Latest News

Africa Risk-Reward Index 2019 shows key trends shaping investment landscape

News Highlight

The report says although elections in Africa can often fuel tensions and raise investment concerns, they are increasingly serving to stabilise Africa's changing political landscape.

The fourth edition of the Africa Risk-Reward Index (ARRI) released today by Control Risks, a global risk consultancy, and Oxford Economics, a global advisory firm, offers a snapshot of the highly-dynamic investment landscape in Africa. The ARRI compares some of the continent’s largest and emerging markets and plots each country’s performance, relative to its African peers.

In a statement released on Wednesday, Control Risks and Oxford Economics said the index offers investors a comparative snapshot of market opportunities and risks across Africa. The report said Africa remains a desirable investment destination with a young and increasingly urban demographic, a wealth of natural resources, and a proven ability to leapfrog technologies in areas such as telecommunications or finance.

“The current edition of the index shows a slight increase in reward scores for some of the continent’s largest economies, including Nigeria, Angola, and Egypt, as the economic recoveries in these giants gain traction,” said Jacques Nel, Chief Economist Southern & East Africa of Oxford Economics. “However, the highest reward potential remains centred in the East Africa region, with expanding services and infrastructure development boosting demand and improving business environments."

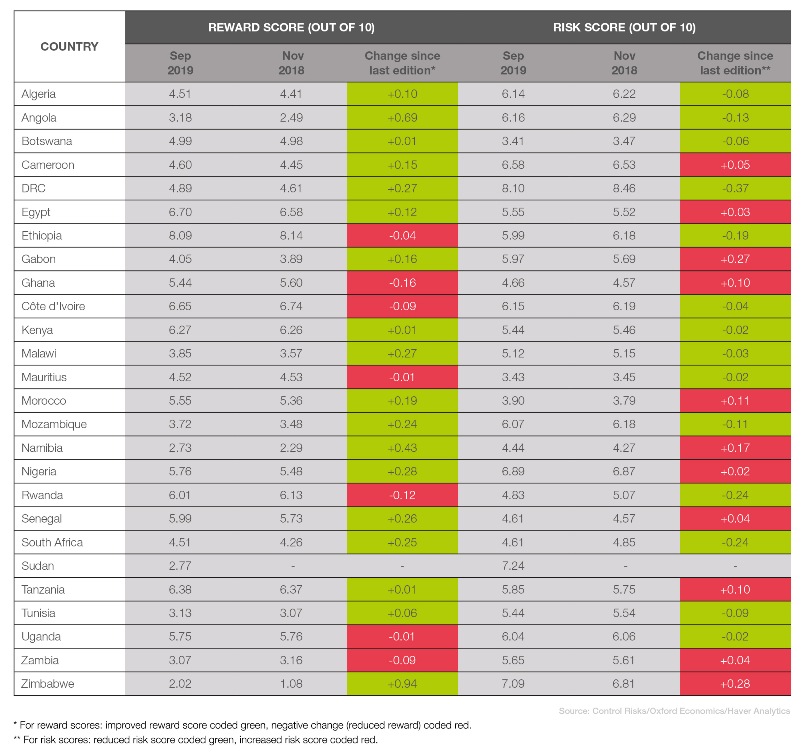

Nigeria's reward score increased slightly from 5.48 (out of 10) in 2018 to 5.76 in 2019. Nevertheless, the country's risk score increased by 0.02 from 6.87 last year to 6.89 in 2019.

Angola increased its reward score by 0.69 from 2.49 in the previous year to 3.18. Zimbabwe's reward score increased by 0.94, recording the highest increase in reward score among the countries on the index.

The ARRI 2019 tracks the evolution of the investment landscape and trends that impact investment strategy across major African markets. One of these key trends is that elections in Africa can often fuel tensions and raise investment concerns. Nevertheless, elections are increasingly serving to stabilise Africa's changing political landscape, according to the report. This is because elections can end prolonged uncertainty, provide legitimacy, and empower incumbent or new African leaders with the mandates required to push forward their reform or counter-reform agendas.

Another trend is that although African investment has traditionally been dominated by its big economies, the emergence of various intercontinental trade blocs is shifting the balance of power. The report explores the significance of the African Continental Free Trade Area (AfCFTA), while raising some concerns about its implementation.

The ARRI 2019 said Africa is no longer an even battlefield for United States and Chinese players as commonly thought. It said there is a surge of interest in Africa from smaller geopolitical players such as Russia, the Gulf states, Turkey, and India. Meanwhile, according to the report, current US-Africa trade is put at USD39 billion, while China-Africa trade has exceeded USD200 billion, and EU-Africa trade is now over USD300 billion.

"The standard narrative of US-China rivalry in Africa had always looked like an over-simplification, but is certainly outdated now,” explained Barnaby Fletcher, Associate Director at Control Risks. “China’s engagement with Africa is undergoing a fundamental shift, the US is playing catch-up, and a host of other countries are seeking to expand their influence in an increasingly multipolar landscape."

Another important takeaway from the report is that the growing competition for investment across the continent is helping to promote reform, which in turn encourages greater investment. As economies diversify, African countries can no longer rely on merely holding the most mineral resources.

Related News

Latest Blogs

- The Museum of West African Art saga

- The complexity and complication of Nigeria’s insecurity

- Between bold is wise and wise is bold

- Prospects of port community system in Nigeria’s maritime sector

- Constitutionalism must anchor discipline in Nigerian Armed Forces

Most Popular News

- NDIC pledges support towards financial system stability

- Artificial intelligence can help to reduce youth unemployment in Africa – ...

- Africa needs €240 billion in factoring volumes for SME-led transformation

- ChatGPT is now the most-downloaded app – report

- Green economy to surpass $7 trillion in annual value by 2030 – WEF

- CBN licences 82 bureaux de change under revised guidelines