Olusola Dahunsi, PhD, Lecturer, KolaDaisi University

Subjects of Interest

- Development Finance

- Fiscal Policy

- Public Sector Reform

CBN’s faltering pursuit of monetary and financial stability 21 Apr 2023

Monetary policy is a technique employed by the Central Bank of Nigeria (CBN) – and other central banks the world over – to control the quantity, cost, and availability of money credit in order to achieve overarching macroeconomic objectives of internal and external balances. The more specific objectives of monetary policy may vary according to the level of development of the economy involved; but invariably, they include the attainment of price stability, interest rate stability, stability of the financial markets, stability in the foreign exchange markets, and ultimately high employment and economic growth.

Where the overall stability of the economy is threatened, short and long-term macroeconomic objectives could be subordinated to each other as necessary. For instance, the central banks are currently prioritising price stability. In the United States, the Federal Reserve is choosing in the short-term (perhaps, to medium term) the control of inflation over employment.

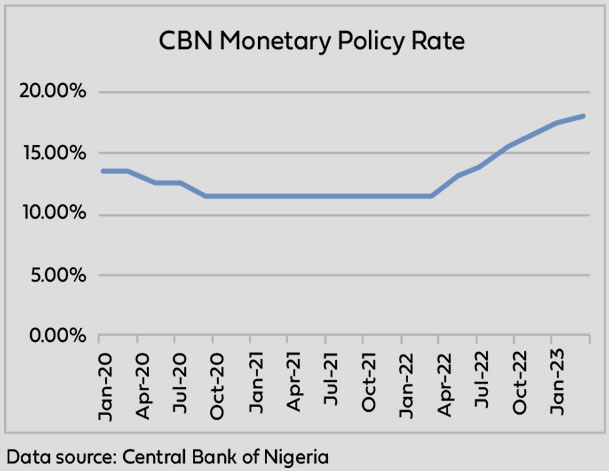

The conduct of monetary policy by the CBN, through its bi-monthly Monetary Policy Committee (MPC) meeting, involves the modulation of the Monetary Policy Rate (MPR), the asymmetric corridor around the MPR, cash reserve ratio, and liquidity ratio. The MPR set the benchmark for both interbank lending rate as well as the interest charged customers by the banks.

After a period of stability of the MPR, it has recently been on an upward volatility as the CBN tries to fight inflation. The MPR was 14 percent between July 2016 and March 2019; and was reduced to 13.5 percent between March 2019 and May 2020. Further downward reviews saw the MPR at 11 percent in May 2022. However, the MPC meeting that month raised the benchmark interest rate by 200 basis points to 13 percent. Subsequent rate hikes took the MPR to 18 percent at the March 2023 MPC meeting.

Although the interest rate hikes are well-intentioned, they nevertheless are fostering monetary and financial instability. An unstable interest rate regime tends to harm spending and borrowing decisions; it makes it harder to plan for the future.

The CBN recently deployed a monetary mechanism that it uses far less frequently: the redesign of the local currency. It also gave directives that limit the volume of cash in the accounts of depositors that they can withdraw. Due to what is now commonly viewed as poor implementation of the naira redesign programme, Nigerians have for months now been unable to even access cash within the limits set by the CBN.

According to the apex bank, the redesign of the naira was aimed at achieving a potpourri of monetary and non-monetary goals. It wanted to reduce the volume of banknotes outside the banking system, restore its statutory ability to control money in circulation, foster efficient management of inflation, combat banditry and ransom-taking activities, among other reasons.

As an independent institution, the naira redesign is among only a few undertakings of the CBN that statutorily requires the approval of the President. Thus, in speaking approvingly of the introduction of the new banknotes, President Muhammadu Buhari on a national broadcast on 16 February 2023 explained that the proportion of the currency in circulation outside the banking system grew by 7 percentage points from 78 percent in 2015 to 85 percent in December 2022. He concluded that the huge volume of banknotes outside the banking system has proven to be practically unavailable for economic activities, which would retard the attainment of the potential for economic growth.

These arguments and the stated goals of the naira redesign programme notwithstanding, it has contributed to acute economic hardship in the country. Contrary to what would have been expected, the programme has negatively impacted economic activities as citizens spend hours in banking halls and in front of Automated Teller Machines (ATMs) in often fruitless efforts to access cash for consumption and business activities. Also unexpectedly, the policy even created financial instability as people started to access the naira at a cost – with the awkward situation of the naira exchanging with itself at a price.

The CBN has often struggled with achieving its mandates, due to misalignment of policy and practical reality. This has been the case with the naira redesign. The proportion of currency in circulation that is in the hands of the general public had increased due to certain underlying factors, such as the inability of many Nigerians to access electronic payment for a wide range of transactions. Electronic banking and e-payment provide alternative means of carrying out transactions to money, and, therefore, reduce the demand for cash. But due to infrastructural deficits, e-banking services often fail. Access to electricity supply to power devices for e-payment is limited and epileptic. These associated risks and lack of access to e-payment necessitated the huge volume of cash required by the large-sized informal sector of the Nigerian economy.

The CBN had misconstrued the demand for cash for a sinister motive for ‘hoarding’ banknotes. But in the face of pressure by the public who genuinely require cash for legitimate economic activities, the bank has had to tweak its directives.

The restriction placed on cash withdrawals by the CBN was a major reason for the failure of the naira redesign. Instead of restricting access to cash, the apex bank could have incentivised Nigerians by granting unrestricted access to the new naira notes and in that way the old notes will fade away over time. In the end, what the CBN appears to have done was use the naira redesign as a camouflage to restrict access to cash. While this became apparent, the bank failed to communicate its intentions clearly, even leaving room for a political motive for the phasing out of the ‘old’ banknotes.

Monetary policy, viewed as the management of interest rates and money stock, regulates and stabilises the economy. Going forward, the CBN must adequately employ the instruments to achieve stability in the general price level and the operations of the financial system and financial markets. Also, the monetary policy instruments must be used to foster the attainment of full employment at which the demand for labour equals the supply of it in the economy. Moreover, extreme movements of the naira value in foreign exchange markets should be regulated through monetary policy since the Nigerian economy is dependent on foreign trade.

Monetary policy should be geared towards achieving economic growth by encouraging people to save and invest through the stabilisation of interest rates. Whereas the combination of monetary and fiscal policy is the best driver for achieving the desired level of economic growth and development, the effectiveness of monetary policy is anchored on the proactiveness of the Central Bank. This is achieved through a rules-based monetary policy and clear communication.

To forestall future policy failure or reversal, the CBN should properly identify and articulate the economic problem(s), set out its objectives in clear terms, design strategies, implement the strategies to achieved stated objectives, evaluate the results, and get feedback from the stakeholders of the policy concerned.

Olusola Dahunsi, PhD, who is a chartered accountant, is a lecturer in the Economics Department at KolaDaisi University, Ibadan.

Latest Blogs By Olusola Dahunsi, PhD

- CBN is fighting inflation instead of stagflation

- Challenges and opportunities of exits of MNCs from Nigeria

- 2023 as year of policy instability in Nigeria

- How to fight Nigeria’s hyperinflation

- First aid and sustainable treatment for fuel subsidy removal shocks