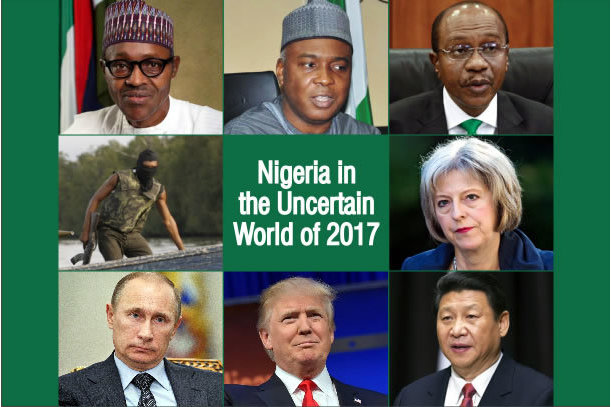

Nigeria in the uncertain world of 2017

Feature Highlight

The uncertainties of 2017 will prevent the full realisation of the positive outlook of the year.

What is certain about 2017 is that it is a year of uncertainty. The unpredictability of this year is unique, although each year unwraps as we journey through it. While there is hope of de-escalation of conflicts around the world, momentums for major geopolitical crises also appear to be building.

In 2017, the world could lose even the weak global economic growth that has trailed the 2008-2009 global financial crisis. But then, there is the promise of a stronger growth impetus in the United States – the world’s largest economy. Notwithstanding, the prospects of 2017 are counterweighted by downside risks. There is no foretelling what would be the reality.

Uncertainty looms over the Nigeria outlook. We know that the All Progressives Congress (APC) government of President Muhammadu Buhari is poor at managing resource deficits. For that reason, individual and corporate Nigerians have just transited through the most difficult year in over two decades. But there is a prospect of a relative resource windfall, and an uptrend in financial inflows, this year. What we don’t know is whether the government that is untested with abundance will squander the financial windfall or the opportunity for its realization. Yet, the materialisation of the positive fiscal outlook relies heavily on developments in the external environment.

But we must hazard informed guesses on what this year has in store. Understanding the risks, can help us avoid what is not fated, as well as soften what could have been a hard landing if there were no mitigation strategy in place. Similarly, identifying the opportunities should help in realising the welfare improvement that the government promised Nigerians – to no avail, yet. So here are the frontiers to Nigeria’s progress or retrogression in 2017.

Governance

Nearly 20 months in the saddle, President Buhari is expected to have improved his grasp of modern democratic governance. One of the probable lessons he would have learnt is that time is of utmost importance in translating campaign promises into government programmes. The yearly budget is the instrument for renewal of the promises. Thus, one expects that the 2017 budget would be passed on time. Saudi Arabia, which is pursuing similar economic diversification programme as Nigeria – but from a stronger financial position – passed its 2017 budget on December 22, 2016.

The Nigerian budget for this year was presented to the National Assembly a week earlier than the previous year’s. Since the presentation, President Buhari has been largely conciliatory in his tone towards the lawmakers who exercise constitutional powers to review and approve the budget proposals. It is the dictate of political pragmatism that the President should do what he has to do to get his budget passed. In getting last year’s budget passed, he substituted pragmatism for grandstanding, and the poorly formulated budget stood less chance of success for its late passing in May.

By the end of last year, it had become obvious that the federal cabinet that should drive the “change” mantra of the administration was too weak. In early December, President Buhari was reportedly set to change his cabinet. This is a sign of remarkable transformation from his rather preposterous view of ministers as “noise-makers.” If adequately reformed, his new cabinet would provide investors a new hope of economic reform and market governance.

The president has also apparently moved away from running down the economy, as he was wont to do, mostly when on foreign trips. The 2017 budget, dubbed “The Budget of Recovery and Growth,” represents an effort at drumming up the economy. This new disposition could become more credible than the propaganda tone of the budget strapline, if the government brings on-board into the right cabinet position an economist of international repute, who understands not just what to do, but also how to communicate economic policy quite effectively to the market.

But the signs we have read may hold no profound change of approach. Even if the National Assembly acknowledges the presidential overtures, it would find that some of the fundamental assumptions of the 2017 budget are unrealistic and should be addressed. We estimate that if, as necessary, the benchmark oil production of 2.2 million barrels per day is adjusted to more realistic and not unambitious 1.9 million bpd, the budget deficit of N2.36 trillion would have to change. And it will be harder to support the N305/$1 exchange rate in the budget with lower oil revenue.

Doing the needful in reviewing the budget will no doubt disarticulate the fundamental assumptions. Although such disarticulation can easily be resolved by relevant officials of the executive and legislature working at a roundtable with their calculators, the exercise could be marred by petty politics. The legislators could also use the opportunity of resolving the unworkable numbers to bargain for so-called “constituency projects” and, thereby, create the usual acrimony that mars the budgetary process.

As for the reform of the cabinet, the media has christened it a “cabinet reshuffle.” The tokenism of such an exercise will remove any hope that the economy would be better managed in the remaining period of Buhari’s mandate. Propaganda would continue to prove a poor substitute for competency at the cabinet level.

Politics

The economy failed spectacularly last year because the politics of managing it was woeful. Nothing exemplifies this better than the rhetoric of President Buhari which promoted the militarisation of the conflict in oil production in the Niger Delta. By losing up to 600,000 barrels per day on the average to militant attacks on oil installations, Nigeria was unable to find succour in oil prices that averaged $42 per barrel – $4 above the benchmark price in the 2016 budget.

But there is now a shift in the politics of Nigeria’s oil economy. Rather than shooting the militants and innocent locals unto stabilisation of oil production, the president has made gestures towards peaceful resolution of the conflict. Doubts about this are removed by the higher budgetary allocation of total N161.5 billion for the Ministry of Niger Delta, the Niger Delta Development Commission, and, more symbolically, the presidential amnesty programme.

If the extant ceasefire in the Niger Delta holds, on the heels of the routing of Boko Haram in the northeast, these policy outcomes – not altogether the strategies – would represent significant victories for stabilising the domestic geopolitics. This should encourage efforts to address the oppressive marginalisation of the Southeast, a “constituency” President Buhari said must be discriminated against for giving him only five percent of the votes he received during the 2015 election.

Party politics is trounced by geopolitics in Nigeria. The latter has been largely understood in its crudest form of the winner-takes-it-all, which fuels the nepotism of the Buhari administration. This approach that breeds super-powerful presidential alter egos has been seen to foster corruption, incompetence and poor integration of the administration. Learning from its own experience, again one expects a more pragmatic politics by the administration in governing the country in 2017.

A wake up call for this has been served by the talk of formation of a new “mega” party to wrest power from the APC in 2019. It would appear this idea came to life, somewhat, in the announcement of the formation of the Action Democratic Party in December. The desirability of stability for the ruling APC party is not because of its ideals – the party’s ideals are hard to see; political stability is required for economic governance.

So at the beginning of 2017, we know very little whether President Buhari has acquired deeper political pragmatism and sagacity to harness their usefulnesses. If the APC remains the major opposition to the government, and if influence is perversely concentrated in the hands of few people who happen to hail from the north as the president, we will see greater disruption of governance by politics this year than we did in 2016.

Civil Society

In spite of the economic recession in 2016, the federal government avoided any major confrontation with civil society groups. This reflected the understanding that President Buhari, with his administration, needed some time to push through his agenda. Also, there was no doubt that the government inherited a weak treasury and a negative economic outlook, due to the crash in oil prices.

For this reason, tough decisions that eroded the welfare of Nigerians – including removal of petrol subsidy and sharp depreciation in the value of the naira – were allowed to pass without much resistance last year. The government will operate from the standpoint of the existent goodwill at the beginning of 2017. What may happen as the year progresses is anyone’s guess.

The flashpoints in government’s relations with civil society this year will include the decision on the national minimum wage. The demand would be made, quite ironically, at a period of productivity dip in the civil service, and when headcount reform is required to address labour redundancy. But wage stagnation in 2017 would be difficult to bear, considering the harsh effect of high inflation on standard of living last year. Therefore, a showdown between the government and organised labour may take a dramatic turn from just the warning strikes of 2016 to major industrial actions.

It is also likely that, beyond wage issues, civil society coalitions may rise against the continuation of incessant killings around the country; continued detention of Nnamdi Kanu of the Indigenous People of Biafra; politically-biased anti-corruption agenda – especially if it continues to distort economic policy; and persistence of other factors that contribute to the poor human rights record of the administration. The various agitations would be energised by politicians who want to alter the current political order.

Finance and Investment

In 2016, the All-Share Index of the Nigerian Stock Exchange lost 6.2 percent value. Inflation rose from 9.6 percent to 18.48 percent. The naira depreciated by 38 percent on the official market, and the gap between the official and parallel market rates widened to 53 percent. These macroeconomic woes can turnaround in 2017.

Substantial increase in oil revenue by the government will boost dollar liquidity, and lure foreign investors into snapping Nigerian equities that have been stuck well below their historical highs. Towards the end of last year, we saw important rallies in domestic crude oil production and prices in the international market. The upside scenarios for both production and price will be driven by the stoppage to the sabotage of oil and gas installations in the Niger Delta and the OPEC production-cut agreement, respectively.

Inflation, which maintained an uptrend throughout last year, had begun to lose upward momentum in the last four months of the year (although the end-of-the-year festivities may have led to the biggest month-on-month increase in December). Given the bumper harvests that the government promised this year – on various agricultural production investments of the public and private sectors – food inflation should be subdued in 2017. And given the structural reform that emphasizes local production, some gains are expected in food production for direct consumption and processing. This will contribute to easing the pressure on the naira in the parallel market.

The return to macroeconomic stability will prove crucial for Nigerian finance and investment. For domestic investors in the real economy and SMEs, they will benefit from lower cost of finance as the Central Bank of Nigeria (CBN) expectedly lowers its Monetary Policy Rate – all things being equal, in the first quarter of the year. Foreign investors would find a stronger incentive in the Nigerian market with more dollar liquidity – arising from higher oil revenue – than with the high interest rate the CBN maintained in 2016.

However, the blind sides to this positive outlook are many. One, the official exchange rate of N305/$1 is quite risky for capital importation into the economy. At best, the exchange rate would delay foreign capital inflows, as investors weigh how quickly the oil market – including Nigeria’s oil production – would support dollar investment, using movement in the parallel market rates as the ultimate advisor.

Two, if the OPEC supply-cut agreement collapses, the outlook of oil price would change somewhat to negative. And if the country does not achieve peace in the Niger Delta to ensure oil production ramps up to 1,900 barrels a day, the bet on Nigeria would also turn negative. The oil licencing round in 2017 is a potential trigger for disruption of oil production, given the favouritism and lack of transparency that were associated with past licencing rounds.

Three, the 2017 budget may not improve transparency in the fiscal regime, because of the broad over-optimism of the assumptions. This was a rating issue for the country last year. The poor perception of the government’s ability to implement the 2016 budget resulted in a rating downgrade by Moody’s. The realisation of the revenue projections was also a subject of debate, in particular the official information that oil production had ramped up to 2 million bpd in November, whereas data by OPEC says production improved from 1.63 million in October to 1.69 million in November.

Four, the administrative capacity to manage the expansionary budget is not assuring. The redundancies of the past 20 months, coupled with leadership vacuum in the federal parastatals – with many of them still without substantive CEOs – and the absence of reform to improve administrative skills would cause much doubt on the implementation of the budget, even if the revenue and the deficit financing were realised.

And, five, the rapid increase in public debt when the economy has yet to be repositioned to convert the deficit financing into production is a cautionary sign that can thwart government’s efforts at external borrowing. In the meantime, the assumption is that if the huge deficit financing is ploughed into infrastructure, it would engender compensatory growth. But no local study has recently affirmed this. In fact, the evidence from the country’s labour pool is a growing army of people lacking in the knowledge and skills to drive productivity increases. No Nigerian government – at federal and state levels – has in the last 20 months prioritised reform to seriously address the fallen educational standards in the country and improve vocational skills.

The external environment

As noted already, uncertainty will be a global phenomenon in 2017. Of all the uncertainties the world faces this year, only significant shock to the supply side of the oil market favours Nigeria. The clearest way this could come about is if Iran runs into a major geopolitical trouble. This can happen as a result of the proxy wars it is involved in in the Middle East, or if President Donald Trump undermines the Iranian nuclear agreement, which may instigate a response from Iran that would lead to restoration of economic sanction against the country.

But it is more than a theoretical proposition that the supply shock can, indeed, come from Russia. That is the effect of the recent quick movement from the post-World War II norm by President Vladimir Putin. From its annexation of Crimea, attack on Ukraine, military intervention in Syria and confrontation with NATO, Russia also is allegedly engaged in cyber warfare with the United States. But a terrestrial warfare between Russia and a Western power will disrupt both the supply and demand sides of the oil market.

A hard Brexit, in which Britain leaves the European Union on unfavourable terms, looks like the possibility now. However, there is indication that the Brexit vote could be subjected to parliamentary review. A new decision will be advised by the huge economic losses Britain will take from leaving the EU. The economic losses, if Brexit materialises, would impact UK investment and aid to Nigeria in the immediate terms.

Yet more risks from the external environment could impact Nigeria. The US and China risk military confrontation over the South China Sea. A trade-cum-currency war between the world’s two largest economies and military powers appears to be brewing as well, considering the rhetoric of Donald Trump. If the confrontational rhetoric takes more than verbal form, it would seriously disrupt the global supply chain and financial markets. Such disruptions will have no winners.

The concern that US policies will impose significant risk on the global systems with President Donald Trump derives from the limited understanding he has exhibited since the campaign on how the delicate balance is maintained in global geopolitics. He is also temperamentally volatile. But so far as President-elect, the “Trump effect” has created momentum for asset price rise in the United States. This has strengthened the dollar and encouraged an outlook for faster increases in interest rate by the Federal Reserve. In which case, Trump’s bite may be much less harmful than his bark.

Nevertheless, US that is growing at a faster rate and where interest rates are rising will constrain investment inflows to Nigeria. Global investors will further pivot away from Nigeria that must lower anchor interest rate in 2017.

But the hope of a stronger US economy rests in the optimisation of the country’s latent economic potentials, as Trump promises to do. But by declaring “let it be a nuclear arms race” with Russia, he showed again that he is unable to focus on a theme. Thereby, the world continues to wonder in what direction President Trump would steer his country and the world when he assumes office.

Conclusion

Policymakers need clarity to put planning into great effect. Investors dislike uncertainty. The uncertainties of 2017 will, therefore, prevent the full realisation of the positive outlook of the year. One hopes the year would not turn out worse.

Jide Akintunde is Managing Editor, and Martins Hile is Executive Editor, of Financial Nigeria publications.

Other Features

-

Analysis of CBN’s new regulations on cash management and dual ...

By revising cash policies and mandating dual connectivity for payment terminals, the Central Bank of Nigeria seeks to ...

-

Africa’s crypto investment market: where growth may emerge next

Africa’s crypto investment market: where the next growth coould explode.

-

Lessons from the 2025 Goalkeepers Report: What kind of innovation ...

The 2025 report issues a clear call to action for policymakers and engaged citizens.

-

Profit: The most powerful engine for scaling impact, dignity, and ...

The most prosperous countries in the world are not those with the most aid programmes. They are those with the most ...

-

Expect turbulent asset markets in 2026

The negative impact of Trump’s tariff and immigration policies will be felt more acutely in 2026.

-

The scars of partition

Contrary to his rosy assurances, partitions often result in tragedy, as borders drawn by cartographers rarely align ...

-

Best site to sell Bitcoin in Nigeria (Fast BTC to Naira in 2026)

Apexpay stands out because it focuses on what Nigerian users actually want: speed, good rates, and simplicity.

-

The quiet influence of securitisation in financing Africa's energy ...

The scale of Africa’s energy transition demands financial solutions that are modern, secure, and scalable.

-

Lean carbon, just power

Why a small, temporary rise in African carbon emissions is justified to reach the continent’s urgent ...

Most Popular News

- NDIC pledges support towards financial system stability

- Artificial intelligence can help to reduce youth unemployment in Africa – ...

- Nigeria not on top 30 Africa ranking for 2023 Legatum Prosperity Index

- Pan-African nonprofit appoints Newman as Advisory and Executive Boards Chair

- FRC Chairman commends NDIC for prompt remittance of operating surplus

- UN adopts new consumer product safety principles