Steve Hanke, Professor of Applied Economics, The Johns Hopkins University

Follow Steve Hanke

![]() @steve_hanke

@steve_hanke

Subjects of Interest

- Fiscal Policy

- Monetary Policy

Hyperinflation: Much talked about, little understood 08 Dec 2017

Professor Liping He from Beijing Normal University has produced a most comprehensive and useful scholarly treatment of world hyperinflation. It is hot off the press. This is a welcomed addition to the literature. Indeed, Hyperinflation: A World History is destined to become a standard reference on the topic.

My basis for this judgment rests on my own travails in grappling with the literature and data on hyperinflation. It also rests on my experience with measuring and stopping hyperinflation. The “Hanke-Krus World Hyperinflation Table” first appeared in the authoritative The Routledge Handbook of Major Events in Economic History (2013). What was the genesis of this Table?

In 2010, I was invited to write a survey article on hyperinflation for The Routledge Handbook of Major Events in Economic History. I accepted the invitation, thinking it would require routine work on my part, and that I could complete the task in short order. I had already surveyed the literature on hyperinflation. In addition, I had accurately estimated the inflation rates in several countries that had experienced episodes of hyperinflation. These included two relatively recent, dramatic episodes of hyperinflation – Yugoslavia, which peaked at a monthly rate of 313 million percent in the month of January 1994, and Zimbabwe, which peaked at an annual rate of 89.7 sextillion (10^23) percent in November 2008. In addition, I had designed and implemented currency reforms that had stopped episodes of hyperinflation, notably Bulgaria’s, which peaked at a monthly rate of 242% in the month of February 1997.

While reflecting on the hyperinflation literature, I was struck by its lack of uniformity and clarity. The literature was widely scattered in time and space; it had been written by many different researchers, and those researchers had used diverse methods to estimate and analyze the inflation episodes studied.

So, I concluded that the best way to “clean up” the subject of hyperinflation was to create a “World Hyperinflation Table.” In my mind, this table would include all of the world’s hyperinflations. The data would be presented in a uniform and clear manner, so that all episodes of hyperinflation could be compared. But, what criteria would be used for an episode of inflation to qualify as a hyperinflation? I specified the following three criteria:

1. Following Professor Phillip Cagan’s classic article on hyperinflation, the economics profession adopted the following criterion: to qualify as a hyperinflation, the inflation rate had to be at least 50 percent per month. I adopted this convention.

2. In addition, I specified that the 50% rate had to persist for at least 30 consecutive days.

3. Lastly, I concluded that the inflation episode had to be fully documented and that inflation estimates had to be replicable.

It turned out that the third criterion was the most difficult one. Fortunately, my chief research assistant at the time, Nicholas Krus, was capable of, and interested in, taking on this research task. Krus and I spent the better part of two years constructing what has come to be known as the Hanke-Krus World Hyperinflation Table. We documented and recalculated the inflation rates for all alleged episodes of hyperinflation in history. The project required the gathering of primary data for each potential case of hyperinflation. This proved to be very difficult and time consuming. For example, primary data for the French episode of hyperinflation of 1795 to 1796 – the first verified hyperinflation – had to be obtained and analyzed. But, that was not the most difficult set of data to obtain. That “prize” was awarded to the Republika Srpska, which experienced a hyperinflation episode in the 1992-1994 period. Fortunately, I was able to use my extensive contacts in the former Yugoslavia to eventually obtain high-quality inflation data.

After a long and onerous research effort, the Hanke-Krus World Hyperinflation Table was published. It is contained in “World Hyperinflations,” a chapter in The Routledge Handbook of Major Economic Events in History (2013), which I co-authored with Nicholas Krus.

I recount these reflections because I thought there would not be too much to say about hyperinflation after the publication of the Hanke-Krus World Hyperinflation Table. However, Prof. Liping He has proven me wrong.

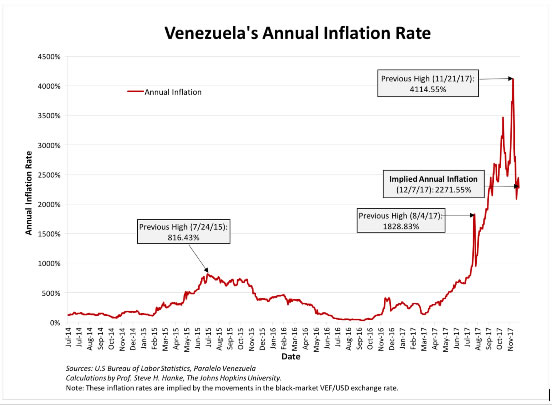

I would also add that new developments in Venezuela have proven me wrong, too. Venezuela became the 57th episode of hyperinflation in history on December 3, 2016. At present (12/7/2017), the annual inflation rate in Venezuela, which I regularly measure, is 2271%. This now stands as the world’s highest rate of annual inflation, but it has not surpassed the 50% per month for 30 consecutive days, hyperinflation threshold. Accordingly, Venezuela, although it has the world’s highest annual inflation rate, is not hyperinflating.

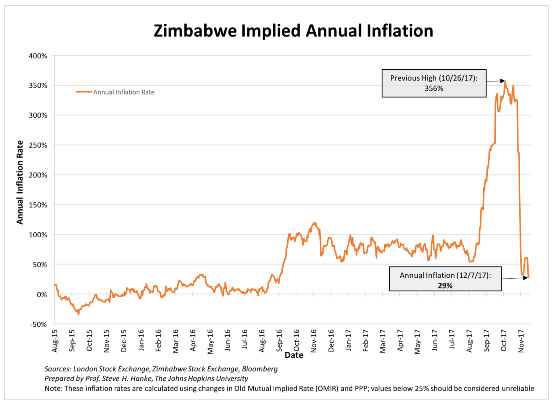

It turns out that Zimbabwe, recently, has also proven me wrong. On October 17, 2017, Zimbabwe entered its second episode of hyperinflation in less than 10 years. The chart below shows what the annual inflation rate for Zimbabwe is today (December 7th) 29%.

Unfortunately, many journalists and writers play fast and loose with the term “hyperinflation” – a term that has a very specific meaning. Not only is the meaning of the “word” specific, but also its measurement, if properly conducted, can be just as precise.

Steve H. Hanke is a Professor of Applied Economics at The Johns Hopkins University in Baltimore and a Senior Fellow at the Cato Institute in Washington, D.C. You can follow Prof. Hanke on Twitter: @Steve_Hanke.