Steve Hanke, Professor of Applied Economics, The Johns Hopkins University

Follow Steve Hanke

![]() @steve_hanke

@steve_hanke

Subjects of Interest

- Fiscal Policy

- Monetary Policy

The menace of central banks: Iran and Turkey front And centre 30 Oct 2018

Currency crises, like those gripping some emerging market countries today, give rise to questions about the desirability of central banking. And why not? After all, central banks armed with discretionary powers to create money and credit are behind each and every currency crisis. They are also the engine that generates inflation. And, it is inflation that destroys wealth, undermines growth, and destabilizes societies.

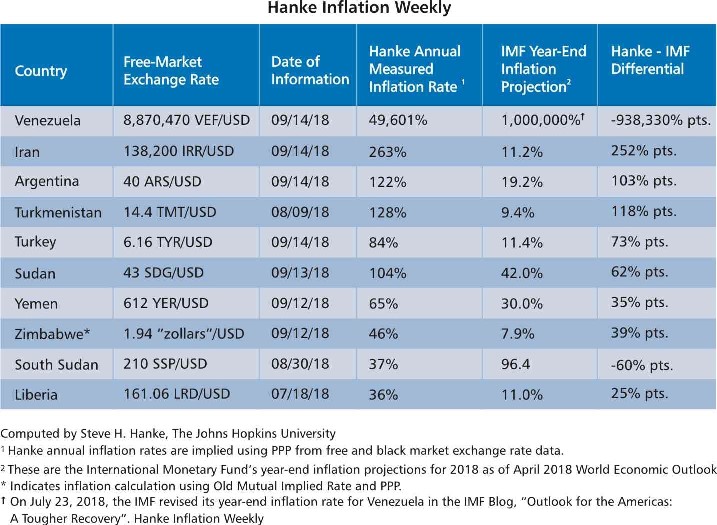

The ten central banks that are currently flunking my “inflation test” are presented in the table below. These central banks are producing annual inflation rates that exceed 35% – the threshold for a failing grade. I, along with my Johns Hopkins-Cato Institute Trouble Currencies Project team, measure inflation rates, we do not project inflation rates. We employ high-frequency data, so that annual inflation rates can be measured on a daily basis.

There are two ways in which to rid countries from the menace of central banks. Countries can replace their domestic currencies with foreign currencies – the “dollarization” option. With official dollarization, a foreign currency has legal tender status. So, a foreign currency is not only used for contracts between private parties, but also for government accounts and the payment of taxes. At present, thirty-two countries are dollarized.

Another attractive option for countries with failing central banks is a currency board system. A currency board issues notes and coins convertible on demand into a foreign anchor currency at a fixed rate of exchange. As reserves, it holds low-risk, interest-bearing bonds denominated in the anchor currency. The reserve levels (both floors and ceilings) are set by law and are equal to 100%, or slightly more, of its monetary liabilities. So, the domestic currency issued via a currency board is nothing more than a clone of its anchor currency. A currency board generates profits (seigniorage) from the difference between the interest it earns on its reserve assets and the expense of maintaining its liabilities.

By design, a currency board, unlike a central bank, has no discretionary monetary powers and cannot engage in the fiduciary issue of money. It has an exchange rate policy (the exchange rate is fixed) but no monetary policy. A currency board’s operations are passive and automatic. The sole function of a currency board is to exchange the domestic currency it issues for an anchor currency at a fixed rate. Consequently, the quantity of domestic currency in circulation is determined solely by market forces, namely the demand for domestic currency.

A currency board cannot issue credit. Accordingly, a currency board imposes a hard budget constraint and discipline on the government. This is an underappreciated feature of currency boards. Unlike central banks, a currency board can’t be used as a means to finance government budgets.

Currency boards have existed in about 70 countries, and none have failed. The first one was installed in the British Indian Ocean colony of Mauritius in 1849. By the 1930s, currency boards were widespread among the British colonies in Africa, Asia, the Caribbean, and the Pacific Islands. They have also existed in a number of independent countries and city-states, such as Danzig and Singapore. One of the more interesting currency boards was installed in North Russia on November 11, 1918, during the civil war. Its architect was none other than John Maynard Keynes, who was a British Treasury official at the time.

Countries that have employed currency boards have delivered lower inflation rates, smaller fiscal deficits, lower debt levels relative to the gross domestic product, fewer banking crises, and higher real growth rates than comparable countries that have employed central banks.

Given the superior performance of currency boards, the obvious question is “What led to their demise and replacement by central banks after World War II?” The demise of currency boards resulted from a confluence of three factors. A choir of influential economists was singing the praises of central banking’s flexibility and fine-tuning capacities. In addition to changing intellectual fashions, newly independent states were trying to shake off their ties with former imperial powers. Additionally, the International Monetary Fund and the World Bank, anxious to obtain new clients and “jobs for the boys,” lent their weight and money to the establishment of new central banks. In the end, the Bank of England provided the only institutional voice that favoured currency boards.

Since their post-World War II demise, currency boards have witnessed something of a resurgence. In terms of size, the most significant currency board today is Hong Kong’s. It was installed in 1983 to combat exchange rate instability. In the wake of the collapse of the Soviet Union, several countries adopted currency boards. They successfully crushed inflation and ushered in stability and growth.

It is important to stress that Argentina’s Convertibility System (1991-2001) was not a currency board. Nevertheless, Kurt Schuler found that some 97% of the world’s major economists misidentified Argentina’s Convertibility System, asserting that is was a currency board. This misidentification has arisen because most have failed to realize that Convertibility allowed Argentina’s central bank (BCRA) to engage in discretionary monetary policies, which the BCRA exercised with reckless abandon. In contrast, a currency board has absolutely no discretionary powers.

The world needs fewer central banks. Venezuela and Argentina should mothball theirs and dollarize. For other countries with failing central banks, currency boards are a proven elixir. Special cases of Iran, Russia, and Turkey are noteworthy. To produce currencies that are as good as gold – a currency not issued by a sovereign – these countries should go for gold-backed currency boards.

Steve Hanke is a professor of applied economics at The Johns Hopkins University and senior fellow at the Cato Institute. Over four decades Hanke has advised dozens of world leaders from Ronald Reagan to Indonesia’s Suharto on currency reforms, infrastructure development, privatization, and how to tame hyperinflation. He also trades currencies and commodities and was the president of the world’s best performing mutual fund in 1995 (+79.25%). Follow him on Twitter @Steve_Hanke.