Unctad records zero new investment policy measures for Nigeria

Feature Highlight

In the reporting period, Japan and Kenya signed a Bilateral Investment Treaty.

The United Nations Conference on Trade and Development (UNCTAD) has released his new Investment Policy Monitor, covering May to October 2016. Nigeria did not feature in the report, having recorded no new investment policy measures over the period covered by the report.

Some 36 countries took a total 53 investment policy measures in the six-month period, most of them relating to foreign investment, and most of the policies were liberalizing in nature.

Boosting foreign investment is seen as an important means of reviving a stagnant global economy.

"Investment promotion and facilitation measures also play a significant role," the policy monitor says. "Most measures were taken by developing countries and transition countries."

Among the most important policy measures are the adoption of new investment laws in Algeria, Myanmar, Namibia, and Tunisia.

Other important developments during the reporting period were the adoption of a comprehensive investment liberalization strategy in India, new procedures on the establishment of foreign enterprises in China, and policies to open up various industries in Bahrain, Indonesia, the Philippines, and Saudi Arabia.

Brazil reversed its decision to allow full foreign ownership for domestic airlines.

The policy monitor also notes the conclusion of more international investment agreements (IIAs).

In September, G20 leaders - representing over two thirds of global foreign direct investment - adopted the Guiding Principles for Investment Policymaking. The guidelines aim to promote a better, more coherent policy environment at the global level and to promote foreign direct investment for inclusive economic growth and sustainable development.

Niger Republic ended a sales monopoly of the State petroleum company. Accordingly, it permitted a joint venture oil refinery between the Government and a foreign corporation to sell petroleum products.

The majority of new investment policy measures aimed at creating more favourable investment conditions. Some of the new investment policy measures contained in the report are below.

- Algeria introduced a new investment law offering tax incentives and infrastructure needed for investment projects.

- Mauritius introduced various tax incentives to both global and non-global businesses. For example, companies holding a "Global Headquarters Administration License" issued by the Financial Services Commission will be eligible for an 8-year tax holiday.

- Tunisia introduced a new Investment Law. Amongst others, the law removes profits taxes on major investment projects for 10 years and gives foreign investors more flexibility to transfer funds out of the country.

- China replaced, to a large extent, the requirement to obtain approval for the establishment of and changes to foreign invested enterprises by a nation-wide filing system. Approval from the Ministry of Commerce or its local branches is still required, only for business proposals that fall under the scope of the Special Administrative Measures of Market Entry for Foreign Investment.

- India introduced another comprehensive FDI liberalization strategy following the one implemented in November 2015. It increased sectoral caps in different industries, brought more activities under the automatic route, and eased conditions under which foreign investment can be made.

- Indonesia introduced its new "Negative List" for investment. It generally permits foreign investment or increases the allowed ceiling in various industries, including e-commerce, tourism, film and airport services. The list also adds restrictions to foreign investment in a number of industries.

- Kenya adopted the new Finance Act. It repeals a 30 percent domestic ownership requirement for newly registering foreign companies that had become effective on 15 June 2016, as part of the Companies Act 2015. The new Finance Act will become effective on 1 January 2017.

- Brazil reversed a decision from March 2016 that would have increased the foreign ownership cap in domestic airlines from 20 to 49 percent and would have repealed the requirement that directors be exclusively Brazilian nationals.

At least four IIAs entered into force during the reporting period: the BITs concluded by Canada with Hong Kong, China, Mali, and Senegal respectively, and the FTA concluded between Colombia and the Republic of Korea.

During the reporting period, negotiations on mega-regional initiatives continued, these include the negotiations for the African Continental Free Trade Area (CFTA), negotiations of the Regional Comprehensive Economic Partnership (RCEP) and the EU-United States Transatlantic Trade and Investment Partnership (TTIP).

In the same period, the EU signed an EPA with the Southern African Development Community (SADC) States, Japan and Kenya signed a Bilateral Investment Treaty.

More details on the report is here.

Other Features

-

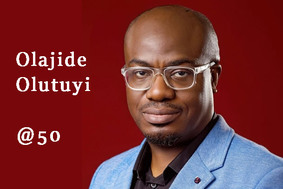

At 50, Olajide Olutuyi vows to intensify focus on social impact

Like Canadian Frank Stronach utilised his Canadian nationality to leverage opportunities in his home country of ...

-

Reflection on ECOWAS Parliament, expectations for the 6th Legislature

The 6th ECOWAS Legislature must sustain the initiated dialogue and sensitisation effort for the Direct Universal ...

-

The $3bn private credit opportunity in Africa

In 2021/2022, domestic credit to the private sector as a percentage of GDP stood at less than 36% in sub-Saharan ...

-

Tinubunomics: Is the tail wagging the dog?

Why long-term vision should drive policy actions in the short term to achieve a sustainable Nigerian economic ...

-

Living in fear and want

Nigerians are being battered by security and economic headwinds. What can be done about it?

-

Analysis of the key provisions of the NERC Multi-Year Tariff Order ...

With the MYTO 2024, we can infer that the Nigerian Electricity Supply Industry is at a turning point with the ...

-

Volcanic explosion of an uncommon agenda for development

Olisa Agbakoba advises the 10th National Assembly on how it can deliver on a transformative legislative agenda for ...

-

Nigeria and the world in 2024

Will it get better or worse for the world that has settled for crises?

-

The Movers and Shakers of Nigeria 2023

This special publication profiles 25 people and institutions based on their societal or industry impact in 2023.

Most Popular News

- IFC, partners back Indorama in Nigeria with $1.25 billion for fertiliser export

- Ali Pate to deliver keynote speech at NDFF 2024 Conference

- Univercells signs MoU with FG on biopharmaceutical development in Nigeria

- CBN increases capital requirements of banks, gives 24 months for compliance

- CBN settles backlog of foreign exchange obligations

- Nasdaq Dubai welcomes $600m sukuk listing by Islamic Development Bank