Afreximbank unveils strategy to increase intra-Africa trade to $250 billion

Summary

Afreximbank's new strategy is centered on three core pillars: Create, Connect, and Deliver.

The African Export Import Bank (Afreximbank) has announced a new strategy aimed at increasing industrialization and trade in Africa by at least 50 percent in the next five years.

Afreximbank said its new strategy – the Afreximbank Intra-African Trade Strategy – involves expanding existing trading activities within Africa’s Regional Economic Communities, integrating informal trade into formal frameworks, reducing trade barriers, and minimizing the foreign exchange costs of intra-Africa trade.

According to a statement released on Tuesday, the Cairo-based bank said it plans to work with partners to ramp up trade among African countries from $170 billion currently to $250 billion by 2021. The new intra-Africa trade strategy would be unveiled during an Intra-Africa Trade Forum scheduled to hold in Abidjan in May.

“Intra-regional trade will drive value addition in Africa and help reduce the continent’s dependence on commodities,” said Dr. Benedict Oramah, President of Afreximbank. “It would also allow for the expansion of domestic trade value chains, thereby strengthening the capacity of African economies to resist economic shocks.”

Afreximbank said its new strategy is centered on three core pillars: Create, Connect, and Deliver. Under the create pillar, the Bank will provide financing for the expansion of the production, processing and export capabilities of African economies. The bank will also provide project financing for the development of industrial parks and the construction of infrastructure to support African services sectors.

The connect pillar consists of initiatives to increase the flow of goods and services between African countries. This includes facilitation of linkages between public and private entities, institutions, agents, and entrepreneurs along the trade value chain. This pillar also involves the launch of an Intra-Africa trade payment platform operated by Afreximbank, which will reduce the foreign currency costs of trade.

As for the deliver pillar, Afreximbank will deepen access of traders to African markets by creating effective and cost-efficient distribution mechanisms through the financing of transport logistics and storage infrastructure.

“The fact that about 40 per cent of intra-Africa trade is done in the informal sector shows that there are institutional gaps,” said Oramah. “Afreximbank intends to play a significant role in reducing these barriers, by promoting the emergence of export trading companies and by helping to resolve regulatory and policy issues through a deepening of partnerships and bilateral trade arrangements.”

Related

-

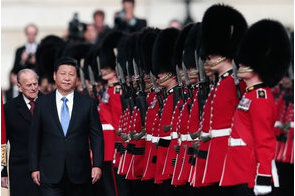

After two centuries, China and the U.K. switch roles

The United Kingdom also recognizes that the rest of its economy has weakened, and so is seeking Chinese investment to build ...

-

Developing countries should push to end fishing subsidies to protect jobs – UNCTAD

Estimated at about $20 billion per year, the UN agency said harmful fishing subsidies enable industrial fishing fleets to ...

-

Guterres makes case for strengthening multilateralism at UNGA 75

He said the dangerous mix of high geo-political tensions and complex threats to peace has now been complicated by COVID-19.