Sourcing financing for Nigerian infrastructure investment

Feature Highlight

Nigeria is awash with resources but lacks the wherewithal to organize, regulate and leverage its huge potentials.

A recent news report has it that there is over $20 billion idling away in domiciliary accounts in Nigeria. The Deputy Governor, Financial System Stability, Central Bank of Nigeria, confirmed this during a meeting of the Joint Appropriation Committees of the National Assembly on the 2016 budget. If we dig deeper, we will find pools of financial resources within the country, either tucked away in pension funds, insurance assets or bank deposits.

In addition, there is about $21 billion in annual remittances from Nigerians in diaspora, accounting for the second single-largest source of forex inflow after oil-export earnings. Over the past decade, diaspora remittances to Nigeria have maintained a consistent uptrend with an average annual growth rate of about 4.25 percent.

Though diaspora remittance is not necessarily a direct income to the federal or state governments, it counts as part of the current account balance and overall liquidity in the economy that could be harnessed for investment purposes -- if only the Nigerian government knew how to aggregate and leverage that.

Regulatory conundrum

Despite the diversified pool of capital, Nigeria remains acutely deficient in access to long-term capital to invest in infrastructure that will create jobs, accelerate growth and improve life for the populace. Why is this the case?

The immediate point that comes to mind is the regulatory mechanism and operating environment. Nigeria is awash with resources but lacks the wherewithal to organize, regulate and leverage its huge potentials. With my experience in a senior public sector position, I understand how the rarity of modern, responsive and smart policy-making inhibits the private sector in churning out the right ideas, products and services.

Until the late 1980s when the administration of Gen. Ibrahim Babangida liberalized the banking sector, that area was an exclusive preserve of the well-heeled and characterized by the existence of few but well-run ‘old-generation’ financial institutions. Their role in intermediation, which comprises lending for the growth of Small and Medium-sized Enterprises (SMEs), was constrained by very low capitalization and risk tolerance. Not even the efforts of the central bank to promote SME financing and rural banking could spur lending and grass-roots financing.

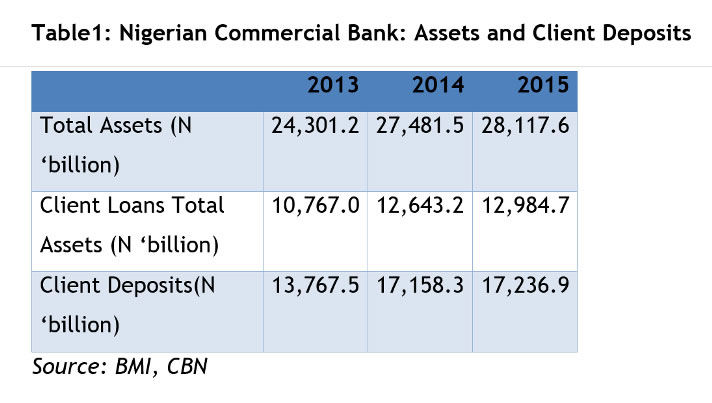

To date, banking penetration remains at about 25 percent of the adult population. A large proportion of SMEs has never raised a bank loan. Though the liberalization resulted in the emergence of numerous banks – with the number peaking at 89 -- not until 2004/2005 did we see the zeal to recalibrate the financial sector to be better capitalized, under reforms introduced by CBN Governor, Prof. Charles Soludo. It was also during this period that the contributory pension law was enacted. Over N5 trillion of assets are already accumulated in the pensions industry, while the banks now boast of stronger capital base and expansive global reach.

But to what effect has all this occurred? What are the impacts of the stronger and robust banking and pension industries on the economy and the lives of Nigerians? Commercial banks remain quite reluctant to lend to the real sector given the inherent default risk. However, banks are more comfortable with investing in government securities, money market instruments and big multinationals in the oil and gas sector.

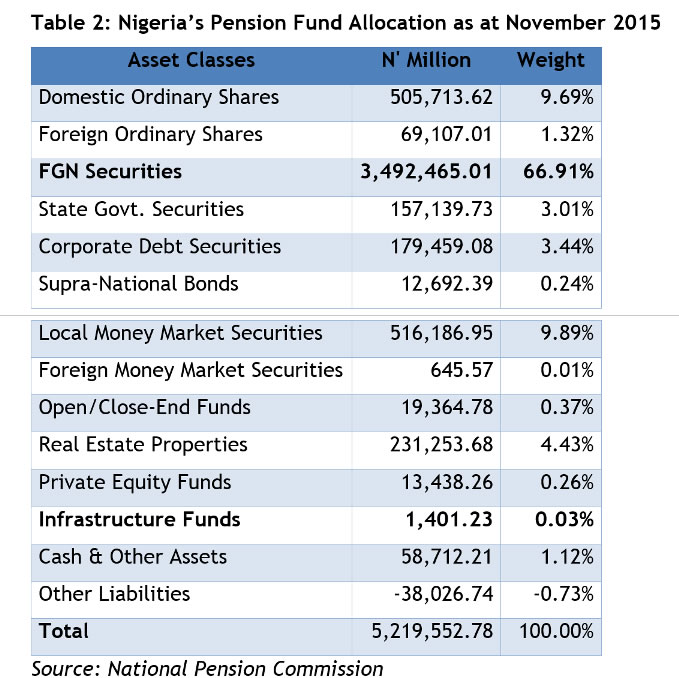

The story is similar to the practice in the pension industry where the regulatory statutes allow Pension Fund Administrators (PFAs) to invest mostly in federal government treasury bonds, money market and dividend yielding stocks at the detriment of infrastructure investments and private equity that otherwise could help catalyze economic growth. Available data from the National Pension Commission show that a paltry 0.03 percent of the funds is invested in infrastructure even though 5 percent cap is stipulated by the regulator.

By its nature, investing in treasury bonds and money market ensures safety of the pension funds. Also, the PFAs owe the fiducial responsibility to make wise investment decisions. But on a second look, you may notice that, supposing policy and regulatory frameworks were to permit PFAs to delve into infrastructure or private equity investments, the onus would be on the PE firms to design suitable strategies to source, invest and diversify into sectors like manufacturing, value-added agriculture, housing/real estate development, power sector, ICT etc, which are sectors with potentially high return on investment.

As an illustration, some of the huge investments in power plants, large scale commercial real estates and toll-roads in emerging and advanced countries are indeed from pension assets and life insurance premiums. This begs the question as to whether Nigerian pension fund administrators and financial regulators have any faith in the economic potential of this nation.

It is the responsibility of portfolio managers, insurance companies, pension asset custodians and bank treasury managers to design suitable investment strategies and deploy assets in these frontier sectors. However, this will not happen unless regulatory policies allow it and the environment is conducive for investments.

Is 2016 Budget a new vista?

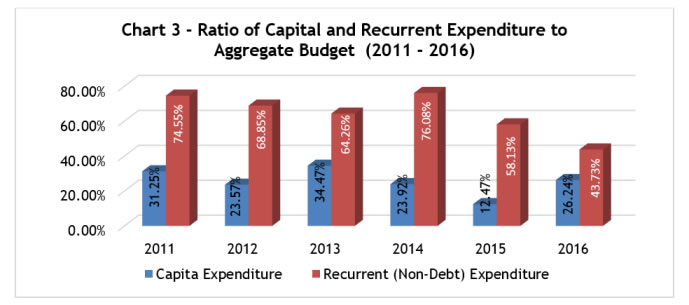

A truly welcome turn of events in the infrastructure finance dynamics in Nigeria is the 2016 budget, recently passed by the Senate but yet to be signed into law by the President. N1.59 trillion ($7.5 billion) or 26.24 percent of the total budget of N6.06 trillion ($30 billion) has been allocated to capital expenditure – a significant improvement from 15.15 percent of the aggregate expenditure allocated in 2015. But now that capital allocation has significantly appreciated, implementation of the budgeted amount is another matter. The practice in previous years was that the recurrent expenditure (covering salaries, overhead and maintenance of bloated government apparatus) was usually fully spent, while only a tiny fraction of the capital expenditure was disbursed for projects, which partly explains the parlous state of our infrastructure. We ought to see a reversal of that trend for Nigeria to turn the corner.

Source: Nigeria’s Budget Office

Arising from the recent National Economic Council retreat, a key target of the federal government is to allocate not less than 30 percent of budget for capital expenditure moving forward. My view is that the capex should be earmarked for the completion of ongoing projects, reconstruction of decaying assets, before taking on new priority projects. Emphasis should be on attracting large-scale private sector investments especially domestically (pension funds, capital markets, private equity funds and central bank intervention funds) into "big-picture" infrastructure projects. Foreign investment can play complementary role.

Ethiopia internally financed a huge hydro-electric dam project at the cost of over $2 billion. Under its 2015 -2020 Growth and Transformation Plan (GTP-11), the country plans to become the top regional electricity exporter as it aims to raise power output to 17,346 megawatts from a current capacity of just over 2,200 MW from hydropower, wind and geothermal sources.

Large infrastructure projects require bold ideas and actions. Nigeria must have a similar ambition and muster the political will to embark on such projects using the resources it has.

Two-point agenda

Top amongst the infrastructure priorities of Nigeria in the foreseeable future will remain in the electricity sector. My views have not changed since the emergence of late President Yar’Adua in 2007, when I proposed that rather than pursuing a 7-point agenda, the administration should have squarely focused on a one-point agenda -- tackling epileptic electricity supply. Needless to say that nine years after, the problem remains intractable while successive administrations have continued to fire scatter-shots.

It is a no-brainer that if we get electricity supply and transportation infrastructure right, Nigeria will be on its way to experiencing an unprecedented leap in economic growth rate to double digits. Productivity levels will soar. Manufacturing activities will improve. And unemployment will nosedive. As cottage industries will sprout, value-added processing of natural resources and agricultural produce will flourish. Easing the regulations and operating environment, by adopting a market-friendly pricing mechanism will attract investment into the power sector.

In conclusion, the intermediation role of Nigeria's financial institutions -- whether it is the banks, capital market, pension funds or insurance outfits -- remains quite weak and inadequate to bridge the long-term infrastructure funding gap. Not necessarily for lack of money, but the country is hamstrung by the inability of the players to mobilize and allocate resources efficiently because of weak regulatory framework and the unfavourable operating environment. Enhancing the ease of doing business in Nigeria by fixing these bottlenecks must be a focal point of action for this administration.

Chamberlain S. Peterside, Ph.D is the Executive Chairman of Xcellon Capital Advisors Limited in Lagos, Nigeria.

Other Features

-

How much is a $100 Steam Gift Card in naira today?

2026 Complete Guide to Steam Card Rates, Best Platforms, and How to Sell Safely in Nigeria.

-

Trade-barrier analytics and their impact on Nigeria’s supply ...

Nigeria’s consumer economy is structurally exposed to global supply chain shocks due to deep import dependence ...

-

A short note on assessing market-creating opportunities

We have researched and determined a practical set of factors that funders can analyse when assessing market-creating ...

-

Rethinking inequality: What if it’s a feature, not a bug?

When the higher levels of a hierarchy enable the flourishing of the lower levels, prosperity expands from the roots ...

-

Are we in a financial bubble?

There are at least four ways to determine when a bubble is building in financial markets.

-

Powering financial inclusion across Africa with real-time digital ...

Nigeria is a leader in real-time digital payments, not only in Africa but globally also.

-

Analysis of NERC draft Net Billing Regulations 2025

The draft regulation represents a significant step towards integrating renewable energy at the distribution level of ...

-

The need for safeguards in using chatbots in education and healthcare

Without deliberate efforts the generative AI race could destabilise the very sectors it seeks to transform.

-

Foundation calls for urgent actions to tackle fake drugs and alcohol

Olajide Olutuyi, Executive Director, Samuel Olutuyi Foundation, warns: “If left unchecked, the ‘death ...

Most Popular News

- NDIC pledges support towards financial system stability

- Artificial intelligence can help to reduce youth unemployment in Africa – ...

- Green economy to surpass $7 trillion in annual value by 2030 – WEF

- ChatGPT is now the most-downloaded app – report

- CBN licences 82 bureaux de change under revised guidelines

- Africa needs €240 billion in factoring volumes for SME-led transformation