Access Bank, UN Global Compact launch report on SDG projects

Summary

Access Bank was the first Nigerian commercial bank to join the UNGC in 2009.

Nigeria’s largest retail bank, Access Bank Plc., joined other organisations and participants in the United Nations Global Compact (UNGC) to launch the first-ever sustainability compendium in Nigeria. The compendium, launched recently at a UNGC Breakfast Dialogue, profiles some of Access Bank’s sustainability initiatives – which are actions taken to advance the achievement of the UN Sustainable Development Goals (SDGs) in Nigeria by 2030.

The UNGC is the world’s largest corporate sustainability initiative. It comprises of over 13,800 corporate participants and stakeholders in over 170 countries. These participants are enjoined to demonstrate their commitment on the SDGs by aligning their strategies and operations with certain universal principles that encompass areas such as human rights, labour, environment and anti-corruption.

The 17 SDGs, also known as the 2030 Agenda for Sustainable Development, focus on ending poverty, eradicating hunger and malnutrition, promoting good health and well-being for all, ensuring inclusive and quality education and achieving gender equality. The SDGs also seek to achieve availability of clean water and sanitation, access to affordable and clean energy, inclusive and sustainable economic growth, as well as sustainable industrialization in an environment of increased innovation.

The UNGC provides a platform for businesses to contribute to implementing these SDGs and the others that advocate a reduction in inequalities, making cities and communities sustainable, responsible consumption and production, urgent climate action, sustainable use of marine resources, protection and restoration of terrestrial ecosystems, peace and justice for all, and partnerships for the goals.

Without adequate funding, the world may risk not achieving the SDGs. UN Secretary-General Antonio Guterres, in his annual report for 2019, called for enhanced international cooperation, private-public partnerships, adequate financing and innovative solutions to meet the SDG targets. Guterres argued that at the current pace of implementation, the targets would not be reached. The estimated shortfall in financing to achieve the SDGs is between $3.3-4.5 trillion per year. The funding gap in developing countries alone is $2.5 trillion per year, according to a 2014 report by UN Conference on Trade and Development (UNCTAD).

The UNGC's Local Networks are platforms on which businesses can engage with other stakeholders such as governments, civil society and communities to map a shared approach and secure various sources of finance, including public and private, domestic and international, to implement the SDGs. Beyond this, the UNGC ensures that its signatories act responsibly by incorporating the principles of the UN Global Compact widely into their strategies and operations, and uphold their basic responsibilities to people and the planet.

Access Bank was the first Nigerian commercial bank to join the UNGC in 2009. As a demonstration of its strategic collaboration to promote Nigeria's socio-economic development, the bank was the co-chair of the UNGC Local Network Steering Committee for three consecutive years, until June 2018 when the network was restructured to have a Board of Directors instead of a Steering Committee. By documenting its actions by which it is championing sustainability in the Nigerian financial services sector, Access Bank has maintained its commitment to the UNGC principles. It has also set the stage to pursue opportunities that can solve societal challenges through business innovation and collaboration, and to achieve long-term success.

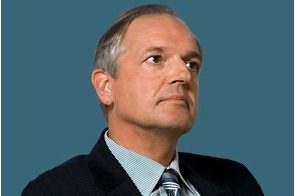

During the launch of the compendium, former Group Managing Director of Access Bank, Aigboje Aig-Imoukhuede, urged corporate organizations as well as small and medium-scale enterprises (SMEs) to invest in and practice sustainability. “The collective will and desire for action amongst organizations has taken a giant leap from where it was few years ago,” Access Bank’s former GMD said. “However, compared to other nations, the statistics of malaria, poverty and deaths in Nigeria paints a very gory picture. Hence, it is the responsibility of every corporate organization, SME and individual to get involved in activities that will aid the achievement of the SDGs come 2030.”

Access Bank has achieved several milestones in its sustainability journey, through which the bank has also recorded substantial impacts and continues to deliver value to its customers and other stakeholders. In March 2019, the bank launched its N15 billion green bond, the first-ever “Climate Bonds Certified” corporate green bond in Africa. According to the bank, the bond would be used in closing Nigeria’s critical infrastructure gaps and finance other green development initiatives.

During the annual UN General Assembly in New York last September, Access Bank and some 130 other global banks launched the Principles for Responsible Banking (PRBs). The principles are designed to enable banks align their business with the goals of the Paris Agreement on climate change and the SDGs, and also scale up their contributions and strategies to achieve both frameworks. The establishment of the PRBs is quite a significant milestone because of the important role of the banking industry in supporting the economic and social transformation of society.

The healthcare sector has also benefited from Access Bank's award-winning sustainability strategy. Amongst the bank’s healthcare-focused products are the Maternal Health Support Scheme (MHSS), Hospital Facility Upgrade Support Scheme (HFUSS), and Betta Mama Betta Pikin initiative. While over 30 hospitals have tapped the HFUSS initiative to improve the quality of healthcare delivery, hundreds of families, including women and children, have leveraged Access Bank's products to undertake various medical procedures and treatments.

The bank's "Malaria To Zero" campaign is an innovative approach to combat and eliminate the deadly malaria disease. The campaign's goal is to save one million lives by 2020 by leveraging private sector financing and other resources.

Head of Sustainability at Access Bank, Omobolanle Victor-Laniyan, said the bank would not relent in its contributions towards the achievement of the SDGs. Accordingly, the bank has entrenched sustainability into every part of its business operations and activities.

“To this end, we have made good progress in driving social, environmental and economic development locally and globally. Despite these, we will not relent. Rather, we will continue to invest our time, resources and work with relevant stakeholders to provide innovative solutions to local and global challenges,” she added.

Access Bank’s sustainability initiatives have received high-profile recognitions locally and internationally. For the fourth year in a row (2016-2019), Access Bank has been the recipient of the “Outstanding Business Sustainability Award” bestowed at the Karlsruhe Sustainable Finance Awards, which is organised annually by the European Organisation for Sustainable Development (EOSD). The bank has also won the “Most Sustainable Bank in Nigeria” award at the World Finance Awards nine times. For two consecutive years, Access Bank won the “Most Sustainable Company in Africa” award conferred at the Sustainability, Enterprise and Reporting Awards.

Among several other awards, Access Bank has been recognized twice by the Central Bank of Nigeria Sustainability Awards, including winning the award category for “Most Sustainable Bank in Nigeria.” The bank also won the “2019 Gender Leader of the Year” which it received at the Africa CEO Forum Awards. It was also the winner of the “Outstanding Healthcare SME-Friendly Bank of the Year” award at the Nigerian Healthcare Excellence Award (NHEA) 2019.

Martins Hile is the Executive Editor, Financial Nigeria

Related

-

Global coalition set to launch One for All campaign for sustainable development

#ONEFORALL campaign will provide a platform for each global citizen to support one of the 17 SDGs.

-

A business model for sustainability

The key to addressing the world’s social and environmental challenges is using the power of markets and building ...

-

Reducing food loss and waste key to achieving SDG 2

Food waste is more prevalent in developed regions. Whereas, there is higher incidence of food loss in developing countries.