Overview of corporate performance in Nigeria: Q1-Q3 2016

Feature Highlight

What the Q3 2016 results of the large Nigerian companies in the non-financial sector suggest is that GDP contraction did not abate in the third quarter.

Mid-October ushered in the reporting season as Nigerian quoted companies began to release their financial statements for the first nine months of 2016. Until then, the All Share Index of the Nigerian Stock Exchange provided an indication of the impact of recessionary pressure on Nigerian equities. Between January and the end of September, the index had depreciated by 1.07%; it further declined by 4.05% as at end of last month.

The nine-month financial reports provide a clearer picture of the impact of macroeconomic indicators on the performance of major companies across various sectors of the economy; the reports also afford analysts the opportunity to closely observe trends in industrial output. Suffice to say the reports give the basis for reading the tea leaves for aggregate output for the third quarter of 2016 ahead of the release of quarterly Gross Domestics Product (GDP) growth data by the National Bureau of Statistics (NBS).

The preeminent challenge being faced by companies is rising input costs. The fall in oil prices, Nigeria's major source of foreign exchange, precipitated an acute shortage of forex and the ensuing pressure on the naira, forcing the Central Bank of Nigeria (CBN) to remove its currency peg of N197 to the dollar back in June. The naira subsequently depreciated by 55% to N305 on the inter-bank market, while plunging to N445/USD on average on the parallel FX market in September. Companies that are heavily dependent on foreign currency for capital expenditure and intermediate goods saw their gross margins shrink. Revenues of highly-leveraged companies were depleted, even as they had to also grapple with rising cost of production due to inflationary pressures. A number of companies faced with these challenges declared huge losses.

Dangote Cement, the leader in the industrial sector, reported a 15% drop in net income to N133.52 billion. Despite a significant top-line growth (21% or N442.1 billion) driven by record volume growth in Nigeria and across other markets where the company operates, Dangote Cement's lower profit was attributed to contraction in gross margin of 47.6% from 62% posted in a comparable period of last year. Cost of sales, which refers to direct costs attributable to the production of the goods or supply of services by a company, increased by 67% for the cement manufacturing giant. Reflecting a general trend in the country's corporate sector, higher energy cost pushed up Dangote Cement's operating expenses by 62%.

Its sister company, Dangote Sugar, also saw a contraction in gross margin due to significant rise in production cost. Dangote Sugar, a major player in the fast-moving consumer goods (FMCG) segment, saw a decline in its gross margin from 25.7% reported in 2015 to 16.5%. Lower finance costs (which was down 56%) for Dangote Sugar, however, helped to reduce pressure on the company's profit – which was N10.1 billion; up 8.4%.

Persistent FX challenges proved to be a drag on the performances of major operators in the FMCG sector. Nestlé Nigeria took a foreign exchange loss of N19.4 billion due to the devaluation of the naira. The company's net finance cost grew 414% to 19.9 billion. This sent its profit plunging 97% in the first nine months of this year. Indeed, for the third quarter of 2016, the company suffered a loss of N51 million, compared to a profit of N8.3 billion it made in Q3 2015.

To mitigate the impact of the dwindling economic environment in Nigeria, Nestlé and other companies are ramping up exports to other countries to diversify their revenue base and generate foreign exchange. Former Nestlé Nigeria Managing Director, Dharnesh Gordhon, who has now been transferred to Nestlé Indonesia after his appointment ended in September, said a weaker naira is helping the company grow exports.

Speaking at the Nigerian Stock Exchange/Bloomberg CEO Roundtable in September, he said, “We really don't have a demand problem. What we're facing are supply challenges such as no fuels for plants, no foreign exchange to buy plant equipment, low growth, and high crime rates.”

Although Nestlé's nine-month revenue grew by 19.9%, the revenue of its rival, Cadbury Nigeria, was relatively flat. Despite cutting back on distribution and administrative expenses, Cadbury reported a loss of N842 million due to higher cost of sales. There are outliers in the FMCG sector like Unilever Nigeria, the longest surviving manufacturing company in Nigeria, which have braced the headwinds and reported huge profits. Unilever grew its bottom line by 1011% to N1.57 billion. Although gross margin shrank by 533 basis points to 29.5%, finance cost reduced by 27.1% and the company also reported a decline in marketing and administrative expenses by 11.7%.

Debt financing could be the necessary pill that companies would have to swallow to provide for much-needed capital. However, there is need for comprehensive debt management plans so as to reduce pressure on net earnings. Surging finance costs were attributed to the lower profit reported by Nigerian Breweries and the huge N2.2 billion loss posted by Guinness Nigeria. Two of the country's largest beer manufacturers saw their finance costs rise by 95.3% and 206.8% for Nigerian Breweries and Guinness Nigeria, respectively.

Loan servicing was also a major drain on the revenue of Transnational Corporation of Nigeria Plc, possibly the most-diversified company in Nigeria, as it posted a N14.2 billion loss in the first nine months of the year, compared to N5.9 billion profit in 2015. Its power subsidiary accounted for 92% of the company's N24.4 billion net finance costs. Except for the hospitality subsidiary of Transnational Corporation of Nigeria, all its subsidiaries – spanning oil and gas, real estate, telecoms, transportation and power – posted losses. An upsurge in income from food and beverages, increased sales of rooms, and upticks in revenue from entertainment and restaurant, related service fees and rentals pushed up the bottom-line growth of Transcorp Hotels by 14% to N2.7 billion.

But despite the current FX shortages in Nigeria, major Nigerian banks have recorded massive profits on the back of foreign currency revaluation gains and card revenue from customers using debit cards for foreign transactions. According to several sources – including CardinalStone Partners, a Lagos-based investment advisory firm – there is an informal agreement between the CBN and banks to set card rates close to the parallel market rate. The aim of this arrangement is to discourage banks form participating in FX round-tripping and currency speculations. This means bank customers using debit cards to settle foreign currency transactions get to pay rates that are higher than the prevailing interbank rate. The spread on the interbank rate, according to CardinalStone Partners, is about 55% on average.

As companies and many Nigerians groan over the scarcity of forex, a number of banks have leveraged the naira depreciation caused by dollar scarcity to boost non-interest income. Guaranty Trust Bank has so far led other banks in declaring the highest non-interest income and profit. The bank's non-interest income rose by 161.3% to an unprecedented N147.4 billion as it declared after-tax profit of N119.93 billion – up 60% – attributed largely to FX revaluation gains. Meanwhile, its interest income rose a meager 5.2%. Zenith Bank posted interest income of N285.67 billion – up 11.3% – while its non-interest income rose by 17.9% to N94.7 billion. As with GT Bank, Zenith Bank's N100 billion profit, which exceeded analysts' expectations, was boosted by FX revaluation gains.

The interest income and non-interest income of United Bank for Africa (UBA) increased by margins of 4.5% and 12%, respectively. Among the leading banks, Access Bank bucked the trend in terms of non-interest income growth. Interest income of Access Bank grew by 40.2% but non-interest income dropped by 9.1%. First Bank of Nigeria (FBN) is also one of the banks that grew its non-interest income. This portion of its financial report grew by 56.5%. Its FX revaluation gains was N68.4 billion.

Mirroring the trend in other economic sectors, the banking sector's operating expenses also generally grew in the review period. Nevertheless, FBN was able to cut its operating cost by 5% and increase gross earnings by 7%. However, the bank's profit after tax (PAT) declined by 15.3% to N42.6 billion due to higher provision for loan losses. Like First Bank, Ecobank Transnational Incorporated grew its top line by 10.8% but its PAT declined by 14.1% to N52.1 billion, weakened by higher impairment charges and operating expenses.

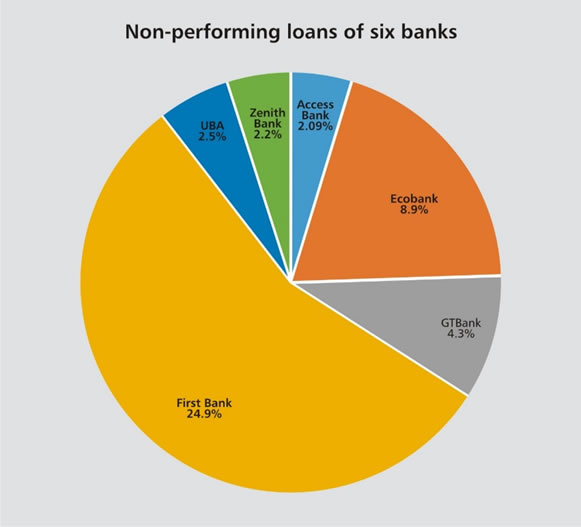

As with most banks, GT Bank's loan impairment charges rose by 570% to N57.08 billion; Zenith Bank's impairment charges grew by 125% to N21.9 billion; impairment charges for Access Bank rose by 6.8% to N12.3 billion; UBA's impairment charges grew by 147% to 9.1 billion. Being the Nigerian bank with the largest exposure to the oil and gas sector, FBN's impairment charges rose by 146% or N114.72 billion. The bank's non-performing loans (NPLs) rose from 4.8% at the end of September 2015 to 24.9% this year.

The high levels of NPLs in the banking sector has been a point of concern for the CBN, which has now permitted banks to write-off fully provided NPLs without waiting for the mandatory one-year period before writing them off. The NPLs in the sector grew from 3.5% as of June 2014 to 11.7% at the end of June 2016. The move by the CBN is aimed at stimulating lending in the sector.

Significant increases in bank deposits as well as foreign currency denominated loans to customers – as a result of naira devaluation – contributed in inflating banking assets. GT Bank's total assets rose by 22.5% (N3.09 trillion); Zenith Bank – 21% (N4.65 trillion); Access Bank – 30.8% (N3.39 trillion); UBA – 56% (N4.48 trillion); First Bank – 21.6% (N5.07 trillion); and Ecobank – 38.8% (N6.5 trillion).

Following the downgrade of Nigeria's sovereign credit rating by Fitch earlier in the year, the ratings agency downgraded the credit ratings of First Bank and UBA due to their rising NPLs and the sovereign state's weaker position to support domestic banks, particularly in foreign currency. However, Access Bank's success in raising $300 million via a Eurobond from the international market recently is expected to boost liquidity in the forex market and pave the way for other banks to start tapping the foreign bond markets once again. The Eurobond issue made Access Bank the first Nigerian lender to raise a bond from the international market since 2014.

Although oil prices have improved from the $30 per barrel range seen at the beginning of the year, Nigerian oil and gas companies are still faced with significant decline in output. The attacks on oil installations have led to the declaration of forces majeures on exports of several Nigerian crude oil grades. Significant downtime at the Trans Forcados pipeline has impacted Seplat Petroleum Development Company's performance since last year. One of the range of solutions Austin Avuru, Seplat's Chief Executive Officer, announced the company is implementing to address such externalities is the establishment of an alternative export route.

Seplat exemplifies the lack of homogeneity in the performance of the corporates. The company reported a $97.8 million loss for the first nine months of this year; even as revenue dropped 51.7% from a year ago to $202.7 million. However, Seplat's gas revenue rose by 48% to $77 million due to higher prices and an uptick in gas production. The company is ramping up its gas production capacity. Working interest gas production rose by 22% to 93 standard cubic feet per day (MMscf/d) as Seplat expands capacity at the Oben gas processing plant in Edo State. The expanded Oben gas plant is expected to increase the company's gross processing capacity from the current 300 MMscf/d to a minimum of 525MMscf/d by the end of this year.

What the Q3 2016 results of the large Nigerian companies in the non-financial sector suggest is that GDP contraction did not abate in the third quarter. Some of the strategies Nigerian companies would have to adopt to weather the storm is to diversify their revenue base by expanding their portfolio of products to mitigate the impact of competition; as well as make forays into new markets. With the high cost of imported intermediate inputs, finding new alternatives locally would help bring down costs and enhance profit. Dangote Cement says it has abandoned the costlier low pour fuel oil (LPFO) in Nigeria for coal. The company hopes that this move will have an immediate impact on margins.

A Financial Nigeria report

Other Features

-

At 50, Olajide Olutuyi vows to intensify focus on social impact

Like Canadian Frank Stronach utilised his Canadian nationality to leverage opportunities in his home country of ...

-

Reflection on ECOWAS Parliament, expectations for the 6th Legislature

The 6th ECOWAS Legislature must sustain the initiated dialogue and sensitisation effort for the Direct Universal ...

-

The $3bn private credit opportunity in Africa

In 2021/2022, domestic credit to the private sector as a percentage of GDP stood at less than 36% in sub-Saharan ...

-

Tinubunomics: Is the tail wagging the dog?

Why long-term vision should drive policy actions in the short term to achieve a sustainable Nigerian economic ...

-

Living in fear and want

Nigerians are being battered by security and economic headwinds. What can be done about it?

-

Analysis of the key provisions of the NERC Multi-Year Tariff Order ...

With the MYTO 2024, we can infer that the Nigerian Electricity Supply Industry is at a turning point with the ...

-

Volcanic explosion of an uncommon agenda for development

Olisa Agbakoba advises the 10th National Assembly on how it can deliver on a transformative legislative agenda for ...

-

Nigeria and the world in 2024

Will it get better or worse for the world that has settled for crises?

-

The Movers and Shakers of Nigeria 2023

This special publication profiles 25 people and institutions based on their societal or industry impact in 2023.

Most Popular News

- IFC, partners back Indorama in Nigeria with $1.25 billion for fertiliser export

- Ali Pate to deliver keynote speech at NDFF 2024 Conference

- Univercells signs MoU with FG on biopharmaceutical development in Nigeria

- CBN increases capital requirements of banks, gives 24 months for compliance

- CBN settles backlog of foreign exchange obligations

- Nasdaq Dubai welcomes $600m sukuk listing by Islamic Development Bank