Paris climate agreement creates $23 trillion investment opportunities in emerging markets – IFC

Summary

SSA represents a $783 million opportunity – particularly for clean energy in Cote d’Ivoire, Kenya, Nigeria, and South Africa.

A new study released today by the International Finance Corporation shows that the Paris Climate Agreement has opened up about $23 trillion in opportunities for climate-based investments in emerging markets between now and 2030.

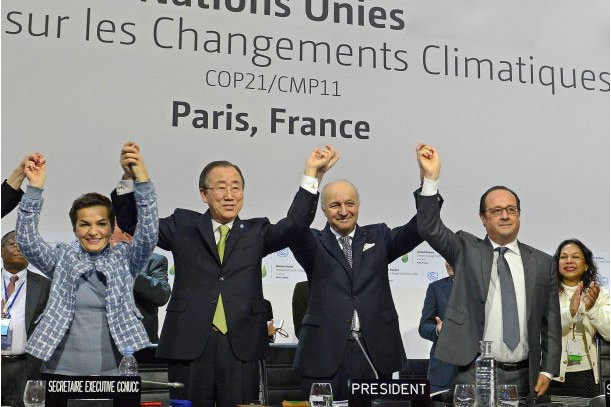

The publication of the new study comes days after the Paris Agreement, which was signed in December 2015, entered into force on November 4th. The agreement, which has been signed by 96 countries so far, requires countries to design strategies to limit the planet’s temperature rise below 2 degrees Celsius by the end of this century.

“There has never been a better time than now for climate-smart investing,” said Philippe Le Houérou, IFC’s Executive Vice President. “This reflects the dramatic reduction in the price of clean technologies and the rise of smart policies that are driving businesses to invest. In this context, it is important to set ambitious goals—which is why IFC has pledged to increase our climate investments to a goal of $3.5 billion a year by 2020 and catalyze another $13 billion through other investors.”

IFC said the new study, which is based on the national climate-change commitments and underlying policies of 21 emerging-market economies, identifies sectors in each region where the potential for climate-based investment is greatest. These sectors include green buildings in East Asia and the Pacific – where China, Indonesia, the Philippines, and Vietnam show a climate-smart investment potential of $16 trillion.

Latin America and the Caribbean offer the next largest opportunity – particularly in sustainable transportation, where the potential for investment in Argentina, Brazil, Colombia, and Mexico is about $2.6 trillion. Opportunities in South Asia are mostly in climate-resilient infrastructure, where $2.5 trillion of opportunities exist in India and Bangladesh.

According to the study, Sub-Saharan Africa represents a $783 million opportunity – particularly for clean energy in Cote d’Ivoire, Kenya, Nigeria, and South Africa. In Eastern Europe, the biggest markets – Russia, Serbia, Turkey, and Ukraine – show a combined investment potential of $665 billion, mostly in energy efficiency and new green buildings. And in the Middle East and North Africa, the total climate-investment potential for Egypt, Jordan, and Morocco is estimated at $265 billion, over a third of which is for renewable-energy generation, while 55 per cent ($146 billion) is for climate-smart buildings, transportation, and waste solutions.

Since December, about 189 countries have submitted national plans that target aggressive growth in climate solutions – including renewable energy, low-carbon cities, energy efficiency, sustainable forest management, and climate-smart agriculture. These plans offer a clear roadmap for investments that will target climate-resilient infrastructure and offset higher upfront costs through efficiency gains and fuel savings, according to the IFC.

The report recommends that governments integrate national climate commitments into their development strategies and budget processes as well as strengthen the investment climate for climate-smart industries. It further advised governments to deploy public funds strategically to mobilize private capital by reducing risk and providing project support.

Related

-

World Bank unveils $16 billion Africa Climate Business Plan

Of the $16.1 billion that the ambitious plan proposes for fast-tracking climate adaptation, $5.7 billion is expected from ...

-

Scientists say 2018 was fourth warmest year on record since 1850

According to the Berkeley Earth’s report, 2019 is expected to be warmer than 2018.

-

Can COP21 save our planet?

Countries are getting ready for Paris in the hope that agreements will be signed and new mechanisms will be implemented ...