Outlook of post-covid-19 Nigerian real estate sector

Summary

In the new workplace post-COVID-19, cities will need to serve more residents who work from home, says PWC.

COVID-19 sent shockwaves throughout the global economy in 2020. Governments across the world responded with different policies to limit the human and economic impact of the pandemic. One year after the World Health Organisation (WHO) declared COVID-19 a pandemic, nearly three million people had died from the disease globally, with more than 127 million cases recorded as of the end of March 2021.

Businesses have been compelled to adapt to the rapidly changing environment. Some organisations and industrial sectors have been resilient – with some even faring well – compared to others that were hit hard and are still struggling to recover.

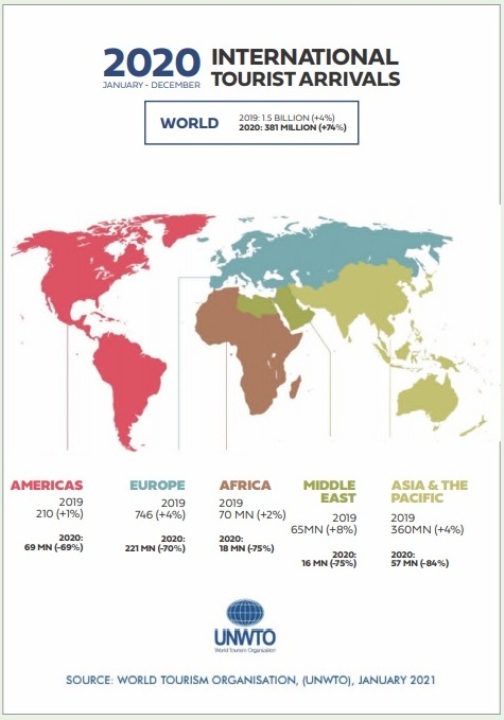

For instance, global tourism suffered its worst year on record in 2020, according to a report by the World Tourism Organization (UNWTO) in January. Globally, international arrivals dropped by 74 per cent. Asia and the Pacific recorded the largest decrease in arrivals (84 per cent), followed by Africa and the Middle East (75 per cent each).

Over the last 12 months since the outbreak of COVID-19 in Nigeria, the country’s real estate sector has been inundated with renegotiations and restructuring activities. Decision-making processes have slowed, and project delivery timelines have been overrun. The industry has also been negatively impacted by rising inflation and currency devaluations. Many players have had to provide huge concessions to sweeten deals.

On a positive note, the volatility in the global capital markets has caused a spike in real estate investments as some investors are acquiring properties as a hedging strategy. This will provide more liquidity for the Nigerian real estate sector.

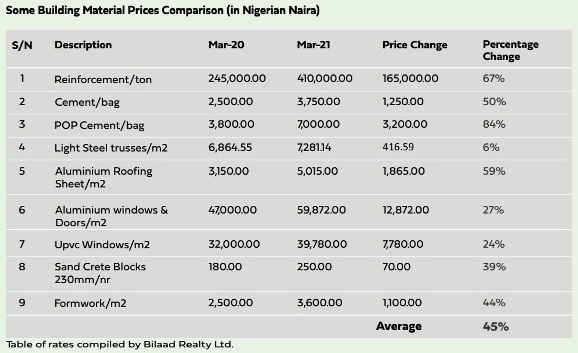

However, the prospect of new investments is dampened by mounting macroeconomic challenges. In the current high inflation environment in Nigeria, the prices of construction materials are fast increasing with no foreseeable end. The table below provides a snapshot of the change in prices of some key building mate-rials and processes between March 2020 and March of this year.

The rising cost of construction will have an impact on the ability of investors to expand their pipeline of projects, a development that has serious implications for the growth of the real estate sector. As construction costs increase, the prices of properties will significantly rise, leading to reduced demand in the market.

Significant intervention is required in the real estate sector by the Nigerian government. The sector grew by 2.81 per cent in fourth quarter of 2020, representing its first positive quarterly growth since Q1 of 2019, according to data from the National Bureau of Statistics (NBS). Although it contributed 5.66 per cent of real GDP in 2020, the real estate industry contracted by 9.22 per cent last year.

It is extremely difficult to predict the path of recovery when wading through a catastrophe like the one brought on by COVID-19. The good news is that global markets are beginning to recover as the pace of COVID-19 vaccination programmes gather pace.

At the end of the pandemic, the market-place would have evolved. Some national governments are eagerly making efforts to invest in infrastructure to jump-start eco-nomic recovery. Both public and private sector project owners are placing new emphasis on sustainability and resilience. This has the potential to change the nature of real estate portfolios, while providing new opportunities.

The COVID-19 pandemic has been a catalyst for change in the real estate industry as companies are deploying technology to create new solutions and expand market opportunities. Proptech (property techno-logy or real estate technology) companies are using technology to transform the way people rent, buy, and manage property. Embedded in their solutions must be technology and mechanisms that minimise energy use and environmental impact of housing/building construction. There should also be solutions that promote energy efficiency practices in buildings.

As governments and organisations incorporate teleworking into the structure of the new workplace post-COVID-19, PricewaterhouseCoopers (PwC) said in a re-port that cities will need to serve more residents who work from home. According to the report, titled "Engineering & Construction in a post-COVID world: weathering the storm," this will likely lead to greater investments in telecom and smart city initiatives.

Despite the challenges facing the Nigerian real estate industry, the government should make it a top priority to provide adequate and affordable housing for the people. The real estate sector’s contribution to GDP is currently less than 10 per cent. Yet, this sector – in combination with construction, agriculture manufacturing and mining and quarrying – contributed to the positive real GDP growth rate the country recorded in Q4 2020 and Nigeria’s exit from recession. With more investment in the sector and a sustainable housing intervention policy, the real estate sector can play a central role in a Nigerian post-COVID-19 recovery strategy.

Bilaad Realty Limited is an Abuja-based company focused on delivering sustainable real estate solutions.

Related

-

Sustainable construction: what, why and how

More sustainable construction is the desire of every stakeholder, from the government to procurement bodies and the ... -

At 61, Nigeria should renew commitment to sustainable housing

The cost structure in the Nigerian (urban) real estate market, based on foreign sourcing of housing materials and inputs, ...

-

Impacts of FMBN on housing delivery in Adamawa State

FMBN has contributed to the creation of no less than 8,500 jobs in Adamawa State.