Jide Akintunde, Managing Editor/CEO, Financial Nigeria International Limited

Follow Jide Akintunde

![]() @JSAkintunde

@JSAkintunde

Subjects of Interest

- Financial Market

- Fiscal Policy

The 2018 budget proposal is worse than nonsense 12 Nov 2017

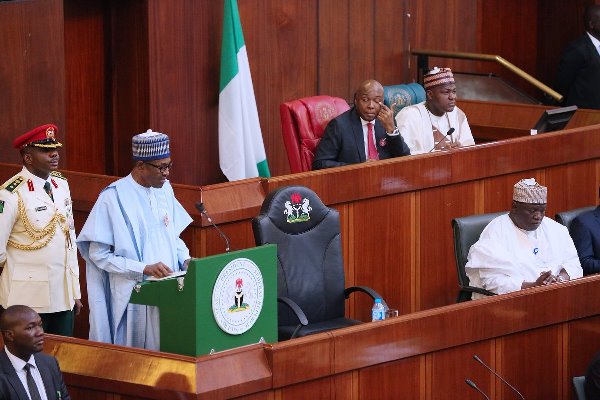

President Muhammadu Buhari presenting the 2018 appropriation bill to the National Assembly

The 2018 appropriation bill could easily be dismissed as essentially nonsense. But that would not solve the problem. If the budget proposal that was presented to the National Assembly on November 7 is passed, either as it is or with hollow tinkering, it would portend serious consequences. The deleterious effects, compounding the harm already caused by the previous two budgets, would remain with the country for years and decades to come.

Three of the ominous consequences of the last two budgets and the 2018 proposal are a debt overhang, lack of capacity to borrow when there is an acute revenue shock in the near future, and loss of faith in government because the budgets lack credibility.

But what exactly makes the 2018 budget proposal nonsensical? Quite a lot of its headline provisions. First, the budget is outsized. At N8.6 trillion, it represents 16 percent expansion over the 2017 budget. To compound the issue, the finance minister, Kemi Adeosun, said a few weeks to the unveiling of the 2018 budget that at least 60 percent of the 2017 capital expenditure would be rolled over to 2018. Therefore, the total budget to be implemented next year is N9.91 trillion. This is the sum of the N8.6 trillion total appropriation for 2018 plus N1.31 trillion, which represents 60 percent of 2017 capex to be rolled over.

It is beyond optimism to think that the government that has not been able to raise total budget implementation to N6 trillion in any of the previous two budget years would deliver nearly N10 trillion fiscal spending in 2018. As at the time the 2018 budget was laid before the National Assembly, fund releases to implement the 2017 capital expenditure had yet to reach 30 percent.

Second, the 2018 appropriation bill sets the benchmark price for crude oil at $45 per barrel. But the Brent Crude was trading at $64 per barrel on November 7, the date President Muhammadu Buhari presented the budget. This means the budget proposal is remarkably conservative with regard to the oil revenue projection. However, the same budget is immoderate with borrowing.

Indeed, the revenue profile of the budget is disconnected from reality and intelligent projection of demand cum supply scenario of oil prices between now and 2018. Still, while the oil benchmark price is conservative, non-oil revenue, which is projected at N4.2 trillion, is overly optimistic. Non-oil revenue for H1 2017 missed the N1.48 trillion projection by 49 percent. Given that the recovery from the 2016/2017 recession is expected to remain tepid in 2018, it is very unlikely that actual non-oil revenue will quadruple next year. Moreover, the duration of the tax recovery effort of the government under the voluntary disclosure programme is substantially in 2017, ending in Q1 2018.

Third, with the pessimism over oil prices, the government plans another huge budget deficit of N2.01 trillion in 2018. Granted, the 2018 deficit is 15 percent less than the N2.36 trillion deficit of the 2017 budget. Nevertheless, the 2018 deficit is still too high, and this is easily avoidable. With the benchmark oil price adjustable to between $50 and $55 per barrel, the deficit could be completely absorbed by the revenue gain. Instead, the $45 per barrel benchmark price leaves room for misappropriation of the revenue differential. With the predilection of the administration for propaganda, a fraction of the fiscal ‘surplus’ could be saved, either in the sovereign wealth fund or the Excess Crude Account for a bragging right.

The absurdity of the $45 oil benchmark price is that, on one front the government would be running a huge budget deficit to be financed by debt. On another front, the same budget would be running an oil-revenue surplus simultaneously, which would be substantially unaccounted for.

Fourth, the administration further headlines its wastefulness by adopting N305/$1 exchange rate. Based on trend market exchange rate, up to N2 trillion or 15% of the naira value of the oil revenue projection for 2018 would be lost. This amount approximates the federal budget deficit of N2.01 trillion.

The level of inefficiency in the 2018 appropriation bill is too high for the National Assembly to pass it without major overhaul of the headline figures. Public debate of the previous and similarly wasteful budgets of the Buhari administration had centred on the allocation to the National Assembly and members’ “constituency projects.” But with the budget of the National Assembly and the constituency projects amounting to less than 2 percent of the overall budget, it is wrong that these direct allocations should define the problem with the budget.

Therefore, Nigerians should now shift focus to prevailing on the National Assembly to overhaul the 2018 budget proposal. The advocacy can benefit from the following insights. One, in apparent lack of coordination in planning, the 2018 budget did not factor the 60 percent of the capex for 2017, which will be rolled over to 2018. Therefore, the capital expenditure for 2018 is reducible by the amount of the 2017 capex that is unimplemented at the end of the year. This is all the more important, because the 2018 budget is planned to realign the budget cycle back to January to December.

Two, the “mega” budgets of the Buhari administration have been justified by, and predicated on, ‘record-level’ allocations to capital expenditure. The capex is often pompously fixed at “unprecedented” 30 percent in the appropriation bills. But using the 2016 budget as an index case, at the time it was passed, the percentage of capital expenditure to the total fell to 26 percent. But with incomplete implementation of the N1.59 trillion capex, the actual percentage of capital expenditure relative to the overall budget fell below 20 percent.

This reality with the 2016 budget will likely be the same with the 2017 budget. Therefore, the very basis of public acceptability of the expansionary budgets and record-level deficits has been eroded. Nigerians would most likely have kicked against a budget that allocates 80 percent to recurrent expenditure.

Three, the last two budgets have jeopardised Nigeria’s public debt sustainability, with the inordinate deficits raising the debt service as a percentage of revenue above 60 percent. Having raised the cost of domestic borrowing by its fiscal operation, the government has now found the local debt market to be too expensive. A different grief is soon to meet the shift to foreign borrowing as contemplated from 2018.

The finance minister maintains at different times that the government is basically going to use foreign debt to “refinance” existing domestic debt – purporting that it is, therefore, not a new borrowing. This is half-truth at best. Only $3 billion of the proposed $5.5 billion foreign borrowing planned for 2018 is for refinancing part of the local debt. The remaining $2.5 billion is new loan. And while Kemi Adeosun touts that the debt refinancing will save N91 billion of government’s debt-service obligations annually over the next few years, the restructuring shifts the burden of repayment of the refinanced loan and new foreign borrowings with longer maturities to the future generation.

Finally, Buhari’s fiscal policy has failed to prove its mettle. Its growth projections are usually missed by miles. The job creation that is projected never materialises. What has crystallised is a huge increase in public debt, which now stands at a staggering N19.6 trillion or $64.2 billion as at June 2017.

The National Assembly has got to show responsibility to the people by ensuring the debt-fuelled expansionary budgetary charade of the Buhari administration ends with the 2017 budget. It is time to restore sense to federal budgeting after the nonsense of the last two years. The nonfeasance of the fiscal authorities after getting the budgets passed must end. What the issues raised above mean is that the 2018 budget proposal should be diligently reworked and not merely tweaked.

Jide Akintunde is Managing Editor, Financial Nigeria publications. He is also Director, Nigeria Development and Finance Forum.