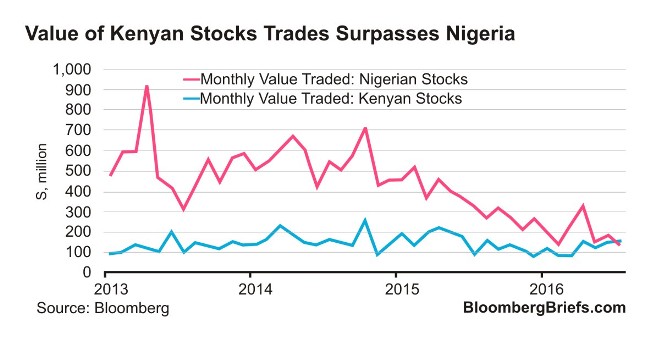

Kenya beats Nigeria in stock-trading for the first time

Feature Highlight

The lack of foreign-exchange liquidity looms as a greater obstacle to foreign investment in Nigeria.

The value of shares traded on the Kenyan stock exchange surpassed Nigeria's for the first time on record in September, as foreign investors shunned the West African economy, battered by militant attacks on oil facilities and shortages of foreign exchange.

The value of shares traded on Nigeria’s exchange fell to $139 million, near the lowest since Bloomberg began compiling such data in 2009. In Kenya, which has an economy an eighth the size of Nigeria's, but which is set to grow by almost 6 percent this year, the value rose 4.2 percent from August to $152 million.

Nigeria is caught between the highest inflation rate in more than a decade and an economy set to contract for the first time since 1991. The naira was allowed to float from June 20, losing more than a third of its value against the dollar since and weakening beyond 300 per greenback for the first time on July 22. The float is anything but free, with Aberdeen Asset Management and Duet Asset Management, among investors, saying the central bank is holding the naira in a tight range.

"Nigeria’s in a recession and it’s got issues around foreign-exchange liquidity," Yvonne Mhango, a sub-Saharan Africa economist at Renaissance Capital, said by phone. "If you compare that to Kenya, an economy that’s growing at 5 or 6 percent, a currency that’s stable, basically you’re seeing a reflection of greater interest in Kenya simply because there"s growth.

“Over and above that, in the case of Kenya, if they want to repatriate their money tomorrow, the foreign-exchange liquidity is available, whereas in Nigeria it's more of an issue: you have to wait a longer time to get your dollars out of the country," Mhango said.

The lack of foreign-exchange liquidity looms as a greater obstacle to foreign investment in Nigeria than the moribund economy, according to Mhango. "As that clears, you'll see improved interest, even before the economy starts showing positive growth — as long as the liquidity issue is addressed, you'll see a pickup in activity."

Neo Khanyile is a Reporter at Bloomberg LP

Source: Bloomberg

Other Features

-

The best sites to buy and sell Bitcoin in Nigeria: A comprehensive ...

Buying and selling BTC doesn’t have to be a hassle. Check out to best sites to buy and sell Bitcoin in Nigeria ...

-

At 50, Olajide Olutuyi vows to intensify focus on social impact

Like Canadian Frank Stronach utilised his Canadian nationality to leverage opportunities in his home country of ...

-

Reflection on ECOWAS Parliament, expectations for the 6th Legislature

The 6th ECOWAS Legislature must sustain the initiated dialogue and sensitisation effort for the Direct Universal ...

-

The $3bn private credit opportunity in Africa

In 2021/2022, domestic credit to the private sector as a percentage of GDP stood at less than 36% in sub-Saharan ...

-

Tinubunomics: Is the tail wagging the dog?

Why long-term vision should drive policy actions in the short term to achieve a sustainable Nigerian economic ...

-

Living in fear and want

Nigerians are being battered by security and economic headwinds. What can be done about it?

-

Analysis of the key provisions of the NERC Multi-Year Tariff Order ...

With the MYTO 2024, we can infer that the Nigerian Electricity Supply Industry is at a turning point with the ...

-

Volcanic explosion of an uncommon agenda for development

Olisa Agbakoba advises the 10th National Assembly on how it can deliver on a transformative legislative agenda for ...

-

Nigeria and the world in 2024

Will it get better or worse for the world that has settled for crises?

Most Popular News

- IFC, partners back Indorama in Nigeria with $1.25 billion for fertiliser export

- NDFF 2024 Conference to boost Nigeria’s blue and green economies

- CBN increases capital requirements of banks, gives 24 months for compliance

- CBN settles backlog of foreign exchange obligations

- Univercells signs MoU with FG on biopharmaceutical development in Nigeria

- Ali Pate to deliver keynote speech at NDFF 2024 Conference