rally of the industrial goods sector index was the listing of BUA Cement, which added ₦1.39 trillion (or 10.1%) to market capitalisation at the beginning of the year, and subsequently, gained 34.1% in the months leading to November 30th when this analysis was put together. In addition, the market's most capitalised company (incidentally, an industrial goods company), Dangote Cement (DANGCEM), share price also gained 44.4% YTD, adding ₦1.1 trillion to its market capitalisation over the period to reach ₦3.5 trillion at the end of November.

The rally in the insurance sector index was mainly fuelled by positive market reaction to the need for businesses and households to have insurance coverage, necessitated by the ugly impact of the pandemic on businesses and households. In addition, the material losses by businesses during the two weeks #EndSars protect that ended on October 20, 2020, amidst hijacking of the peaceful protest by hoodlums boosted the outlook for insurance businesses and by extension, insurance stock valuation. For perspective, the insurance sector index posted a month-on-month gain of 8.8% in November, the highest monthly return YTD.

For the banking sector index, the positive performance has been largely inspired by the relief to the balance sheet of banks, following the introduction of a forbearance measure by the CBN which allowed the lenders to restructure the term of repayment condition for businesses in their loan books badly affected by the pandemic shocks, and the provision of a single digit (specifically, at 5.0%) special standing lending facility (SLF) window to banks to tap liquidity and support efforts to reflate the economy.

On the flip side, the oil & gas sector index was the leading laggard, down 17.5% YTD. This was followed by the consumer goods sector index, which receded by 2.2% YTD. The underwhelming performance of the oil & gas sector index on the bourse is not surprising. The shock of the COVID-19 pandemic on global oil prices was devastating. Brent crude oil price, which traded $67.75 per barrel on the last day of 2019, had since collapsed to $46.84 (traded $9.12 per barrel on April 21, 2020, at the peak of the pandemic), while the average daily global consumption level fell below 90.0 million barrels per day (MBPD) – the first time in over two decades. This had caused a negative ripple effect on the performance of major oil companies, as shown in the H1:2020 financial report of listed players. For example, SEPLAT plc, Nigeria’s most capitalized publicly listed oil company on the NSE, reported a 34.0% decline in gross revenue in H1:2020 to $233.5 million and a loss before tax (LBT) of $145.3 million as against profit before tax (PAT) of $120.4 million in the corresponding period of 2019 due to the global crude oil price crash.

Lastly, the underwhelming performance of the consumer goods sector index was mainly a reflection of market reaction to the slowdown in profitability of companies in the sector, especially those in the brewery sector. For instance, Nigerian Breweries (NB) plc, the largest brewing company in Nigeria with an estimated market share of 55.8%, reported declines of 10.8% and 57.0% in revenue and PBT year-on-year in H1:2020 to ₦152.81 billion and ₦8.34 billion respectively, due to weak volume sales, especially in Q2 (April to June) as strict enforcement of COVID-19 prevention measures such as closure of pubs, and the restriction imposed on large gathering weighed on brewers performances.

Beyond the five primary sectors tracked by the NSE, the two recently listed Information and Communications Technology (ICT) firms of the bourse have demonstrated exceptional influence on overall market performance. Specifically, MTN Nigeria Plc, listed on May 17th at ₦99.00 per share (20.35-million-unit shares), achieved a price gain of 56.8% between January and November 2020 to reach ₦155.20. Notably, 21.7% of this rally occurred in the current quarter, driven by strong domestic investor sentiment. Similarly, Airtel Africa Plc, which was listed in July 2019, rallied 47.3% to ₦588.50 per share by the end of November 2020. Collectively, the market capitalisation of these two telecommunications giants represented 29.3% of total market share and contributed 39.4% of the ₦5.40 trillion year-to-date (YTD) gains in market capitalisation as of the end of November 2020.

Chart 2: Quarterly NSE Sectoral Indices Performance

Source: NSE, Author’s Compilation

NSE Performance Compared to Peers

The YTD remarkable nature of Nigeria’s stock market performance also has a global colouration. Compared to ten other major global indices across the developed and emerging markets (see chart 3 below), the NSE index stands tall and may end the year as one of the top-five best-performing globally. It is important to add that other major exchanges in Africa, South Africa, Egypt, Ghana, and Kenya, have not only underperformed the Nigerian bourse YTD, but are largely in the negative region, save South Africa’s FTSE/JSE with a minuscule 4bps YTD return. In addition, the Nigerian market remains relatively attractive among SSA peers with a Price to Earnings (P/E) ratio of 7.46x as against the peer average of 10.17x, outperforming South Africa’s JSE-ASI (14.67x), Egypt’s EGX-30 (11.18x), and Kenya’s NSE-ASI (11.46x) sequentially.

Chart 3: Global Colouration of NSE-ASI Performance

Source: Bloomberg, Author’s Compilation

Outlook & Recommendations

As earlier highlighted, the Nigerian bourse is well positioned to end the year among the global top five best-performing exchanges in 2020. To ensure the Nigerian market continues to do well in the years to come, the following measures or policy actions should be given the necessary attention by capital market regulators, operators, and the fiscal authority.

Promote financial literacy: Nigeria has one of the lowest financial inclusion rates in Africa, 64.1%, below its target of 80.0% for the year. Bridging this gap through aggressive promotion of financial literacy across every segment of the economy would have a positive pass-through effect on the performance of the Nigerian exchange in the years ahead. Hence, government institutions such as the CBN and the Securities and Exchange Commission (SEC), and private operators such as the NSE and private businesses need to have their hands on dec in promoting financial literacy programmes to support the sustained growth of the equity segment of the Nigerian capital market.

Encourage digitisation of investment processes: The ongoing COVID-19 pandemic episode has further strengthened the case for the democratisation of investment processes through leveraging smartphone technology to reach a wider potential market, especially the large youthful population of Nigeria and cross-border prospects. By fully digitising account opening and trading processes, more local and domestic prospects would be attracted to the Nigerian market, thereby paving the way for a future rally of the market.

Incentivise public listing by companies: Nigeria has only about 135 actively trading companies on the NSE (gross number of listed companies, 155) compared to 256 on the South African bourse, with a market cap nearly twenty-fold that of Nigeria. To attract more companies to list on the Nigerian exchange and support future growth prospects, the government would need to introduce incentives such as tax waivers. On the part of the regulators, such as the SEC and CBN, listing requirements would need to be recalibrated to include ones that can encourage fringe businesses to be attracted to public listing. Sensitisation on the benefits of public listing, such as access to cheap capital, should be proactively communicated. Lastly, the NSE can become more proactive by creating new product lines to encourage more participation on the bourse and boost the future performance outlook of the bourse. In addition, listing fees and other requirements for onboarding on the exchange should be made more attractive to attract more companies. The fintech space appears to have seen increased attraction in recent years, given the actualisation of a unicorn’s status by two of Nigeria’s leading fintech enterprises - Interswitch and Paystack – and the strong global pivot to digitalisation on the back of the Covid-19 shocks. Hence, creating a special board for small and mid-weight fintech companies to list on the exchange would be a future growth catalyst for the bourse.

Pursue FX stability and stable inflation rate: The major reason for the mass capital flow reversal by foreign investors, as earlier highlighted, is the concern about FX illiquidity due to the global collapse in crude oil prices – Nigeria’s largest source of FX. To re-attract foreign investors back into the Nigerian equities market, the monetary authority, led by the CBN, would need to work hand in hand with the fiscal authority to curate and implement policies that would boost organic channels of FX inflows to the foreign reserves to allay the fears of illiquidity and currency-shock-induced inflation on the Nigerian market.

Samuel Taiwo is recognised as a leader in Financial Planning and Analytics whose work lies at the intersection of corporate finance, supply-chain intelligence, and consumer-market stability. With a decade of experience supporting multinational CPG and commercial organisations, he has built a reputation for applying advanced analytics, pricing insights, and predictive modelling to solve complex financial and operational challenges. His early research contributions and expanding industry engagement continue to strengthen evidence-based financial planning, enhance market transparency, and reinforce the analytical foundations needed for capital-market development and broader economic resilience.

Related

-

Sustainability linked loans and the prospects for Nigerian businesses

There have been globally accepted principles promulgated over the years by collaborative efforts for sustainable finance.

-

Africa must stop buying what it already has

The future is still ours to claim. But it will not be given. It must be built – by Africans, for Africans, with ...

-

NSBP hosts conference on Sustainability Standards

SSCI facilitates and advances an economy that works within the planetary boundaries and does not erode or destroy the very ...