Latest News

Allianz: Macro and market developments are top risks in 2016 for Africa

News Highlight

Cyber incidents are cited in the survey as the most important long-term risk for companies in the next 10 years.

The 2016 Allianz Risk Barometer, the fifth annual survey on corporate risks, was released today in Lagos by Allianz Global Corporate & Specialty (AGCS). The Risk Barometer is based on responses from over 800 risk experts from more than 40 countries around the world.

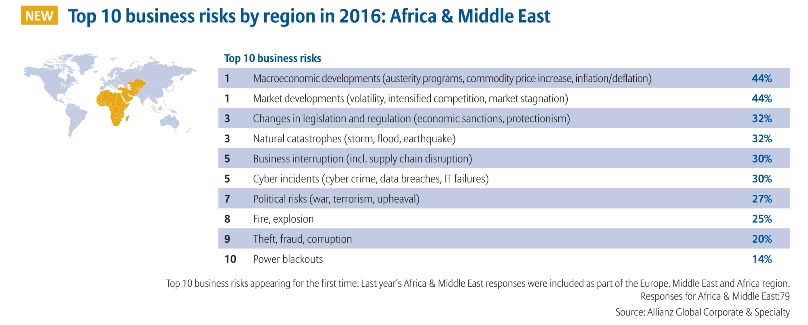

According to the survey, the major risk for businesses in Africa and Middle East are macroeconomic developments such inflation, deflation, and drop in commodity prices. 44 percent of respondents identified market developments such as volatility and competition among the top three business risks in Africa, followed by changes in legislation and regulation, a risk segment that 32 percent of respondents identified.

“The biggest contraction in global trade since the financial crisis, BRICS and other emerging markets hitting a wall and a subdued knock-on-effect from the drop in commodity prices help ensure market and macro developments rank highly in this year’s Risk Barometer,” Ludovic Subran, Chief Economist at trade credit insurer Euler Hermes, a sister company of AGCS, said in statement released on Wednesday.

Business interruption (BI), including supply chain interruption is also top business risk in Africa in 2016, and globally, according to AGCS. Subran said the fall in oil prices has stressed supply chains. According to him, “Sectors such as construction for example, have not done as well as anticipated because of structural difficulties. Further, some sectors, such as machinery and equipment, have seen the collateral damage of plummeting investment in the oil and gas industry.”

AGCS, which provides insurance and risk consultancy across the whole spectrum of specialty, alternative risk transfer and corporate business, said political risks (war, terrorism and upheaval) rank higher in Africa than any other region surveyed by the 2016 Risk Barometer. Also ranked among the top 10 business risks in Africa on the Allianz Risk Barometer are natural catastrophes, business interruptions, cyber incidents, fire and explosions, theft and corruption as well as power blackouts.

Cyber incidents are cited in the survey as the most important long-term risk for companies in the next 10 years. Accordingly, the report shows that businesses are less concerned about traditional risks such as natural catastrophes. They are increasingly worried about the impact of disruptive events such fierce market competitions and cyber-attacks.

Five years ago, cyber incidents were identified as a risk by just one percent of respondents in the first Allianz Risk Barometer. But increasing concerns about cyber-crime, data breaches, and technical IT failures have pushed this up on the Risk Barometer

“The corporate risk landscape is changing as many industrial sectors are undergoing a fundamental transformation,” said Chris Fisher Hirs, CEO of AGCS. “New technologies, increasing digitalisation and the ‘Internet of Things’ are changing customer behaviour, industrial operations and business models, bringing a wealth of opportunities, but also raising awareness of the need for an enterprise-wide response to new challenges. As insurers we need to work together with our corporate clients to help them to address these new realities in a comprehensive manner.”

Many businesses in Africa are facing a growing number of challenges which threaten their profitability and possibly also their business models. Delphine Maïdou, AGCS’ Africa CEO said, “Businesses constantly have to be on their toes, turning out new products, services or solutions in order to stay relevant to the customer and to thrive in this rapidly changing and globally competitive environment.”

Maïdou added that “Innovation cycles are becoming rapidly shorter; market entry barriers are coming down; increasing digitalisation and new ‘disruptive’ technologies have to be quickly adopted while potentially more agile start-ups are entering the game.”

Apart from regional analysis, the Allianz Risk Barometer also explores sector-specific risks, for example for manufacturing, marine and shipping and other major industries.

Related News

Latest Blogs

- Lessons for Nigeria's climate finance strategy

- Prospects of a cruise ship port in Nigeria’s blue economy

- Insights from Alame V Shell on corporate liability for environmental damage

- Threats and mitigation strategies against plastic waste in agriculture

- Iran v Israel, what it means for Nigeria

Most Popular News

- Artificial intelligence can help to reduce youth unemployment in Africa – ...

- Renewable energy boom highlights growing regional divide

- IMF commends reform at Federal Inland Revenue Service

- Global carbon pricing mobilises over $100 billion for public budgets

- Global foreign direct investment falls for second consecutive year – UNCTAD

- Allianz identifies wildfires as a growing global threat