World Bank reports $61.2 billion in investments and assistance to countries

Summary

The World Bank said it worked with partners to deliver financial solutions for the world’s most pressing problems.

The World Bank Group has reported that it provided $61.2 billion in loans, grants, equity investments and guarantees to support countries and private businesses in the fiscal year ended June 30, 2016.

According to a report released on Tuesday, the World Bank said its commitments to sub-Saharan African countries in the period under review – July 1, 2015 to June 30, 2016 – reached $12.5 billion.

The global financial institution said as developing countries face continuing economic headwinds, the Group worked with partners to deliver innovative financial solutions to address some of the world’s most pressing problems.

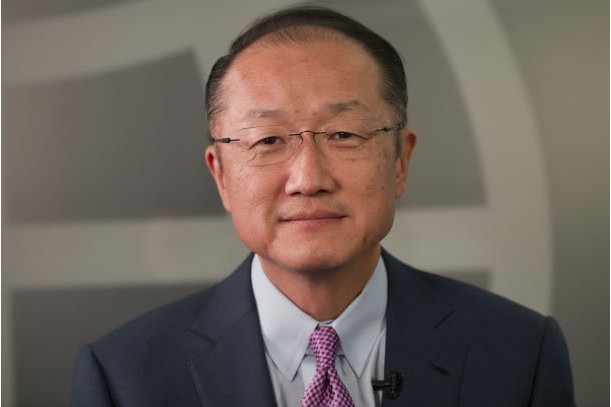

“In a world where risks are multiplying – slower global growth, increasing numbers of forcibly displaced people, and abrupt changes in the environment due to climate change – low- and middle-income countries are asking us for more help,” said World Bank President Jim Yong Kim. “We’re encouraged that countries are turning to the World Bank Group for assistance. We’ll continue to meet the growing demand for innovative financial tools, leveraging donor funds into much larger low-interest loans, and our global knowledge to help countries address their most challenging issues.”

The International Bank for Reconstruction and Development (IBRD) – a member of the World Bank Group that provides financing, risk management products, and other financial services to countries – provided a total funding of $29.7 billion, up from its previous year’s commitment of $23.5 billion.

The International Development Association (IDA) – which provides interest-free loans and grants to the world’s 77 poorest countries – gave a total of $16.2 billion in concessional financing over the last year. The World Bank said the lending by the IBRD and IDA has increased to $160 billion from 2013 t0 2016.

Long-term investments made by the International Finance Corporation (IFC) – the private sector lending arm of the World Bank – rose to a record of approximately $18.6 billion, comprising of $11 billion from IFC's account and $7.6 billion mobilised from other investors.

Meanwhile, the Multilateral Investment Guarantee Agency (MIGA) – the political risk insurance and credit enhancement arm of the World Bank – had a record year of $4.3 billion of issuance of political risk insurance and credit enhancement guarantees.

The World Bank said MIGA plays a vital role in helping to mitigate risks and navigate private investors to emerging markets as investors are looking for greater protection in this vulnerable economy.

Over the last one year, the the World Bank said it launched the Middle East and North Africa (MENA) Financing Initiative to support Lebanon and Jordan, in partnership with the United Nations (UN) and Islamic Development Bank. The initiative will provide the kind of financing that is usually only available to the world's poorest countries as Lebanon and Jordan have taken in the largest share of refugees in relation to the size of their populations.

In 2016, the World Bank also announced the launch of the Pandemic Emergency Financing Facility, an innovative, fast-disbursing global financing mechanism designed to protect the world against deadly pandemics and create the first-ever insurance market for pandemic risk.

The Bank also unveiled an Africa Climate Business Plan in Paris, which has already approved a $111 million climate smart agriculture project for Niger which will directly benefit about 500,000 farmers and agro pastoralists.

Related

-

S&P Global affirms AfDB's AAA rating with a stable outlook

The ratings agency further stated that it expects AfDB to “prudently manage growth in private-sector lending in a way ...

-

IMF grants debt relief for 19 African countries

The purpose of debt relief under the CCRT is to free up resources assigned to debt service to meet exceptional balance of ...

-

Achieving fiscal and employment boosts with solid minerals development

Formalisation of the solid minerals sector is the route to its sustainable development and economic viability.